SEOUL, December 11 (AJP) - A U.S. rate cut typically delivers immediate relief to Korean financial markets. This time, it barely moved sentiment. Investors quickly pivoted to risks emerging across the Pacific — namely the possibility of a Japanese rate hike that could unleash sweeping reversals of international capital leveraged through decades of zero-interest Japanese funding.

As widely expected, the U.S. Federal Reserve delivered a third consecutive rate cut, lowering the federal funds rate to 3.50–3.75 percent and narrowing the gap with Korea’s base rate at 2.50 percent. A smaller interest differential usually encourages capital to remain in Korea. That pattern did not materialize.

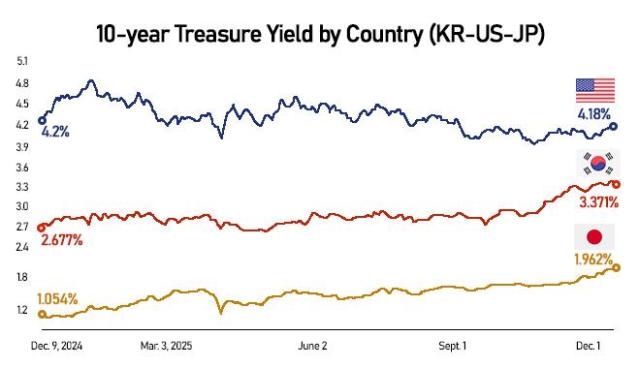

The dollar jumped 6.70 won to 1,473.30. The KOSPI fell 0.6 percent and the KOSDAQ slipped 0.04 percent on Thursday. The 10-year government bond yield inched up to 3.378 percent from Wednesday's 3.371 percent.

BOJ policy and JGB yields fuel unwind fear

The yen carry scare has returned.

The Bank of Japan is under pressure to move on interest rates as long-term yields — those attached to financial products with maturities of one year or more — rise faster than authorities expected, heightening inflation risk.

BOJ Governor Kazuo Ueda acknowledged the shift during a parliamentary budget committee session on Tuesday, reiterating earlier signals pointing toward an eventual rate hike.

Japan for decades tolerated a weak yen to boost export competitiveness and fight deflation.

The “yen carry trade” — in which global investors borrow cheap yen and invest in higher-yielding assets abroad — was central to this strategy.

The trade thrived when Japanese interest rates stayed pinned at zero while U.S. and global rates surged during the tightening cycle. But with Japanese inflation now hitting the 2 percent target and concerns of overshooting rising, the BOJ’s stance is changing.

A shift toward Japanese tightening — as the U.S. loosens — raises the risk of a carry trade unwind, which can drain capital from markets heavily reliant on foreign funds. Korea is particularly vulnerable when the won hovers near crisis-level ranges.

Deputy chiefs overseeing fiscal, monetary, and financial policy convened an emergency macro-financial meeting Thursday, warning that vulnerabilities in the bond and FX markets could intensify under diverging global monetary conditions.

The won fell 3.2 percent against the dollar in November, steeper than the Taiwanese dollar’s 1.9 percent decline and the Japanese yen’s 1.4 percent.

Much of the downward pressure stems from a combination of rapid M2 money supply expansion and persistent net outflows stemming from individuals’ and institutions’ high overseas investment appetite.

Analysts agree that a carry-trade unwind could accelerate the won’s decline but stop short of calling the situation a crisis.

“Unlike last year, when yen futures were net short, this year long positions dominate. The market has already anticipated a BOJ rate hike,” said Cho Yong-gu, researcher at Shinyoung Securities.

He added that for the Korean won and bond yields to stabilize, a BOJ rate hike could paradoxically be helpful, as it would calm super long-term JGB yields and prevent broader turmoil in Asian currency markets.

Japanese government bond yields have been stoking unwind fears. The 10-year JGB yield has nearly doubled in a year, rising from 1.054 percent on Dec. 9, 2024 to 1.956 percent on Wednesday — surpassing the 1.87 percent level recorded in December 2008. A surge driven partly by heavy Japanese government bond issuance to fund stimulus has amplified inflation concerns, making BOJ tightening more urgent.

Experts also bet on BOJ tightening

Markets remain divided on the BOJ’s next move, as government and central bank signals continue to diverge.

Heo Seong-woo, researcher at Hana Securities, said that expectations of rising inflation and wage growth — pushing the BOJ toward a December rate hike — have contributed to climbing JGB yields.

“Core CPI, excluding fresh food, has risen to 3 percent, and super-core CPI, excluding energy, has increased to 3.1 percent. Prices are clearly climbing, and the government bond bid-to-cover ratio was poor compared to last year. The BOJ has no choice but to raise rates.”

Yen market positioning also supports the case for tightening.

Researcher Cho of Shinyoung noted that the yen’s exchange rate is above 155 per dollar, approaching the 162 level reached in July when the carry trade last unwound. He added that the 160 mark is considered a psychological ceiling in Tokyo markets.

“We must remember that July’s unwind occurred during a decoupling — the U.S. Fed was cutting rates while the BOJ was tightening,” Cho said, arguing that another rate hike is “predictable.”

Copyright ⓒ Aju Press All rights reserved.