Journalist

Candice Kim

-

Price war at home as K-beauty expands overseas SEOUL, February 04 (AJP) - The quality of K-beauty is no longer in question. With low entry barriers and easy access to standardized ingredients and manufacturing, producing cosmetics has become relatively simple. What now separates winners from losers is speed, packaging, branding and, increasingly, price. As Korean beauty brands continue to expand their global footprint — especially in the United States — competition at home is intensifying around affordability. While K-beauty has evolved from a viral trend into a major export industry, its fiercest battle is unfolding on domestic shelves. That rivalry is sharpening with the latest move by Musinsa, which said it will open the first standalone offline store for its private-label brand Musinsa Standard Beauty on Feb. 12 at Hyundai Department Store’s Mokdong branch in Seoul. The opening marks its formal entry into South Korea’s fast-growing ultra-low-priced cosmetics segment. The move places Musinsa in direct competition with Daiso, which has built a mass-market following around cosmetics priced mostly between 1,000 won and 5,000 won ($0.75 to $3.75). Daiso’s budget beauty line has become a magnet not only for local shoppers but also for foreign tourists seeking affordable K-beauty souvenirs. “Whenever I visit Korea, I clear out the Daiso cosmetics aisles with my credit card,” said Ashley Lee, a Korean American living in the United States. “My colleagues back home always ask me to bring back specific products.” According to Daiso, overseas card transactions across its stores jumped about 60 percent in 2025 from a year earlier. At its Myeongdong Station branch — one of the most popular locations for tourists — foreign card sales rose roughly 40 percent year-on-year from January to November. “The Myeongdong store is among our busiest for foreign visitors, and beauty products are our top-selling category there,” a company official said. Sales data underline how rapidly budget beauty has grown. At Asung Daiso, cosmetics sales surged 85 percent in 2023, 144 percent in 2024 and 70 percent in 2025, making the segment one of the fastest-expanding corners of Korea’s retail market. Larger players, including Olive Young and major hypermarkets, have since moved in, intensifying competition for value-conscious consumers. Musinsa is positioning itself squarely in that battleground. Its Musinsa Standard Beauty products are mostly priced between 3,900 won and 5,900 won ($2.90 to $4.40) — slightly above Daiso’s entry-level range but well below typical mid-priced offerings at health-and-beauty chains. The pricing reflects an effort to carve out a “value-for-money” niche rather than compete directly in premium branding. Its first beauty-only store will span about 30 square meters and showcase around 20 core products, suggesting a pilot format designed to test demand. “The Mokdong store features a dedicated space solely for our beauty line,” a Musinsa official said. “After launching ultra-low-priced products last September, transaction volumes grew rapidly, giving us confidence in this segment.” “In cosmetics retail, online and offline channels have to work together,” said Kim Ju Duk, a professor of the beauty industry department at Sungshin Women’s University. “When consumers can test products in person, it has a direct impact on purchase decisions, and that experience often leads to repeat purchases online later.” He added that Musinsa’s move could meaningfully lift sales. “Olive Young’s growth accelerated after it started running online and offline channels in parallel around 2017 and 2018. If Musinsa follows a similar path, this offline push could turn out to be a very effective strategy.” The company is treating the store as a testbed, citing Mokdong’s dense student population and surrounding academies as key factors. If successful, similar beauty-focused outlets could follow. The push comes as foreign demand increasingly shapes the K-beauty market. Retailers in districts such as Myeongdong and Seongsu report rising purchases by overseas visitors, many of whom favor lower-priced skincare and cosmetics for everyday use or gifts. Against that backdrop, analysts see Musinsa’s move as a bet that price competitiveness — not just trend-driven marketing — will define the industry’s next phase. “Foreign customers already account for about 25 percent of transactions for Musinsa Standard Beauty,” a company official said. “As our offline presence expands, exposure to overseas visitors will grow naturally.” The brand’s flagship stores, including its Myeongdong outlet, already draw roughly half of their customers from abroad, according to the company. With competitive pricing and manufacturing partnerships with firms such as Cosmax, Musinsa expects foreign demand to continue rising. Musinsa entered the private-label beauty business in 2021 with affordable functional products, but sharpened its strategy after forming a partnership with Cosmax in September last year. Since then, it has expanded its low-cost lineup and plans further collaborations, including with Dashu and LG Household & Health Care. Under its current roadmap, Musinsa aims to position Musinsa Standard Beauty as a sub-10,000-won value brand, while differentiating its other private labels — Oddtype and Whizzy — in color cosmetics. The company plans to focus on online channels at home and offline expansion overseas for those brands. While sales data from the Mokdong store are yet to emerge, broader market figures point to rising stakes. With Daiso posting triple-digit growth in some years and foreign demand adding momentum, the fight for Korea’s budget beauty consumers is no longer a sideshow. It is becoming one of the industry’s main fronts. 2026-02-04 15:24:12

