SEOUL, September 30 (AJP) - South Korea’s government and automaking conglomerate are tapping alternative markets and local sourcing as tariff talks with the United States drag on without conclusion.

Hyundai Motor Group has rolled out contingency measures while negotiations remain in limbo. The automaker is leaning more on domestic suppliers, adjusting dealer incentives to avoid immediate consumer price hikes, and accelerating model launches in Europe.

Hyundai Mobis, the group’s parts arm, last week hosted the inaugural Auto Semicon Korea forum with 23 companies and research institutes—a move widely seen as part of a broader push to localize auto semiconductor production.

“In the short term we are adjusting dealer incentives to avoid raising consumer prices, while in the longer term we are focusing on local sourcing and expanding production in the United States,” a Hyundai official said.

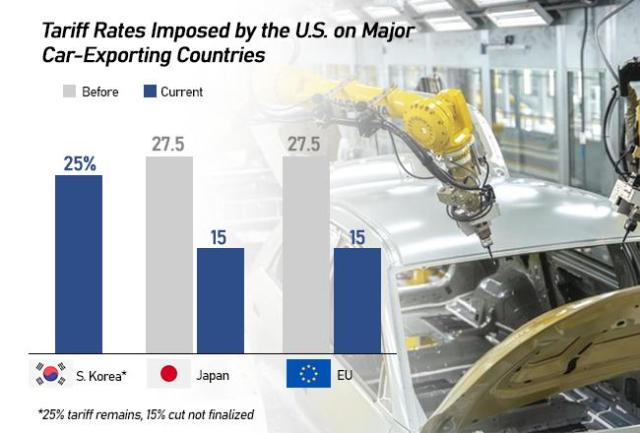

Seoul and Washington reached a provisional deal to cut U.S. tariffs on Korean cars from 25 percent to 15 percent, but a final agreement has yet to be signed. Korean brands remain disadvantaged, facing a 25 percent levy compared with the 15 percent rate applied to Japanese and European cars.

The industry ministry has rolled out low-key support, including a “Trade Law Caravan” program to help small and medium-sized suppliers navigate U.S. regulations and prepare contingency plans.

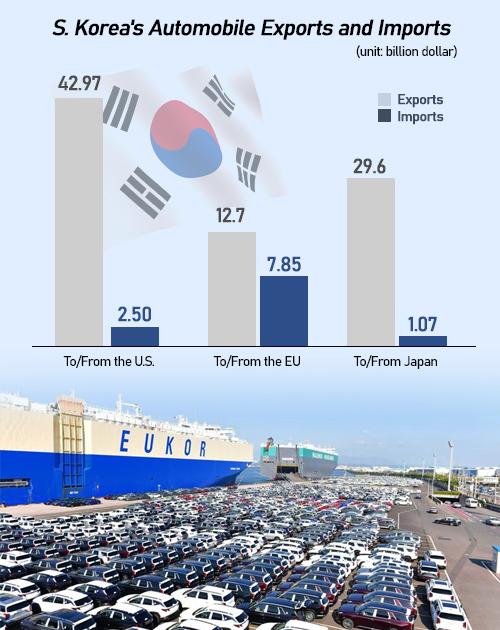

Cars are a pillar of Korea’s exports. Last year, Korea shipped $43 billion worth of cars to the U.S., dwarfing $2.5 billion in imports. Exports to Europe totaled $2.7 billion against $7.85 billion in imports, while shipments to Japan hit nearly $3 billion—triple its imports from Japan.

“The tariff burden will likely cut Hyundai Motor Group’s operating margin by about 1 percentage point this year and up to 2 percentage points if fully applied,” said Lee Jae-il of Eugene Investment & Securities. “But basic product competitiveness remains intact, so there will be no sudden shift in demand toward Japanese or European cars.”

The global auto chip market is projected to expand 9 percent annually to reach $138 billion by 2030, underscoring why Hyundai Mobis is aiming to boost the share of locally developed semiconductors to 10 percent by that year.

“We are expanding joint development with fabless firms and design houses while strengthening ties with major foundries,” said Lee Kyu-seok, president of Hyundai Mobis. “We will also encourage IT and mobile companies to enter the auto sector, helping build a domestic ecosystem.”

Executive vice president Park Chul-hong added that optimizing chips with controllers and conducting real-car testing will “speed up development and enhance competitiveness.”

Copyright ⓒ Aju Press All rights reserved.