SEOUL, October 06 (AJP) - Abundant investment opportunities lie in diverse global markets when matched with Korea’s high-tech, manufacturing, and soft-power competitiveness, said Patrick Han, head of Global Business at SK Securities.

"Identifying needs before demand arises and aligning them with Korean capital is the path forward for Korean investment banking," Han told AJP in an exclusive interview, highlighting that Korea’s financial sector lags far behind its industrial peers.

While Korean manufacturers dominate global markets in semiconductors, batteries, shipbuilding, and culture, Korean financial institutions still rank below even some Southeast Asian peers, Han noted, blaming the weakness on a complacent focus on traditional corporate financing at home and a lack of bold overseas outreach.

"Korean IB evolves around large companies, and such an inward approach acts as a constraint. The blue ocean lies in global finance," he said.

He added that Korea’s IB culture of chasing quick returns is why domestic names remain absent from multi-billion-dollar international government procurements and public projects that demand long-term commitment.

Han is steering SK Securities toward large-scale, strategic projects. His office is advising Lithuania’s finance ministry, brokering the sale of a major Indonesian bank, investing in a Southeast Asian hospital group, and exploring a food-security zone project in the region. It is also working on a cross-investment venture between a U.S. consortium and Korean shipbuilders in the maintenance, repair, and overhaul (MRO) sector.

With 25 years of international banking experience—including stints at JPMorgan, RBS, and CGS-CIMB—Han has been reshaping SK Securities’ Global Business Division since taking charge last year.

"As head of Global Business, I cover the entire spectrum — trading, brokerage, corporate finance, and wealth management. Our priorities center on inbound deals, outbound deals, and offshore transactions," he said.

Inbound and outbound deals will be the division’s main focus this year, while offshore business will expand gradually.

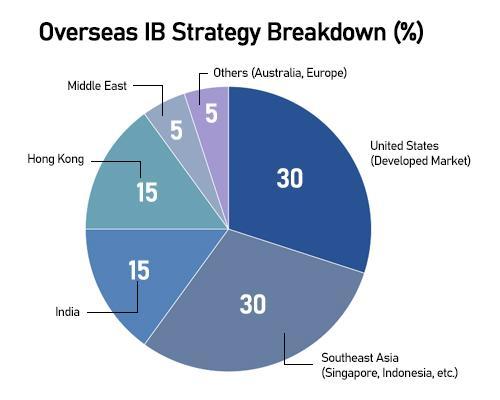

Han applies a differentiated approach to each market.

The United States poses as the most strategic market, rich with M&A, licensing, and real estate opportunities. "Advanced manufacturing, semiconductors, AI, shipbuilding, defense, and nuclear energy are the most promising sectors," he said. He has already organized a Korean roadshow for Primary Wave, the world’s largest music IP investment firm, and helped raise funds for LA Golf Partners.

Asia is a diverse, fragmented landscape. Southeast Asia will serve as the hub for M&A and consumer industry investments, particularly K-content, cosmetics, and knowledge services.

India offers potential in manufacturing and finance, while China’s reopening hinges on political and regulatory shifts. In Japan, Korean SMEs can leverage ultra-low financing by pairing Japanese capital with Korean technology.

Drawing on his long regional experience, Han sees selective opportunities in the GCC states. "The region is not as cash-rich as before, so projects must be chosen carefully," he cautioned. Korea’s track record in construction and energy gives it an edge.

Han emphasizes cultural fluency alongside financial acumen. Sixteen years in the U.K. taught him that understanding local codes of business and culture is as critical as market data.

His humanistic approach blends creativity with finance. At a recent Seoul event hosted by Indonesia’s Ministry of Tourism, he proposed building retirement "silver towns" for Koreans instead of traditional resorts, while linking Korean healthcare to wealthy Southeast Asian clients.

On market outlook, Han expects global markets to take a breather after this year’s bull runs, particularly on Wall Street. Still, he forecasts select Korean sectors — notably AI, semiconductors, defense, shipbuilding, and nuclear — will sustain long-term momentum into next year.

Copyright ⓒ Aju Press All rights reserved.