Price war at home as K-beauty expands overseas SEOUL, February 04 (AJP) - The quality of K-beauty is no longer in question. With low entry barriers and easy access to standardized ingredients and manufacturing, producing cosmetics has become relatively simple. What now separates winners from losers is speed, packaging, branding and, increasingly, price. As Korean beauty brands continue to expand their global footprint — especially in the United States — competition at home is intensifying around affordability. While K-beauty has evolved from a viral trend into a major export industry, its fiercest battle is unfolding on domestic shelves. That rivalry is sharpening with the latest move by Musinsa, which said it will open the first standalone offline store for its private-label brand Musinsa Standard Beauty on Feb. 12 at Hyundai Department Store’s Mokdong branch in Seoul. The opening marks its formal entry into South Korea’s fast-growing ultra-low-priced cosmetics segment. The move places Musinsa in direct competition with Daiso, which has built a mass-market following around cosmetics priced mostly between 1,000 won and 5,000 won ($0.75 to $3.75). Daiso’s budget beauty line has become a magnet not only for local shoppers but also for foreign tourists seeking affordable K-beauty souvenirs. “Whenever I visit Korea, I clear out the Daiso cosmetics aisles with my credit card,” said Ashley Lee, a Korean American living in the United States. “My colleagues back home always ask me to bring back specific products.” According to Daiso, overseas card transactions across its stores jumped about 60 percent in 2025 from a year earlier. At its Myeongdong Station branch — one of the most popular locations for tourists — foreign card sales rose roughly 40 percent year-on-year from January to November. “The Myeongdong store is among our busiest for foreign visitors, and beauty products are our top-selling category there,” a company official said. Sales data underline how rapidly budget beauty has grown. At Asung Daiso, cosmetics sales surged 85 percent in 2023, 144 percent in 2024 and 70 percent in 2025, making the segment one of the fastest-expanding corners of Korea’s retail market. Larger players, including Olive Young and major hypermarkets, have since moved in, intensifying competition for value-conscious consumers. Musinsa is positioning itself squarely in that battleground. Its Musinsa Standard Beauty products are mostly priced between 3,900 won and 5,900 won ($2.90 to $4.40) — slightly above Daiso’s entry-level range but well below typical mid-priced offerings at health-and-beauty chains. The pricing reflects an effort to carve out a “value-for-money” niche rather than compete directly in premium branding. Its first beauty-only store will span about 30 square meters and showcase around 20 core products, suggesting a pilot format designed to test demand. “The Mokdong store features a dedicated space solely for our beauty line,” a Musinsa official said. “After launching ultra-low-priced products last September, transaction volumes grew rapidly, giving us confidence in this segment.” “In cosmetics retail, online and offline channels have to work together,” said Kim Ju Duk, a professor of the beauty industry department at Sungshin Women’s University. “When consumers can test products in person, it has a direct impact on purchase decisions, and that experience often leads to repeat purchases online later.” He added that Musinsa’s move could meaningfully lift sales. “Olive Young’s growth accelerated after it started running online and offline channels in parallel around 2017 and 2018. If Musinsa follows a similar path, this offline push could turn out to be a very effective strategy.” The company is treating the store as a testbed, citing Mokdong’s dense student population and surrounding academies as key factors. If successful, similar beauty-focused outlets could follow. The push comes as foreign demand increasingly shapes the K-beauty market. Retailers in districts such as Myeongdong and Seongsu report rising purchases by overseas visitors, many of whom favor lower-priced skincare and cosmetics for everyday use or gifts. Against that backdrop, analysts see Musinsa’s move as a bet that price competitiveness — not just trend-driven marketing — will define the industry’s next phase. “Foreign customers already account for about 25 percent of transactions for Musinsa Standard Beauty,” a company official said. “As our offline presence expands, exposure to overseas visitors will grow naturally.” The brand’s flagship stores, including its Myeongdong outlet, already draw roughly half of their customers from abroad, according to the company. With competitive pricing and manufacturing partnerships with firms such as Cosmax, Musinsa expects foreign demand to continue rising. Musinsa entered the private-label beauty business in 2021 with affordable functional products, but sharpened its strategy after forming a partnership with Cosmax in September last year. Since then, it has expanded its low-cost lineup and plans further collaborations, including with Dashu and LG Household & Health Care. Under its current roadmap, Musinsa aims to position Musinsa Standard Beauty as a sub-10,000-won value brand, while differentiating its other private labels — Oddtype and Whizzy — in color cosmetics. The company plans to focus on online channels at home and offline expansion overseas for those brands. While sales data from the Mokdong store are yet to emerge, broader market figures point to rising stakes. With Daiso posting triple-digit growth in some years and foreign demand adding momentum, the fight for Korea’s budget beauty consumers is no longer a sideshow. It is becoming one of the industry’s main fronts. 2026-02-04 15:24:12 -

LG Electronics showcases B2B solutions at North American, European trade shows SEOUL, February 04 (AJP) - LG Electronics is participating in major business-to-business trade shows in North America and Europe this week, presenting heating, ventilation and air conditioning systems and commercial display solutions as it seeks to expand its B2B operations. The South Korean electronics maker exhibited HVAC solutions ranging from unitary systems to AI data center cooling technology at AHR EXPO 2026, North America's largest air conditioning trade show, which concludes on Wednesday in Orlando, Florida. LG Electronics displayed core HVAC components including compressors, motors, fan motors and drives at the event. The company also presented what it calls an "all-in-one component solution" that combines key air conditioning parts optimized for residential and commercial buildings. Separately, LG Electronics is presenting commercial display products and software solutions at ISE 2026, Europe's largest display trade show running through Friday in Barcelona, Spain. The exhibition includes the company's high-resolution "LG MAGNIT" signage, low-power "E-Paper" displays, and cloud-based software platforms such as LG ConnectedCare and LG SuperSign. LG Electronics' B2B revenue reached 24.1 trillion won ($18 billion) last year, accounting for more than 35 percent of total sales on a standalone basis. The company has set a target to increase the B2B share of revenue to 40 percent by 2030. The B2B business includes HVAC, automotive components and commercial displays. 2026-02-04 14:00:14

LG Electronics showcases B2B solutions at North American, European trade shows SEOUL, February 04 (AJP) - LG Electronics is participating in major business-to-business trade shows in North America and Europe this week, presenting heating, ventilation and air conditioning systems and commercial display solutions as it seeks to expand its B2B operations. The South Korean electronics maker exhibited HVAC solutions ranging from unitary systems to AI data center cooling technology at AHR EXPO 2026, North America's largest air conditioning trade show, which concludes on Wednesday in Orlando, Florida. LG Electronics displayed core HVAC components including compressors, motors, fan motors and drives at the event. The company also presented what it calls an "all-in-one component solution" that combines key air conditioning parts optimized for residential and commercial buildings. Separately, LG Electronics is presenting commercial display products and software solutions at ISE 2026, Europe's largest display trade show running through Friday in Barcelona, Spain. The exhibition includes the company's high-resolution "LG MAGNIT" signage, low-power "E-Paper" displays, and cloud-based software platforms such as LG ConnectedCare and LG SuperSign. LG Electronics' B2B revenue reached 24.1 trillion won ($18 billion) last year, accounting for more than 35 percent of total sales on a standalone basis. The company has set a target to increase the B2B share of revenue to 40 percent by 2030. The B2B business includes HVAC, automotive components and commercial displays. 2026-02-04 14:00:14 -

