SEOUL, December 04 (AJP) - South Korea’s income gap between the top and bottom 20 percent of households widened to 5.78 times last year, snapping a three-year trend of improvement as income growth slowed and gains increasingly concentrated among high-income earners and older asset-holding households.

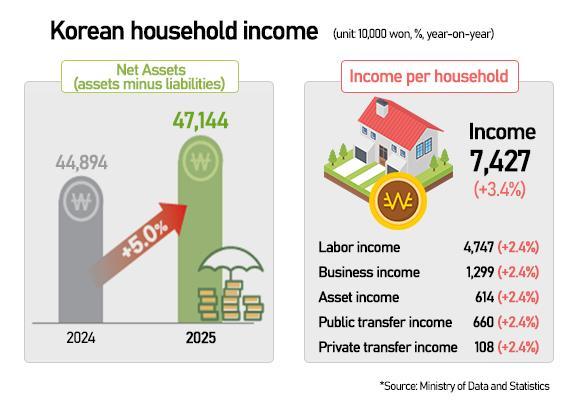

According to the 2025 Household Finance and Welfare Survey released by the Ministry of Data and Statistics on Thursday, average household income rose 3.4 percent to 74.27 million won ($54,900) in 2024, the slowest increase in five years.

Average household assets stood at 566.8 million won and liabilities at 95.34 million won as of March 2025. Housing and property assets accounted for 75.8 percent of total household assets, with the largest holdings among those in their 50s and 60s.

Income growth slowed sharply across major categories—wages, business earnings and asset income—pulling down overall gains. Public and private transfer income, however, swung back into positive territory after a decline the previous year.

Gains were heavily skewed toward upper-income households. The top 20 percent saw income climb 4.4 percent to 173.38 million won, while the bottom quintile posted a 3.1 percent increase and the second-lowest quintile just 2.1 percent.

The pattern also diverged by age. Households headed by people in their 50s recorded a 5.9 percent income increase, supported by strong labor and asset gains. Those led by seniors aged 60 and older saw income rise 4.6 percent. In contrast, 40-something households posted a 2.7 percent rise, and those headed by adults under 40 saw income inch up only 1.4 percent amid weaker wage and asset gains and a decline in business income.

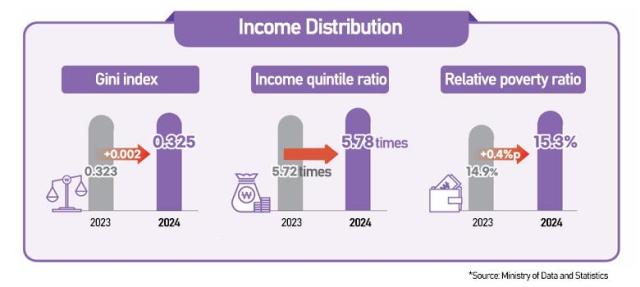

The Gini coefficient for disposable income rose to 0.325 from 0.323, worsening for the first time since 2021. The income quintile ratio—comparing average income of the top 20 percent with that of the bottom 20 percent—expanded to 5.78 from 5.72.

While inequality widened among working-age households, retirees moved in the opposite direction. For those aged 66 and older, both the Gini coefficient and quintile ratio improved, reflecting higher senior employment, increased national and basic pension benefits, and stronger asset income. The relative poverty rate among retirees fell 2.1 percentage points to 37.7 percent, the lowest level since the data series began in 2011.

Non-consumption household spending—including taxes, social insurance contributions and interest payments—rose 5.7 percent to an average of 13.96 million won.

Surveyed households estimated their “adequate” average monthly living cost after retirement at 3.41 million won, slightly higher than a year earlier.

Copyright ⓒ Aju Press All rights reserved.