![Lee Chul-kyu, chairman of the National Assembly's Trade, Industry, Energy, SMEs, and Startups Committee, processes bills including the K-Steel Act at a meeting on Nov. 21. [Photo=Yonhap]](https://image.ajunews.com/content/image/2025/12/02/20251202111556250821.jpg)

SEOUL, December 03 (AJP) - South Korea’s steel and petrochemical industries are coming under renewed strain amid a global economic slowdown and intensifying competition from China, prompting the government to move quickly on targeted legislation to stabilize two of the country’s most critical industrial pillars.

Following the recent passage of the K-Steel Act, the Petrochemical Industry Competitiveness and Support Act is also expected to clear the National Assembly soon, according to multiple officials on Dec. 2. The twin laws mark one of the most interventionist industrial policy moves in years, reflecting rising deficits, weak margins and partial production shutdowns across the sector.

Calls for a legal framework have grown louder as companies including Lotte Chemical and HD Hyundai Chemical submit restructuring plans. The special legislation is designed to smooth corporate overhaul processes and provide government backing for a shift toward higher-value production.

Under the K-Steel Act, the steel industry is designated as essential to national security and economic stability, enabling broader support for R&D, investment and supply-chain management. It also establishes a special committee under the Prime Minister to coordinate industrial strategy and allows limited antitrust exemptions for joint investment and cooperation projects—an unusual step that underscores the severity of current pressures.

The petrochemical bill goes further on financial and regulatory support, offering tax incentives, policy loans, regulatory easing and workforce retraining to facilitate restructuring. Such sector-specific laws are rare in Korea and typically reserved for moments of significant structural or geopolitical risk.

The push comes as the U.S.–China tech rivalry reshapes global trade flows and China’s massive capacity expansion shifts it from a net petrochemical importer to a price-setting producer. This has depressed global margins and intensified competition for Korean firms.

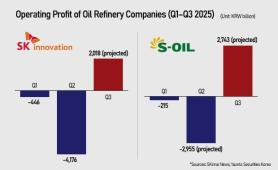

Despite a mild pickup in export volumes this year, profitability remains depressed due to price falls. Domestic petrochemical plants operated at 70–80 percent capacity in the first half, with operating margins sliding steadily since 2022. To avert deeper losses, the government recently urged companies to cut ethylene output by 2.7–3.7 million tons.

Industry officials expect the pending legislation to accelerate overdue restructuring.

“Once the special laws go into effect, companies will finally be able to push ahead with long-delayed restructuring and efficiency upgrades,” said one industry official, noting that follow-up support and policy consistency will determine the effectiveness of the overhaul.

* This article, published by Aju Business Daily, was translated by AI and edited by AJP.

Copyright ⓒ Aju Press All rights reserved.