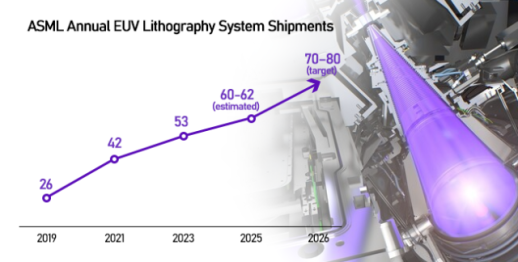

ASML's ambitious revenue target raise capacity upgrade room for memory chipmakers in AI heyday SEOUL, February 02 (AJP) - ASML’s ambitious revenue target signals greater room for scaling and production ramp-ups among chipmakers including Samsung Electronics and SK hynix, which together supply roughly 80 percent of the memory used in AI accelerators and hyperscale data centers. The outlook follows stronger-than-expected 2025 earnings from ASML, which reported total net sales of €32.7 billion ($38.8 billion), while fourth-quarter net bookings surged to €13.16 billion ($15.6 billion), more than double market expectations. The increase was driven largely by demand for extreme ultraviolet (EUV) lithography systems, which are essential for manufacturing advanced chips used in artificial intelligence workloads. EUV tools accounted for about 56 percent of new bookings in the fourth quarter. ASML holds a de facto monopoly on EUV lithography, making its production capacity a structural constraint for the global semiconductor industry. Unlike conventional chipmaking equipment, EUV systems remain a tightly rationed resource due to their complexity and precision requirements. Annual EUV shipments have risen only gradually, from 26 units in 2019 to 42 units in 2021, 53 units in 2023 and an estimated 60–62 units in 2025. For 2026, ASML is targeting output of 70–80 units, its highest level to date, according to industry estimates. Even at that level, supply remains well below demand. Global chipmakers — including Taiwan Semiconductor Manufacturing Co., Micron Technology and Intel — are competing aggressively for limited allocations, as capacity upgrades and technology transitions increasingly hinge on securing additional EUV machines. “Lithography tools are the most critical equipment in semiconductor manufacturing, regardless of whether the chips are for memory or logic,” said Lee Jong-hwan, a professor of system semiconductor engineering at Sangmyung University. “Because EUV systems are ultra-precision machines, only a limited number can be produced each year, which is why ASML’s annual output is measured in just several dozen units.” “In AI semiconductors, both memory and non-memory chips are essential,” he added. “The surge in EUV demand reflects how AI workloads are expanding across both segments. Given that advanced DRAM, including high-bandwidth memory, is now produced at around the 10-nanometer class in Korea, it is highly likely that Samsung Electronics and SK hynix have already secured reservations for sub-10nm EUV tools.” ASML’s decision to raise its 2026 revenue guidance to €34 billion–€39 billion is therefore widely interpreted as a sign that a substantial portion of next year’s EUV output has already been committed to leading customers, including Korean memory makers ramping up production of high-bandwidth memory and advanced DRAM for AI accelerators. The company has also doubled its long-term revenue target for 2030 to €60 billion ($71 billion), supported by the successful delivery of its first commercial-grade high–numerical aperture (High-NA) EUV system, the TWINSCAN EXE:5200B. Compared with standard EUV tools using a 0.33 numerical aperture, the High-NA system operates at 0.55NA, enabling nearly three times the transistor density — a critical advantage for next-generation AI processors. The first systems were delivered to SK hynix and Intel. With EUV tools costing well over $150 million each and available in limited numbers, competitiveness is increasingly determined not only by access, but by how efficiently chipmakers convert those investments into higher yields and faster production ramps. SK hynix, the world’s leading supplier of high-bandwidth memory for AI data centers, has already moved early. The company said it installed a production-ready High-NA EUV system at its M16 fab in Icheon in 2025. ASML also expects its exposure to China to decline as export controls tighten, with China’s revenue share projected to fall from about 33 percent in 2025 to around 20 percent in 2026. Rising demand from South Korea, Taiwan and the United States is expected to more than offset the decline. As global investment in AI infrastructure accelerates, ASML’s constrained EUV output is set to remain a key gatekeeper — turning access, execution and yield management into decisive variables for Korea’s memory chipmakers in the next phase of the semiconductor cycle. 2026-02-02 14:39:16

ASML's ambitious revenue target raise capacity upgrade room for memory chipmakers in AI heyday SEOUL, February 02 (AJP) - ASML’s ambitious revenue target signals greater room for scaling and production ramp-ups among chipmakers including Samsung Electronics and SK hynix, which together supply roughly 80 percent of the memory used in AI accelerators and hyperscale data centers. The outlook follows stronger-than-expected 2025 earnings from ASML, which reported total net sales of €32.7 billion ($38.8 billion), while fourth-quarter net bookings surged to €13.16 billion ($15.6 billion), more than double market expectations. The increase was driven largely by demand for extreme ultraviolet (EUV) lithography systems, which are essential for manufacturing advanced chips used in artificial intelligence workloads. EUV tools accounted for about 56 percent of new bookings in the fourth quarter. ASML holds a de facto monopoly on EUV lithography, making its production capacity a structural constraint for the global semiconductor industry. Unlike conventional chipmaking equipment, EUV systems remain a tightly rationed resource due to their complexity and precision requirements. Annual EUV shipments have risen only gradually, from 26 units in 2019 to 42 units in 2021, 53 units in 2023 and an estimated 60–62 units in 2025. For 2026, ASML is targeting output of 70–80 units, its highest level to date, according to industry estimates. Even at that level, supply remains well below demand. Global chipmakers — including Taiwan Semiconductor Manufacturing Co., Micron Technology and Intel — are competing aggressively for limited allocations, as capacity upgrades and technology transitions increasingly hinge on securing additional EUV machines. “Lithography tools are the most critical equipment in semiconductor manufacturing, regardless of whether the chips are for memory or logic,” said Lee Jong-hwan, a professor of system semiconductor engineering at Sangmyung University. “Because EUV systems are ultra-precision machines, only a limited number can be produced each year, which is why ASML’s annual output is measured in just several dozen units.” “In AI semiconductors, both memory and non-memory chips are essential,” he added. “The surge in EUV demand reflects how AI workloads are expanding across both segments. Given that advanced DRAM, including high-bandwidth memory, is now produced at around the 10-nanometer class in Korea, it is highly likely that Samsung Electronics and SK hynix have already secured reservations for sub-10nm EUV tools.” ASML’s decision to raise its 2026 revenue guidance to €34 billion–€39 billion is therefore widely interpreted as a sign that a substantial portion of next year’s EUV output has already been committed to leading customers, including Korean memory makers ramping up production of high-bandwidth memory and advanced DRAM for AI accelerators. The company has also doubled its long-term revenue target for 2030 to €60 billion ($71 billion), supported by the successful delivery of its first commercial-grade high–numerical aperture (High-NA) EUV system, the TWINSCAN EXE:5200B. Compared with standard EUV tools using a 0.33 numerical aperture, the High-NA system operates at 0.55NA, enabling nearly three times the transistor density — a critical advantage for next-generation AI processors. The first systems were delivered to SK hynix and Intel. With EUV tools costing well over $150 million each and available in limited numbers, competitiveness is increasingly determined not only by access, but by how efficiently chipmakers convert those investments into higher yields and faster production ramps. SK hynix, the world’s leading supplier of high-bandwidth memory for AI data centers, has already moved early. The company said it installed a production-ready High-NA EUV system at its M16 fab in Icheon in 2025. ASML also expects its exposure to China to decline as export controls tighten, with China’s revenue share projected to fall from about 33 percent in 2025 to around 20 percent in 2026. Rising demand from South Korea, Taiwan and the United States is expected to more than offset the decline. As global investment in AI infrastructure accelerates, ASML’s constrained EUV output is set to remain a key gatekeeper — turning access, execution and yield management into decisive variables for Korea’s memory chipmakers in the next phase of the semiconductor cycle. 2026-02-02 14:39:16 -

