SEOUL, November 11 (AJP) - South Korea's food giant CJ CheilJedang on Tuesday reported double-digit fall in its third-quarter earnings as the global popularity of K-food was outweighed by money-losing bio and feed operations.

According to its disclosure, its operating profit plunged 25.6 percent on year to 203 billion won on revenue of 4.5 trillion won ($3.08 billion) for the quarter ended September.

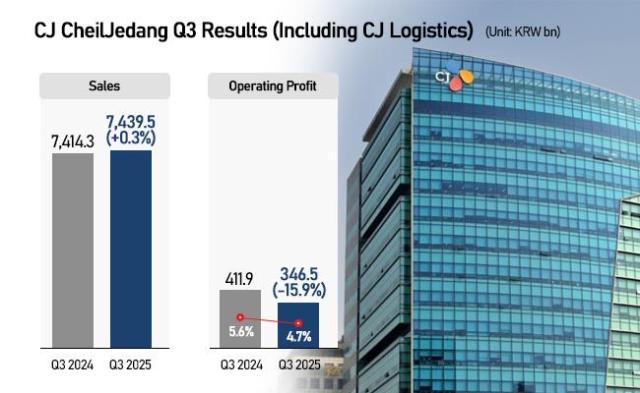

Including CJ Logistics, consolidated revenue inched up 0.3 percent on year to 7.43 trillion won, while operating profit still dropped 15.9 percent to 346.5 billion won.

The drag was attributed to the Bio division and the Feed & Care (livestock and animal feed) business.

The Bio unit posted revenue of 979 billion won, down 8 percent on year, while operating profit tumbled 72 percent to 22 billion won. The company cited intensified competition in high-value amino acids such as tryptophan and arginine, which drove down margins and pressured overall market conditions.

Feed & Care revenue fell 2 percent to 569 billion won, while operating profit slumped 63 percent to 12 billion won, weighed down by declining livestock prices in Vietnam, one of its key sourcing markets.

The core food remained resilient on robust overseas demand, but its bottom line was hurt by ongoing U.S.-China trade tensions that hurt food inputs like soybeans.

The unit generated revenue of 2.98 trillion won, up slightly from a year earlier, while operating profit rose 4 percent to 168.5 billion won. CJ CheilJedang said reduced holiday gift-set sales were offset by stronger sales of Global Strategy Products (GSP) such as mandu dumplings and instant rice.

The company added that soaring soybean prices in North America, sharp foreign exchange fluctuations, and increased promotional spending in Europe pushed up costs, but domestic processed-food sales helped cushion profitability.

Revenue rose across all major overseas markets — the Americas, Japan, China, Oceania, and Europe — with Europe, a relatively new market for the company, delivering a robust 13 percent on-year increase. In contrast, domestic revenue slipped 3 percent due to weaker Chuseok gift-set sales.

CJ Logistics helped offset some of the group’s earnings weakness. The subsidiary reported revenue of 3.67 trillion won, up 3 percent on year, while operating profit rose 4 percent to 148 billion won, supported by expanding domestic parcel volumes and increased orders from third-party logistics (3PL) clients.

CJ CheilJedang was trading at 227,000 won as of 9:40 a.m., down 1.3 percent, as the outlook on trade environment remains foggy.

CJ CheilJedang estimated modest top-line growth but projects its operating margin to decline from 5.6 percent in the third quarter to around 3 percent due to costs related to surging soybean prices in North America.

It was buoyant about expansion across Asia and Oceania and plans to keep up the European momentum by implementing region-specific strategies.

Copyright ⓒ Aju Press All rights reserved.