SEOUL, December 11 (AJP) - South Korea plans to relax rules that restrict financial capital from investing in high-tech industries, including artificial intelligence and semiconductors, while maintaining the core principle of separating industrial and financial capital, the government said on Thursday.

Deputy Prime Minister and Finance Minister Koo Yun-cheol briefed President Lee Jae Myung on the proposed regulatory changes during a policy briefing session in Sejong. President Lee said the administration was preparing “practical measures within the separation principle,” adding that the work was nearing completion.

Lee also asked whether the government was creating special provisions to secure funding for early-stage, capital-intensive technologies.

Koo said the proposed adjustments would not alter the underlying separation rule, which prevents financial firms from exerting control over industrial companies. “We have preserved the principle, but we are proposing regulatory easing to support sectors that require massive investment,” he said.

South Korea introduced its financial–industrial separation policy in 1982 to stop conglomerates from using financial affiliates as private funding channels. The framework was tightened after the 1997 Asian financial crisis, when chaebol-led cross-support and aggressive expansion were criticized for exacerbating systemic risks.

Debate over easing the restrictions resurfaced in the 2010s as major technology platforms such as Kakao and Naver expanded into financial services. Although the cap on industrial capital’s stake in banks was raised from 4 percent to 34 percent, voting rights and other limitations remained in place.

Growing demand for regulatory relaxation has continued alongside the rapid rise of digital finance, but concerns over market concentration and conflicts of interest have slowed progress.

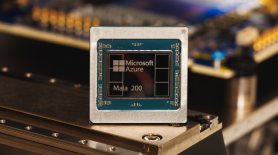

The Lee administration, however, has stressed that high-tech strategic sectors — including semiconductors and AI — require more flexible capital rules.

The Ministry of Economy and Finance said it plans to move forward with measures to ease the investment constraints.

* This article, published by Aju Business Daily, was translated by AI and edited by AJP.

Copyright ⓒ Aju Press All rights reserved.