Foreign workers missing after deadly factory fire in South Korea SEOUL, January 31 (AJP) - A massive fire at a household goods factory in South Korea left at least one foreign worker dead and another missing, authorities said on Saturday, highlighting ongoing safety concerns involving migrant labor in the country’s manufacturing sector. The blaze broke out at around 2:55 p.m. on Friday at a factory in Eumseong County, North Chungcheong Province, which produces sanitary products such as wet wipes and diapers. Firefighters declared the fire fully extinguished after more than 21 hours of operation, battling structural collapses and intense heat fueled by highly flammable materials inside the facility. Of the 83 workers on site at the time, 81 managed to evacuate. However, two foreign nationals — a Nepali man in his 20s and a Kazakh man in his 50s — were initially unaccounted for. One body, believed to be one of the missing workers, was discovered early Friday near a stairwell on the second floor of the building. Authorities have transferred the remains to a local funeral home and requested forensic identification. The second worker remained missing as of Friday afternoon, with rescue teams continuing searches using heavy equipment and urban detection devices amid unstable debris. Investigators said both missing workers were subcontracted employees responsible for waste processing inside the production building, working on the ground floor where the fire is believed to have originated. Fire officials said the factory’s sandwich-panel structure and large volumes of combustible pulp materials caused the flames to spread rapidly, complicating rescue efforts and forcing overnight suspensions due to collapse risks. Police have launched a serious industrial accident investigation and plan to examine whether safety management protocols were properly followed once on-site recovery is completed. The incident has renewed scrutiny over working conditions faced by foreign laborers in South Korea’s industrial sector, where migrant workers are often employed through subcontractors in high-risk environments. 2026-01-31 17:44:31

Foreign workers missing after deadly factory fire in South Korea SEOUL, January 31 (AJP) - A massive fire at a household goods factory in South Korea left at least one foreign worker dead and another missing, authorities said on Saturday, highlighting ongoing safety concerns involving migrant labor in the country’s manufacturing sector. The blaze broke out at around 2:55 p.m. on Friday at a factory in Eumseong County, North Chungcheong Province, which produces sanitary products such as wet wipes and diapers. Firefighters declared the fire fully extinguished after more than 21 hours of operation, battling structural collapses and intense heat fueled by highly flammable materials inside the facility. Of the 83 workers on site at the time, 81 managed to evacuate. However, two foreign nationals — a Nepali man in his 20s and a Kazakh man in his 50s — were initially unaccounted for. One body, believed to be one of the missing workers, was discovered early Friday near a stairwell on the second floor of the building. Authorities have transferred the remains to a local funeral home and requested forensic identification. The second worker remained missing as of Friday afternoon, with rescue teams continuing searches using heavy equipment and urban detection devices amid unstable debris. Investigators said both missing workers were subcontracted employees responsible for waste processing inside the production building, working on the ground floor where the fire is believed to have originated. Fire officials said the factory’s sandwich-panel structure and large volumes of combustible pulp materials caused the flames to spread rapidly, complicating rescue efforts and forcing overnight suspensions due to collapse risks. Police have launched a serious industrial accident investigation and plan to examine whether safety management protocols were properly followed once on-site recovery is completed. The incident has renewed scrutiny over working conditions faced by foreign laborers in South Korea’s industrial sector, where migrant workers are often employed through subcontractors in high-risk environments. 2026-01-31 17:44:31 -

Korea signs $1bn-plus Chunmoo rocket deal with Norway SEOUL, January 31 (AJP) - South Korea has secured a major defense export deal with Norway, with presidential chief of staff Kang Hoon-sik saying in a Facebook post on Saturday that the Norwegian government had signed a contract to purchase the Chunmoo multiple rocket launcher system. The contract is worth about 1.3 trillion won ($970 million). Kang Hoon-sik, chief of staff to President Lee Jae-myung, said the agreement was finalized following approval by the Norwegian government and parliament, marking South Korea’s largest-ever arms export to a Nordic country. The deal comes after Norway selected Hanwha Aerospace as the preferred bidder for its long-range precision fire system (LRPFS) program, estimated at 19 billion Norwegian kroner ($1.8 billion), with the Chunmoo system forming the core of the package. Kang, who is visiting Norway as a special presidential envoy for strategic economic cooperation, said the contract follows months of high-level discussions with Norwegian defense and foreign affairs officials. 2026-01-31 14:36:57

Korea signs $1bn-plus Chunmoo rocket deal with Norway SEOUL, January 31 (AJP) - South Korea has secured a major defense export deal with Norway, with presidential chief of staff Kang Hoon-sik saying in a Facebook post on Saturday that the Norwegian government had signed a contract to purchase the Chunmoo multiple rocket launcher system. The contract is worth about 1.3 trillion won ($970 million). Kang Hoon-sik, chief of staff to President Lee Jae-myung, said the agreement was finalized following approval by the Norwegian government and parliament, marking South Korea’s largest-ever arms export to a Nordic country. The deal comes after Norway selected Hanwha Aerospace as the preferred bidder for its long-range precision fire system (LRPFS) program, estimated at 19 billion Norwegian kroner ($1.8 billion), with the Chunmoo system forming the core of the package. Kang, who is visiting Norway as a special presidential envoy for strategic economic cooperation, said the contract follows months of high-level discussions with Norwegian defense and foreign affairs officials. 2026-01-31 14:36:57 -

Korea, U.S. fail to reach deal in tariff talks as discussions set to continue SEOUL, January 31 (AJP) - South Korea and the United States failed to reach a conclusion in tariff negotiations this week, as talks over Washington’s potential reimposition of higher duties on Korean goods ended without agreement. South Korea’s Industry Minister Kim Jung-kwan said Saturday that discussions with U.S. Commerce Secretary Howard Lutnick had deepened mutual understanding but fell short of producing a concrete outcome. “Both sides were able to better understand each other’s positions, but further dialogue will be needed,” Kim told reporters after meeting Lutnick for more than two hours at the U.S. Commerce Department in Washington. Kim said no final decision had been made on whether the United States would proceed with raising tariffs on South Korean exports, adding that negotiations remain ongoing. The talks followed renewed pressure from U.S. President Donald Trump, who last week warned that tariffs on Korean products — including automobiles, timber and pharmaceuticals — could be raised back to 25 percent if South Korea fails to pass legislation supporting pledged U.S. investment. Kim visited Washington earlier this week to urge the United States not to reinstate higher tariffs, emphasizing Seoul’s commitment to implementing bilateral trade agreements and advancing a proposed special law aimed at facilitating Korean investment in the United States. South Korea’s industry ministry said the two sides agreed that investment projects under the proposed legislation should be mutually beneficial to both economies, though it acknowledged that additional discussions would be required. Kim said further consultations will continue via video conference after his return to Seoul, marking the end of his U.S. visit. 2026-01-31 11:28:51

