SEOUL, November 25 (AJP) - The final three months of the year are the busiest for global retailers, with brands competing for visibility through discounts, clearance deals and year-end promotions. Korea’s “Sale Festa”—the nationwide bargain season running from late October to mid-November—remains modest in scale compared to America’s Black Friday and China’s Singles’ Day, but global reach is widening, powered by the strong performance of Korean appliances, beauty brands and increasingly influential fashion platforms.

According to Jinkyung Goo, director at the Korea Institute for Industrial Economics and Trade (KIET), the differences stem from market structure: “The U.S. model originated from clearing year-end inventory across a vast territory with high logistics cost, while Korea and China adopted the season more as a consumption-activating tool driven by online retail ecosystems.”

Industry estimates show that 2025 Sale Festa sales are projected to reach 9.5 trillion to 10 trillion won, up from roughly 8.7 trillion to 9 trillion won in 2024 and 7.6 trillion to 8 trillion won in 2023, driven almost entirely by platform-led promotions and rising cross-border demand.

Unlike the United States, where shoppers still camp outside stores for doorbuster deals, Korea and China rarely see such scenes. The retail dynamics in both markets are now dominated by online ecosystems, with platforms aggressively capitalizing on user traffic spikes rather than clearing inventory.

Goo adds that “Korea’s online penetration has become so strong that promotions naturally center on e-commerce rather than physical stores. Companies see bigger promotional effects online, so the season evolved digitally rather than through brick-and-mortar.”

In Korea, platforms such as Olive Young, Musinsa, SSG, Coupang and LotteON rely on the Sale Festa brand to boost year-end revenue. They use app push notifications, flash deals, roulette-style coupons and tiered discount tools to convert user engagement into purchases.

A Musinsa official noted that winter is the peak sales season for fashion platforms: “Outerwear sales determine the success of the year, and Black Friday helps us amplify brand revenue. This year about 4,500 brands participated, and we prepared logistics aggressively to prevent delivery delays.”

The company added that Ugg boots, faux-fur jackets and half-coats emerged as top performers during this season.

Musinsa’s “Sale Festa/Black Friday” sales surged 73 percent in 2022 and 44 percent in 2023, underscoring how platforms have turned the season into a strategic revenue engine.

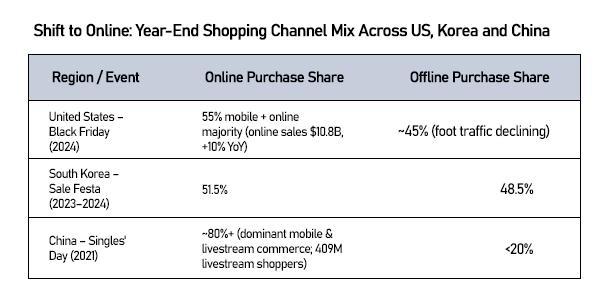

Korean consumers overwhelmingly shop online, with 51.5 percent preferring e-commerce over physical stores, according to the Korea International Trade Association.

The United States remains an outlier, with Black Friday still functioning as a national ritual rooted in inventory clearing. Retailers such as Best Buy, Target and Walmart use the period to flush old stock ahead of year-end accounting. But even in the U.S., online sales now dominate: Black Friday 2024 online revenue hit $10.8 billion, up 10 percent year-on-year, with mobile transactions accounting for 55 percent, according to Adobe Analytics. Shopify merchants alone generated $11.5 billion during the Black Friday–Cyber Monday period. Still, the culture of crowds lining up at dawn remains uniquely American.

China’s Singles’ Day dwarfs both markets. Fueled by aggressive discounting, mobile payments and livestream commerce, Alibaba posted 57.1 billion yuan (US$9.3 billion) in a single day as far back as 2014—more than U.S. Black Friday and Cyber Monday combined at the time. The ecosystem has since evolved into a full consumer-stimulus infrastructure tied directly to Beijing’s consumption-boosting policies. By 2021, 409 million Chinese shoppers—nearly a third of all internet users—were using livestream platforms for purchases.

Goo explains, “China’s Singles’ Day scaled rapidly because livestream commerce and mobile payments created a promotional infrastructure at the national level. Unlike Korea, sheer market size means the ceiling for growth is much higher.”

Category trends also differ. Electronics and household goods dominate U.S. demand, whereas Korea sees strongest traction in beauty, fashion and small appliances. China skews toward livestream-driven impulse purchases, premium imports and cross-border e-commerce.

According to Korean retail platforms, Black Friday in Korea functions less as a ‘clearance’ period and more as a ‘sales accelerator.’ Olive Young and Musinsa both highlight that the domestic market already runs frequent seasonal promotions, reducing the role of Black Friday as a once-a-year deep-discount event.

Despite the differences in culture and mechanics, all three markets share one theme: year-end shopping seasons have become a barometer of consumer confidence.

Korea’s case is especially telling. The country’s domestic “Black Friday” shows how platforms—not big-box stores—now dictate consumption trends, reflecting a hyper-digitized retail landscape where algorithms, loyalty funnels and app engagement shape spending patterns far more than in-store displays.

As Goo puts it, “For Korea’s version to scale further, platforms will need to expand their reach to overseas consumers. Domestic market size is limited, so long-term growth depends on strengthening cross-border accessibility.”

Copyright ⓒ Aju Press All rights reserved.