SEOUL, November 07 (AJP) - Korean contents have enjoyed spectacular global exposure this year through major streaming platforms, but without the halo of K-Pop Demon Hunters — the rare breakout that dominated global charts — the industry can hardly claim meaningful wins amid a dearth of blockbuster titles, mounting production costs, and waning originality.

The third-quarter results of CJ ENM, Korea’s largest entertainment and media group, offer a glimpse into this year’s K-drama performance. On Thursday, the company reported consolidated revenue of 1.12 trillion won ($830 million) and a modest operating profit of 17.6 billion won for the July–September period.

Its media platform unit logged an operating loss of 3.3 billion won. The film and drama division returned to the black with a profit of 6.8 billion won, helped largely by additional distribution in Latin America and the Middle East.

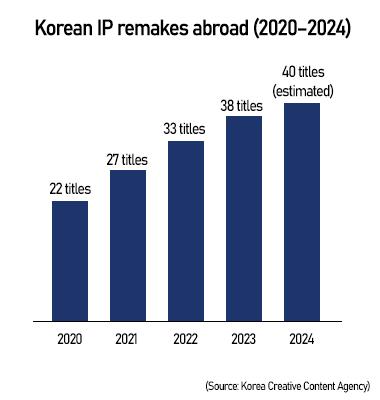

Industry data show that while Korean IP remakes overseas continue to grow — from 22 in 2020 to nearly 40 this year — profitability has narrowed as production budgets balloon and domestic platforms rely more heavily on global OTT partnerships.

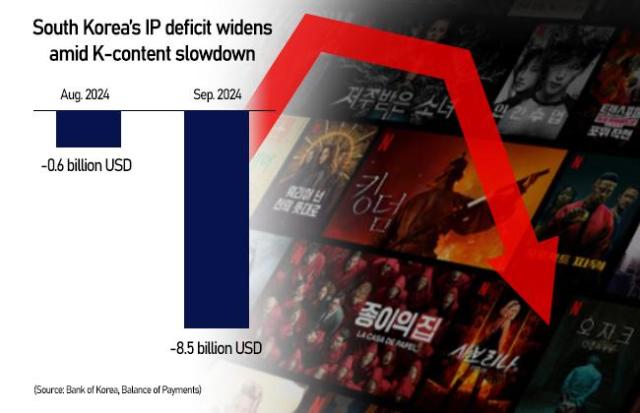

According to the Bank of Korea, the nation’s royalties balance swung to a deficit of $8.5 billion in September from $0.6 billion in August, reflecting rising payments for foreign IP.

On the small screen, the pipeline has been thin and underwhelming.

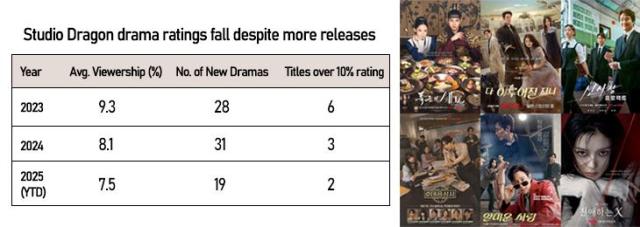

Average TV ratings for Studio Dragon — the flagship behind Queen of Tears and Castaway Diva — fell to 7.5 percent from 9.3 percent in 2023. The number of new titles achieving double-digit viewership dropped from six to three.

The studio produced 19 new dramas this year, down from 31 last year and 28 in 2023.

“On the surface, K-content still looks strong, but from an industrial standpoint the creative pipeline has weakened,” said Jin Lee, professor of cultural content studies at Hanyang University. “Korean studios are shifting toward co-productions with global OTTs, which help overseas expansion but reduce creative control and profit margins.”

TVING, CJ ENM’s streaming arm, saw monthly active users rise 8.6 percent year on year, but its domestic market share remains below 10 percent — far behind Netflix’s 45 percent.

“Consumers now watch what they want and leave,” Lee added. “For Korean platforms, sustaining loyalty and cumulative growth has become extremely difficult.”

CJ ENM’s film business showed a similar pattern. Among roughly 24 theatrical releases between 2023 and 2024, only eight broke even. Mid-budget films such as Exhuma and The Escape significantly outperformed expectations.

Film revenue rose 12 percent on year to 372.8 billion won, but operating margins narrowed to 1.8 percent from 3.2 percent a year earlier.

Across the broader market, Korean films attracted 71 million theatergoers in 2024 — up 18 percent on year but still 46 percent below pre-COVID levels.

Average terrestrial drama ratings fell to 6.7 percent this year from 8.2 percent in 2023, while cable shows excluding Queen of Tears averaged 4.9 percent, the lowest since 2020.

Industry watchers cite complacency and idea fatigue for the slowdown.

“Historical or fantasy series are considered safe because they ‘look Korean,’ but over-repetition risks a creativity deficit,” Lee said.

CJ ENM said it will continue to deepen partnerships with global media groups while improving returns on content investment. A company official said it aims to “expand global influence through strategic collaboration” and enhance profitability across its content and platform businesses.

Copyright ⓒ Aju Press All rights reserved.