Korea, U.S. fail to reach deal in tariff talks as discussions set to continue SEOUL, January 31 (AJP) - South Korea and the United States failed to reach a conclusion in tariff negotiations this week, as talks over Washington’s potential reimposition of higher duties on Korean goods ended without agreement. South Korea’s Industry Minister Kim Jung-kwan said Saturday that discussions with U.S. Commerce Secretary Howard Lutnick had deepened mutual understanding but fell short of producing a concrete outcome. “Both sides were able to better understand each other’s positions, but further dialogue will be needed,” Kim told reporters after meeting Lutnick for more than two hours at the U.S. Commerce Department in Washington. Kim said no final decision had been made on whether the United States would proceed with raising tariffs on South Korean exports, adding that negotiations remain ongoing. The talks followed renewed pressure from U.S. President Donald Trump, who last week warned that tariffs on Korean products — including automobiles, timber and pharmaceuticals — could be raised back to 25 percent if South Korea fails to pass legislation supporting pledged U.S. investment. Kim visited Washington earlier this week to urge the United States not to reinstate higher tariffs, emphasizing Seoul’s commitment to implementing bilateral trade agreements and advancing a proposed special law aimed at facilitating Korean investment in the United States. South Korea’s industry ministry said the two sides agreed that investment projects under the proposed legislation should be mutually beneficial to both economies, though it acknowledged that additional discussions would be required. Kim said further consultations will continue via video conference after his return to Seoul, marking the end of his U.S. visit. 2026-01-31 11:28:51 -

LG Elec profit slumps in 2025 on restructuring costs, media business losses SEOUL, January 30 (AJP) - LG Electronics reported a sharp decline in operating profit in 2025, as hefty one-off restructuring costs and persistent weakness in its media and entertainment business weighed heavily on earnings, overshadowing steady growth in its core home appliance and vehicle component units. The South Korean electronics maker said its annual operating profit fell 27.5 percent from a year earlier to 2.48 trillion won ($1.8 billion), after slipping into an operating loss in the fourth quarter amid rising cost burdens. LG posted an operating loss of 109 billion won in the October–December period, marking its first quarterly loss in nine years, as delayed demand recovery for display-based products, intensifying competition in the global TV market and increased marketing expenses eroded profitability. Earnings were further pressured by several trillion won in non-recurring costs related to a company-wide voluntary retirement program implemented in the second half of the year, the company said. While revenue growth continued, profitability deteriorated as cost pressures outpaced sales expansion. The company’s media and entertainment division swung to an operating loss of 751 billion won for the year, reversing a profit recorded a year earlier, as sluggish global TV demand and price competition from Chinese rivals weighed on margins. By contrast, LG’s core businesses delivered relatively resilient performance. The home appliance division posted operating profit of 1.28 trillion won, supported by production optimization, price adjustments and cost controls aimed at mitigating tariff-related risks. The vehicle solutions unit also delivered its strongest performance on record, with operating profit rising to 559 billion won, driven by smoother conversion of order backlogs into sales. Business-to-business revenue, including vehicle components, heating, ventilation and air conditioning, and component solutions, rose 3 percent year on year to 24.1 trillion won, reflecting the company’s ongoing shift toward so-called “quality growth” areas. Subscription-based appliance services and direct-to-consumer sales channels continued to expand, with subscription revenue jumping 29 percent to nearly 2.5 trillion won. LG said the restructuring measures are expected to help ease fixed-cost burdens over the medium to long term, while efforts are under way to strengthen competitiveness in its media business. Looking ahead, the company said it plans to reinforce its OLED and LCD product lineup and expand its webOS-based advertising and content ecosystem. LG also highlighted growing opportunities in cooling solutions for artificial intelligence data centers, including plans to commercialize liquid-cooling technologies and deepen related partnerships. Shares of LG Electronics closed down 1.8 percent at 99,100 won on Friday. 2026-01-30 17:38:35

LG Elec profit slumps in 2025 on restructuring costs, media business losses SEOUL, January 30 (AJP) - LG Electronics reported a sharp decline in operating profit in 2025, as hefty one-off restructuring costs and persistent weakness in its media and entertainment business weighed heavily on earnings, overshadowing steady growth in its core home appliance and vehicle component units. The South Korean electronics maker said its annual operating profit fell 27.5 percent from a year earlier to 2.48 trillion won ($1.8 billion), after slipping into an operating loss in the fourth quarter amid rising cost burdens. LG posted an operating loss of 109 billion won in the October–December period, marking its first quarterly loss in nine years, as delayed demand recovery for display-based products, intensifying competition in the global TV market and increased marketing expenses eroded profitability. Earnings were further pressured by several trillion won in non-recurring costs related to a company-wide voluntary retirement program implemented in the second half of the year, the company said. While revenue growth continued, profitability deteriorated as cost pressures outpaced sales expansion. The company’s media and entertainment division swung to an operating loss of 751 billion won for the year, reversing a profit recorded a year earlier, as sluggish global TV demand and price competition from Chinese rivals weighed on margins. By contrast, LG’s core businesses delivered relatively resilient performance. The home appliance division posted operating profit of 1.28 trillion won, supported by production optimization, price adjustments and cost controls aimed at mitigating tariff-related risks. The vehicle solutions unit also delivered its strongest performance on record, with operating profit rising to 559 billion won, driven by smoother conversion of order backlogs into sales. Business-to-business revenue, including vehicle components, heating, ventilation and air conditioning, and component solutions, rose 3 percent year on year to 24.1 trillion won, reflecting the company’s ongoing shift toward so-called “quality growth” areas. Subscription-based appliance services and direct-to-consumer sales channels continued to expand, with subscription revenue jumping 29 percent to nearly 2.5 trillion won. LG said the restructuring measures are expected to help ease fixed-cost burdens over the medium to long term, while efforts are under way to strengthen competitiveness in its media business. Looking ahead, the company said it plans to reinforce its OLED and LCD product lineup and expand its webOS-based advertising and content ecosystem. LG also highlighted growing opportunities in cooling solutions for artificial intelligence data centers, including plans to commercialize liquid-cooling technologies and deepen related partnerships. Shares of LG Electronics closed down 1.8 percent at 99,100 won on Friday. 2026-01-30 17:38:35 -

