SEOUL, July 30 (AJP) - Reliance Industries, India's largest private-sector company, is navigating a complex energy and geopolitical landscape while accelerating its transformation into a deep-tech and advanced manufacturing leader. Once known primarily for its dominance in oil refining and petrochemicals, the Mumbai-based conglomerate is now positioning itself at the forefront of India's digital and industrial transition.

The shift comes as new sanctions pressure the company's long-standing energy procurement strategy. On July 18, the European Union announced its 18th sanctions package against Russia, further reducing the price cap on Russian crude. Reliance, which had benefited from discounted Russian oil following the 2022 invasion of Ukraine, began adjusting course. That same week, the company made an unusual move by purchasing Murban crude from Abu Dhabi, signaling a strategic pivot away from its traditional reliance on Russian Urals.

Reliance is also broadening its upstream footprint. On July 29, the company announced a joint operation agreement with Oil and Natural Gas Corporation and BP Exploration to explore hydrocarbon reserves in the Saurashtra basin in northwestern India.

While oil remains a pillar of the business, Reliance's transformation has touched nearly every major sector of the Indian economy. The company's evolution from modest beginnings to industrial heavyweight traces back to 1957, when founder Dhirubhai H. Ambani began a yarn trading business in Mumbai with seed capital of around 300 dollars. In 1966, he formally established Reliance Commercial Corporation, focusing on importing polyester yarn and exporting spices.

The company rebranded as Reliance Textiles Industries in 1973 and went public in 1977. From there, it systematically expanded across sectors, entering petrochemicals in 1980, oil refining in 2000, telecommunications in 2002, and retail in 2006. In 2010, it launched Reliance Foundation, which has since grown into India's largest non-profit organization.

The pace of change quickened in 2016 with the launch of Reliance Jio, the company's telecom arm that reshaped India's data market. Starting in 2020, Reliance began forging partnerships with global tech firms to advance India's digital infrastructure. Today, the group operates across four core sectors: energy, retail, digital services, and media and entertainment.

Reliance's financial performance has remained strong despite external headwinds. For the first quarter of 2025, the company reported consolidated revenue of 2,73,252 crore rupees, or 32.9 billion dollars, up 6 percent year-on-year. Net profit rose 78 percent to 26,994 crore rupees, or 3.3 billion dollars, largely driven by gains from the sale of its stake in Asian Paints.

Reliance Jio posted 24 percent earnings growth, supported by an increase in average revenue per user to nearly 2.50 dollars. The retail division reported revenue of 84,171 crore rupees, or 10.1 billion dollars, up 11.3 percent. JioStar, its media venture, recorded revenue of 9,904 crore rupees, or 1.2 billion dollars, following a strong Indian Premier League season.

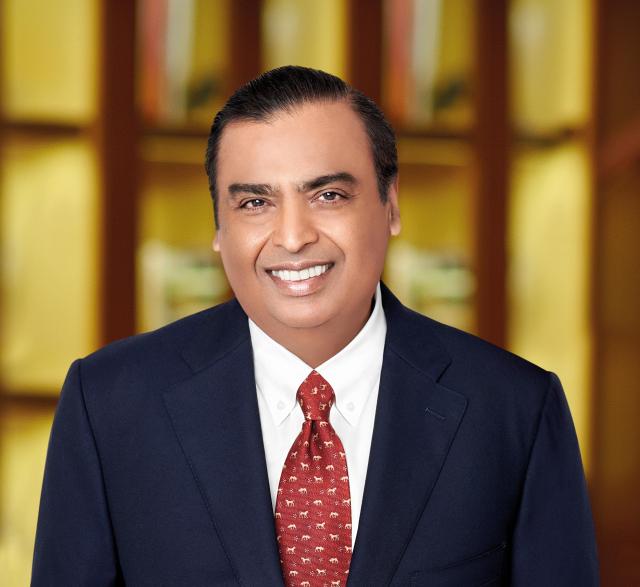

Leadership remains firmly in the hands of the Ambani family. Chairman Mukesh D. Ambani, son of the company's founder, leads the group alongside his wife Nita Ambani, chair of Reliance Foundation. Their three children also play key roles. Akash Ambani chairs Reliance Jio Infocomm. Isha Ambani serves on executive boards. Anant Ambani leads the company's green energy initiatives.

In a June 25 interview with McKinsey and Company, Mukesh Ambani spoke openly about the group's next chapter. "I used to push my leaders by saying, 'We have to be owners of technology. We must be innovators,'" he said.

Regarding the ongoing AI competition, Asia's richest man emphasized that Reliance doesn't need to "go into the high-risk GPU game" but should focus on everything "downstream," attracting bright minds for digital transformation.

As Reliance navigates sanctions-driven supply chain shifts while pursuing technological evolution, the conglomerate's ability to adapt and innovate positions it not just as India's industrial champion, but as a bellwether for how traditional energy giants can reinvent themselves in an era of digital disruption and geopolitical realignment.

Copyright ⓒ Aju Press All rights reserved.