SEOUL, November 02 (AJP) - Blockchain technology is moving beyond individual and corporate applications to become the foundation of digital sovereignty at the national level. Amid this shift, global blockchain company Sign is drawing attention for presenting a new framework for state-led blockchain governance.

During Korea Blockchain Week held in Seoul last month, Sign released a new white paper titled "Sovereign Infrastructure for Global Nations (S.I.G.N.)." The paper outlines how blockchain governance can evolve from its original decentralization philosophy into a "Sovereign Governance Architecture" — a system that supports national digital infrastructure while maintaining both autonomy and legitimacy.

At the center of the proposal is the "Double Chain Architecture," a structure combining two blockchain layers. The first, called the Sovereign Public Chain, is designed for public administration, fiscal management, and policy execution. The second, the Privacy Permissioned Chain, is tailored for secure data handling and financial operations.

Sign emphasized that a national blockchain must combine transparency, autonomy, and legal oversight. "A state-led blockchain should not simply serve as a distributed ledger," the company said, "but as a governance infrastructure that enables digital sovereignty."

On October 24, Sign signed an agreement with the National Bank of Kyrgyzstan to begin a Central Bank Digital Currency (CBDC) project known as "Digital SOM." The system will serve roughly 7.2 million citizens and link to the local stablecoin "KGST."

The initiative represents a dual digital currency framework, combining a government-backed CBDC with a private stablecoin. It is expected to improve efficiency in domestic payments, tax collection, and welfare distribution while upgrading cross-border settlement systems. Industry observers said Sign's infrastructure could go beyond digital payments to accelerate the digital transformation of public sectors such as taxation and social welfare.

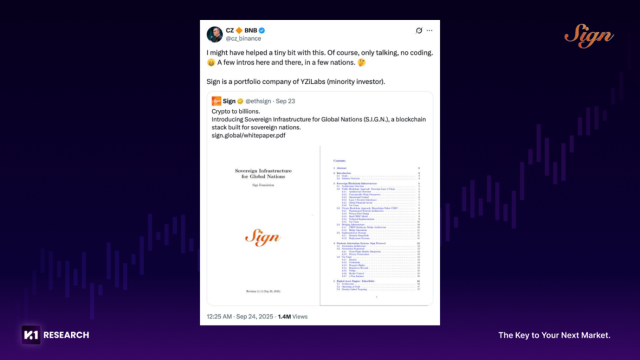

On October 27, YZi Labs — a cryptocurrency investment firm rebranded from Binance Labs — announced a 25.5 million-dollar strategic investment in Sign. The funding round also included global investors such as IDG Capital. Sign said it plans to use the new capital to advance the development of sovereign blockchain infrastructure for governments around the world.

YZi Labs manages more than 10 billion dollars in assets globally and has invested in over 300 projects across 25 countries in sectors including Web3, AI, and biotechnology. The latest investment follows an initial round made in December 2024 and is intended to accelerate blockchain adoption in public systems, combining digital sovereignty with real-world utility.

"Sign is turning blockchain into everyday infrastructure," said Dana H., an investment partner at YZi Labs. "Its move from users to enterprises and now to national-level applications will set a new standard for digital sovereignty and public infrastructure."

Sign plans to work with BNB Chain to build a Sovereign Blockchain Application Platform for governments and public institutions. CEO and co-founder Xin Yan said, "The crypto industry is rich in technology but poor in adoption. Sign aims to build national digital infrastructures — such as currency systems and verifiable proofs — that make blockchain part of everyday life."

The company is currently partnering with government agencies in Thailand, South Korea, the Middle East, and Central Asia, with a ten-year plan to help countries develop their own digital currency and identity systems. Industry experts describe Sign’s approach as a sign of how blockchain is evolving from a philosophy of decentralization into a tool for national governance and public infrastructure.

Copyright ⓒ Aju Press All rights reserved.