After conquering beauty front, Olive Young expands to wellness with Gwanghwamun opening SEOUL, January 29 (AJP) - Best known as South Korea’s dominant K-beauty retailer, Olive Young is opening a new chapter — one that extends beyond cosmetics and into everyday wellness. The company on Thursday unveiled to the media the first flagship store of its new wellness platform, Olive Better, in Gwanghwamun, one of Seoul’s busiest and most symbolic district name recently gaining renewed global fame. The area sits at the heart of the capital, home to government offices, multinational corporations and major cultural events. In March, it is set to lend its open space for the much-awaited comeback performance by global K-pop group BTS — a reminder of how the district routinely draws massive crowds of both locals and foreign visitors. The location itself carries commercial weight. The site previously housed one of Seoul’s most heavily trafficked two-story Starbucks stores, long known as a landmark meeting point for office workers and tourists alike. From beauty to daily wellness At a media briefing held earlier in the day, Olive Young framed Olive Better as its attempt to redefine wellness not as a niche category, but as part of daily life. An Olive Young official described the concept through a “six-well” philosophy: Eat well, nourish well, fit well, glow well, relax well and care well. The shift comes as interest in wellness has accelerated in South Korea since the pandemic, expanding from fitness and dieting toward sleep quality, stress management and functional nutrition. Some visitors said the space felt reminiscent of U.S. wellness-focused retailers, drawing parallels to Trader Joe’s for its accessibility and to Erewhon for its curated, premium aesthetic. Why create a separate brand? Given Olive Young’s dominance in the health-and-beauty retail market, the decision to launch a separate wellness platform raises an obvious question. Company officials said wellness demands a fundamentally different retail structure. “Beauty focuses on visible results, but wellness is about habits,” an Olive Young representative said. “We needed a space that helps consumers practice small routines consistently, rather than simply buy products.” Defining K-wellness Asked how Olive Young defines K-wellness (Korean wellness), particularly for global consumers with different cultural standards, the company emphasized a domestic-first strategy. “Olive Better is designed primarily for Korean customers,” an official told AJP. “The core of K-wellness lies in how people maintain their health within extremely busy daily schedules.” “If that culture naturally takes root here, foreign visitors may eventually become interested in how Koreans manage wellness in everyday life — much like how K-beauty spread globally,” the official added. A store shaped by urban routines That philosophy becomes clear inside the Gwanghwamun store. The merchandise targets time-constrained urban consumers. Near the entrance, shelves are lined with ginger shots, portable protein drinks and functional beverages designed for quick consumption between work schedules. Unlike traditional beauty retail, Olive Better allows visitors to sample food and drinks on-site — replacing cosmetic testers with tasting stations. Further inside, entire sections are dedicated to rest and recovery. Sleep-related products occupy prominent space, including loungewear, pajamas and melatonin-infused products — a category that has grown rapidly in Korea in recent years. “Interest in sleep hygiene among young adults has increased noticeably,” said Dr. Lee, a neurologist specializing in sleep patterns. “Many people now receive sleep education or try behavioral and lifestyle adjustments first, and if those don’t work, they proceed to medical treatment,” he said. The rise in sleep-focused consumption reflects a broader shift in how Koreans perceive wellness — not as luxury, but as survival in high-pressure urban life. Wellness as culture, not category Rather than presenting wellness as aspiration or transformation, Olive Better frames health as something practical — routines that can be executed between commutes, meetings and late nights. In the middle of Seoul’s political, corporate and cultural crossroads, the store positions wellness not as escape, but as part of daily motion. For Olive Young, the bet is clear: if wellness becomes an everyday practice for Koreans, it may eventually travel abroad not as a product export, but as culture. Olive Better officially launches Friday. 2026-01-29 19:19:40

After conquering beauty front, Olive Young expands to wellness with Gwanghwamun opening SEOUL, January 29 (AJP) - Best known as South Korea’s dominant K-beauty retailer, Olive Young is opening a new chapter — one that extends beyond cosmetics and into everyday wellness. The company on Thursday unveiled to the media the first flagship store of its new wellness platform, Olive Better, in Gwanghwamun, one of Seoul’s busiest and most symbolic district name recently gaining renewed global fame. The area sits at the heart of the capital, home to government offices, multinational corporations and major cultural events. In March, it is set to lend its open space for the much-awaited comeback performance by global K-pop group BTS — a reminder of how the district routinely draws massive crowds of both locals and foreign visitors. The location itself carries commercial weight. The site previously housed one of Seoul’s most heavily trafficked two-story Starbucks stores, long known as a landmark meeting point for office workers and tourists alike. From beauty to daily wellness At a media briefing held earlier in the day, Olive Young framed Olive Better as its attempt to redefine wellness not as a niche category, but as part of daily life. An Olive Young official described the concept through a “six-well” philosophy: Eat well, nourish well, fit well, glow well, relax well and care well. The shift comes as interest in wellness has accelerated in South Korea since the pandemic, expanding from fitness and dieting toward sleep quality, stress management and functional nutrition. Some visitors said the space felt reminiscent of U.S. wellness-focused retailers, drawing parallels to Trader Joe’s for its accessibility and to Erewhon for its curated, premium aesthetic. Why create a separate brand? Given Olive Young’s dominance in the health-and-beauty retail market, the decision to launch a separate wellness platform raises an obvious question. Company officials said wellness demands a fundamentally different retail structure. “Beauty focuses on visible results, but wellness is about habits,” an Olive Young representative said. “We needed a space that helps consumers practice small routines consistently, rather than simply buy products.” Defining K-wellness Asked how Olive Young defines K-wellness (Korean wellness), particularly for global consumers with different cultural standards, the company emphasized a domestic-first strategy. “Olive Better is designed primarily for Korean customers,” an official told AJP. “The core of K-wellness lies in how people maintain their health within extremely busy daily schedules.” “If that culture naturally takes root here, foreign visitors may eventually become interested in how Koreans manage wellness in everyday life — much like how K-beauty spread globally,” the official added. A store shaped by urban routines That philosophy becomes clear inside the Gwanghwamun store. The merchandise targets time-constrained urban consumers. Near the entrance, shelves are lined with ginger shots, portable protein drinks and functional beverages designed for quick consumption between work schedules. Unlike traditional beauty retail, Olive Better allows visitors to sample food and drinks on-site — replacing cosmetic testers with tasting stations. Further inside, entire sections are dedicated to rest and recovery. Sleep-related products occupy prominent space, including loungewear, pajamas and melatonin-infused products — a category that has grown rapidly in Korea in recent years. “Interest in sleep hygiene among young adults has increased noticeably,” said Dr. Lee, a neurologist specializing in sleep patterns. “Many people now receive sleep education or try behavioral and lifestyle adjustments first, and if those don’t work, they proceed to medical treatment,” he said. The rise in sleep-focused consumption reflects a broader shift in how Koreans perceive wellness — not as luxury, but as survival in high-pressure urban life. Wellness as culture, not category Rather than presenting wellness as aspiration or transformation, Olive Better frames health as something practical — routines that can be executed between commutes, meetings and late nights. In the middle of Seoul’s political, corporate and cultural crossroads, the store positions wellness not as escape, but as part of daily motion. For Olive Young, the bet is clear: if wellness becomes an everyday practice for Koreans, it may eventually travel abroad not as a product export, but as culture. Olive Better officially launches Friday. 2026-01-29 19:19:40 -

