SEOUL, February 04 (AJP) - South Korea has deployed nearly every tool in its policy playbook to defend the won, which authorities say has weakened “excessively” beyond its fundamentals — a view shared even by the U.S. Treasury secretary.

Measures have ranged from pressuring public and private institutions to sell dollar holdings to offering tax incentives aimed at drawing capital back home. Yet despite these efforts, the national coffers have paid a heavy price.

As of the end of January 2026, foreign exchange reserves stood at $425.91 billion, down $2.15 billion from the previous month, following a decline of more than $2 billion in December, according to the Bank of Korea (BOK) on Wednesday. Nearly $4.2 billion has been depleted in just two months.

The central bank attributed the decline primarily to its FX swap arrangement with the National Pension Service (NPS). Under the program, the BOK supplies dollars to the NPS for overseas equity purchases, temporarily limiting capital outflows that typically weaken the won.

The BOK has said the swap would temporarily dent reserves but be reversed once the dollars are returned. However, whether the strategy is producing meaningful results remains uncertain.

The average exchange rate rose to 1,467.35 won per dollar in December, up from 1,461 in November. Despite continued intervention, the rate remained weak at around 1,451 won as of Feb. 4. In late January, the won posted the sharpest decline among major currencies, briefly approaching the 1,470 level.

Private dollar hoarding offsets intervention

A broader look at the private sector highlights a structural challenge.

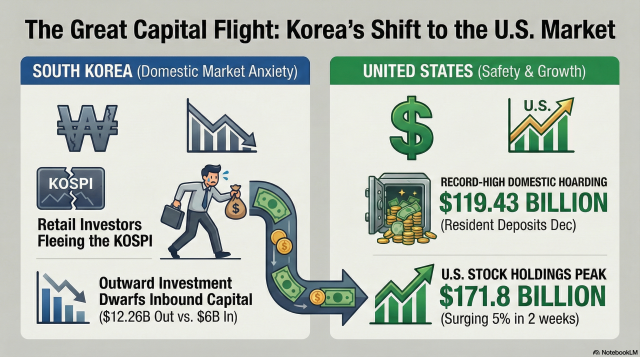

According to BOK data released on Jan. 26, resident foreign currency deposits reached a record $119.43 billion in December, up $15.88 billion from November. Both the balance and the monthly increase marked all-time highs.

The central bank is well aware of the trend. At a press conference following the January Monetary Policy Board meeting, BOK Governor Rhee Chang-yong noted that individuals and corporations already hold ample dollar liquidity.

Rhee explained that many market participants, betting on continued dollar strength, prefer lending their dollars in financial markets rather than selling them in the spot market.

“The issue lies in circulation structure, not in total supply,” he said.

Meanwhile, growing preference for overseas assets reflects persistent skepticism over corporate earnings growth and long-term prospects for “Korea Inc.”

Data from the Korea Securities Depository show that Korean investors’ holdings of U.S. stocks reached a record $171.8 billion, rising 5 percent between Dec. 31 and Jan. 16.

The BOK also reported that outward securities investment surged by $12.26 billion in November, led by equities, while foreign inflows remained below $6 billion and were concentrated largely in bonds.

Policy efforts face structural limits

Authorities are rolling out measures to attract capital back home, including Reshoring Investment Accounts and the National Growth Fund. The Financial Supervisory Service is also considering incentives such as higher interest rates for converting dollars into won.

South Korea’s gradual inclusion in the World Government Bond Index through November is also raising hopes for stronger foreign inflows.

Still, analysts stress that sustained currency stability ultimately depends on economic fundamentals.

Shinhan Securities expects the exchange rate to remain around 1,400 won per dollar, citing weak growth and slowing potential output.

South Korea’s economy contracted 0.3 percent in the fourth quarter of 2025, while full-year growth barely reached 1 percent.

“The reason many people are investing in ‘Gobbuss’ (KODEX 200 Futures Inverse 2X) even as the KOSPI hits record highs is anxiety over the real economy,” said an investment banking official, speaking on condition of anonymity.

“The psychology behind refusing to sell dollars is essentially the same.”

Stocks surge despite currency weakness

Despite the won’s fragility, equity markets continued to rally.

The KOSPI closed Wednesday at a record 5,371.10, up 1.57 percent. Institutional investors posted net purchases of 1.4 trillion won ($964.2 million), while retail investors sold a net 1 trillion won.

In January, institutions were net buyers of 34 trillion won, while retail and foreign investors were net sellers of 2.7 trillion won and 3.7 trillion won, respectively.

Meanwhile, the dollar rose 1.30 won to close at 1,452.30.

Copyright ⓒ Aju Press All rights reserved.