Samsung vs SK hynix HBM4 race, pioneer holds a clear lead -for now SEOUL, January 29 (AJP) - South Korea’s two dominant memory-chip makers, Samsung Electronics and SK hynix, have formally entered the race for next-generation high-bandwidth memory, or HBM4, as demand from artificial-intelligence chipmakers tightens an already constrained market. The companies, which together command roughly 80 percent of high-bandwidth memory used in AI accelerators, held back-to-back earnings conference calls on the same day for the first time, offering competing visions of how the next phase of the AI-driven memory cycle will unfold. Both projected sustained supply tightness this year despite aggressive capacity expansion, following record earnings in 2025. The rivalry centers on HBM4, the next standard for AI memory, where Samsung is newly entering the supply chain of Nvidia after SK hynix enjoyed a near-monopoly position in earlier generations. SK hynix, which pioneered the HBM market and delivered an industry-leading 58 percent operating margin from chip sales in the fourth quarter, expressed confidence that its technological lead would carry into the next cycle. “Our commercialization capabilities and product quality, which have earned customer trust, cannot be overtaken in a short period,” said Song Hyun-jong, president of SK hynix’s corporate center. “As with HBM and HBM3, we aim to secure overwhelming leadership in HBM4.” Samsung, which plans to roll out 11.7-gigabits-per-second HBM4 products as early as next month, said demand is already outstripping supply. Orders for 2026 have exceeded the company’s current capacity, executives said, with key customers seeking advance bookings for 2027 deliveries. “Despite continued expansion, our capacity cannot keep up with demand,” said Kim Jae-june, executive vice president of Samsung’s memory division, adding that HBM revenue this year is expected to more than triple from 2025 levels. Both companies pledged a “significant” ramp-up in capacity this year compared with 2026, though neither disclosed precise figures. SK hynix said it remains comfortable committing capital investment equivalent to roughly 30 percent of this year’s projected revenue. Samsung said it will respond to customer demand through timely shipment of competitive HBM4 products while expanding sales of AI-related memory and addressing rising NAND demand linked to AI workloads. For now, the competitive gap is already visible in financial results. Samsung posted strong operating income and record sales in the fourth quarter and full year of 2025, but lagged SK hynix in profitability. Samsung reported 16.4 trillion won in chip operating profit for the December quarter, while SK hynix generated 19.17 trillion won on sales of 80.8 trillion won, yielding the industry’s highest margin. For full-year 2025, Samsung recorded 24.9 trillion won in chip operating profit, compared with SK hynix’s 47.2 trillion won on sales of 97.15 trillion won, underscoring the advantage of SK hynix’s heavier exposure to AI-related, high-margin memory. Kim Duk-ki, a professor of electronic engineering at Sejong University, said the surge in memory profitability reflects AI-driven demand outpacing supply, but warned that overly rapid investment expansion could reintroduce volatility in a historically cyclical industry. “If capital spending accelerates too quickly, price instability could eventually follow,” he said. Market analysts largely expect SK hynix to retain its lead. Counterpoint Research estimates the company will account for about 54 percent of global HBM4 sales this year, compared with 28 percent for Samsung and 18 percent for Micron. The firm previously held 62 percent of HBM3 shipments as of mid-2025. Goldman Sachs expects SK hynix to maintain a comfortable lead in HBM3 through at least 2026, while UBS forecasts the company could capture around 70 percent of the HBM4 market tied to next-generation AI platforms, including Nvidia’s Rubin architecture. Samsung Electronics shares closed down 0.7 percent at 161,300 won on Thursday, while SK hynix climbed 2.7 percent to 864,000 won, reflecting investors’ contrasting reactions to the two chipmakers’ earnings and outlook. For now, Samsung’s entry marks a meaningful escalation in competition. But in the early stages of the HBM4 cycle, investors and customers alike appear to see the pioneer as remaining firmly in front. * AJP Yuna Ryu and Yoo Joonha contributed to this story. 2026-01-29 17:43:00

Samsung vs SK hynix HBM4 race, pioneer holds a clear lead -for now SEOUL, January 29 (AJP) - South Korea’s two dominant memory-chip makers, Samsung Electronics and SK hynix, have formally entered the race for next-generation high-bandwidth memory, or HBM4, as demand from artificial-intelligence chipmakers tightens an already constrained market. The companies, which together command roughly 80 percent of high-bandwidth memory used in AI accelerators, held back-to-back earnings conference calls on the same day for the first time, offering competing visions of how the next phase of the AI-driven memory cycle will unfold. Both projected sustained supply tightness this year despite aggressive capacity expansion, following record earnings in 2025. The rivalry centers on HBM4, the next standard for AI memory, where Samsung is newly entering the supply chain of Nvidia after SK hynix enjoyed a near-monopoly position in earlier generations. SK hynix, which pioneered the HBM market and delivered an industry-leading 58 percent operating margin from chip sales in the fourth quarter, expressed confidence that its technological lead would carry into the next cycle. “Our commercialization capabilities and product quality, which have earned customer trust, cannot be overtaken in a short period,” said Song Hyun-jong, president of SK hynix’s corporate center. “As with HBM and HBM3, we aim to secure overwhelming leadership in HBM4.” Samsung, which plans to roll out 11.7-gigabits-per-second HBM4 products as early as next month, said demand is already outstripping supply. Orders for 2026 have exceeded the company’s current capacity, executives said, with key customers seeking advance bookings for 2027 deliveries. “Despite continued expansion, our capacity cannot keep up with demand,” said Kim Jae-june, executive vice president of Samsung’s memory division, adding that HBM revenue this year is expected to more than triple from 2025 levels. Both companies pledged a “significant” ramp-up in capacity this year compared with 2026, though neither disclosed precise figures. SK hynix said it remains comfortable committing capital investment equivalent to roughly 30 percent of this year’s projected revenue. Samsung said it will respond to customer demand through timely shipment of competitive HBM4 products while expanding sales of AI-related memory and addressing rising NAND demand linked to AI workloads. For now, the competitive gap is already visible in financial results. Samsung posted strong operating income and record sales in the fourth quarter and full year of 2025, but lagged SK hynix in profitability. Samsung reported 16.4 trillion won in chip operating profit for the December quarter, while SK hynix generated 19.17 trillion won on sales of 80.8 trillion won, yielding the industry’s highest margin. For full-year 2025, Samsung recorded 24.9 trillion won in chip operating profit, compared with SK hynix’s 47.2 trillion won on sales of 97.15 trillion won, underscoring the advantage of SK hynix’s heavier exposure to AI-related, high-margin memory. Kim Duk-ki, a professor of electronic engineering at Sejong University, said the surge in memory profitability reflects AI-driven demand outpacing supply, but warned that overly rapid investment expansion could reintroduce volatility in a historically cyclical industry. “If capital spending accelerates too quickly, price instability could eventually follow,” he said. Market analysts largely expect SK hynix to retain its lead. Counterpoint Research estimates the company will account for about 54 percent of global HBM4 sales this year, compared with 28 percent for Samsung and 18 percent for Micron. The firm previously held 62 percent of HBM3 shipments as of mid-2025. Goldman Sachs expects SK hynix to maintain a comfortable lead in HBM3 through at least 2026, while UBS forecasts the company could capture around 70 percent of the HBM4 market tied to next-generation AI platforms, including Nvidia’s Rubin architecture. Samsung Electronics shares closed down 0.7 percent at 161,300 won on Thursday, while SK hynix climbed 2.7 percent to 864,000 won, reflecting investors’ contrasting reactions to the two chipmakers’ earnings and outlook. For now, Samsung’s entry marks a meaningful escalation in competition. But in the early stages of the HBM4 cycle, investors and customers alike appear to see the pioneer as remaining firmly in front. * AJP Yuna Ryu and Yoo Joonha contributed to this story. 2026-01-29 17:43:00 -

SK hynix best-yet Q4 and 2025 income, beating consensus and Samsung Elec SEOUL, January 28 (AJP) -SK hynix, leveraging its dominant lead in high-bandwidth memory (HBM) powering hyperscalers and AI accelerators, delivered its strongest-yet quarterly and annual results and expects further gains this year as global memory revenue approaches $1 trillion. According to a regulatory filing Tuesday, operating income for the quarter ended December surged to 19.17 trillion won ($13.5 billion), up 68 percent from the previous quarter and 137 percent from a year earlier, marking the company’s best quarterly performance on record. Quarterly revenue climbed to a historic high of 32.83 trillion won. The results comfortably beat market expectations. A FnGuide consensus had projected operating profit of 16.4 trillion won on sales of 30.83 trillion won. SK hynix shares closed 5.13 percent higher at 841,000 won, although the earnings were released after market close and earlier than scheduled Thursday, coinciding with Samsung Electronics’ earnings call. For the full year, operating profit more than doubled to 47.2 trillion won from 23.47 trillion won in 2024, surpassing Samsung Electronics’ preliminary consolidated operating profit of 43.5 trillion won for 2025. Annual revenue jumped 47 percent year on year to 97.15 trillion won. An operating margin of 49 percent underscored the pricing power of the pure-play chipmaker, meaning nearly half of every won in chip sales translated into operating profit. “Our results demonstrate the outcome of strategic execution that secured both profitability and growth by reinforcing technology leadership and expanding the share of premium products,” SK hynix said in a statement, adding that 2025 marked “a year in which the company once again proved its world-class technological competitiveness.” SK hynix has been enjoying a clear heyday, overtaking long-time industry leader Samsung Electronics in global memory market share in the first half of the year, largely on the back of its leadership in HBM — widely described as the core memory architecture behind Nvidia’s AI accelerators. Despite market speculation over Samsung Electronics’ rapid progress in sixth-generation HBM4, SK hynix is widely believed to have secured nearly 70 percent of supply allocations for Nvidia’s next-generation Rubin platform, scheduled for release this year. Counterpoint Research estimates SK hynix will command around 54 percent of global HBM4 sales this year, compared with 28 percent for Samsung Electronics and 18 percent for Micron. In HBM3, the company accounted for 62 percent of shipments as of June 2025 and 57 percent of revenue as of September. Goldman Sachs expects SK hynix to maintain a comfortable lead in HBM3 through at least 2026, while UBS forecasts the company will capture around 70 percent of the next AI-standard memory market, HBM4. Bank of America, meanwhile, recently described 2026 as a “supercycle comparable to the memory boom of the 1990s,” projecting year-on-year growth of 51 percent in DRAM sales and 45 percent in NAND, with SK hynix positioned as the primary beneficiary of the industry-wide upswing. 2026-01-28 17:11:48

SK hynix best-yet Q4 and 2025 income, beating consensus and Samsung Elec SEOUL, January 28 (AJP) -SK hynix, leveraging its dominant lead in high-bandwidth memory (HBM) powering hyperscalers and AI accelerators, delivered its strongest-yet quarterly and annual results and expects further gains this year as global memory revenue approaches $1 trillion. According to a regulatory filing Tuesday, operating income for the quarter ended December surged to 19.17 trillion won ($13.5 billion), up 68 percent from the previous quarter and 137 percent from a year earlier, marking the company’s best quarterly performance on record. Quarterly revenue climbed to a historic high of 32.83 trillion won. The results comfortably beat market expectations. A FnGuide consensus had projected operating profit of 16.4 trillion won on sales of 30.83 trillion won. SK hynix shares closed 5.13 percent higher at 841,000 won, although the earnings were released after market close and earlier than scheduled Thursday, coinciding with Samsung Electronics’ earnings call. For the full year, operating profit more than doubled to 47.2 trillion won from 23.47 trillion won in 2024, surpassing Samsung Electronics’ preliminary consolidated operating profit of 43.5 trillion won for 2025. Annual revenue jumped 47 percent year on year to 97.15 trillion won. An operating margin of 49 percent underscored the pricing power of the pure-play chipmaker, meaning nearly half of every won in chip sales translated into operating profit. “Our results demonstrate the outcome of strategic execution that secured both profitability and growth by reinforcing technology leadership and expanding the share of premium products,” SK hynix said in a statement, adding that 2025 marked “a year in which the company once again proved its world-class technological competitiveness.” SK hynix has been enjoying a clear heyday, overtaking long-time industry leader Samsung Electronics in global memory market share in the first half of the year, largely on the back of its leadership in HBM — widely described as the core memory architecture behind Nvidia’s AI accelerators. Despite market speculation over Samsung Electronics’ rapid progress in sixth-generation HBM4, SK hynix is widely believed to have secured nearly 70 percent of supply allocations for Nvidia’s next-generation Rubin platform, scheduled for release this year. Counterpoint Research estimates SK hynix will command around 54 percent of global HBM4 sales this year, compared with 28 percent for Samsung Electronics and 18 percent for Micron. In HBM3, the company accounted for 62 percent of shipments as of June 2025 and 57 percent of revenue as of September. Goldman Sachs expects SK hynix to maintain a comfortable lead in HBM3 through at least 2026, while UBS forecasts the company will capture around 70 percent of the next AI-standard memory market, HBM4. Bank of America, meanwhile, recently described 2026 as a “supercycle comparable to the memory boom of the 1990s,” projecting year-on-year growth of 51 percent in DRAM sales and 45 percent in NAND, with SK hynix positioned as the primary beneficiary of the industry-wide upswing. 2026-01-28 17:11:48