SEOUL, December 17 (AJP) - South Korea's shipbuilding industry is expected to extend its growth streak into 2026 after posting record shipments in 2025, although slowing global orders and intensifying competition from Chinese yards are emerging headwinds, according to forecasts compiled by the Korea Chamber of Commerce and Industry (KCCI).

Vessel exports are projected to reach an estimated $31.2 billion this year, up 22 percent, driven mainly by liquefied natural gas (LNG) carriers and large container ships. LNG carriers and container vessels accounted for 38.1 percent and 33.3 percent of total exports, respectively.

Export growth is expected to moderate next year. Based on current order books, KCCI forecasts exports of $33.92 billion in 2026, marking a slower but still solid annual increase of 8.6 percent.

Orders thin, but Korea holds ground

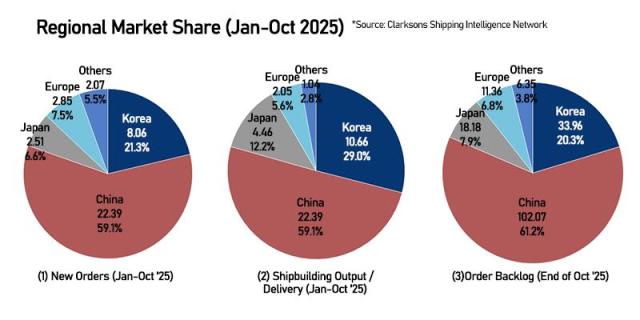

New orders thinned sharply in 2025, clouding the mid-term outlook. Global ship orders through October plunged 43 percent year-on-year to 37.89 million compensated gross tonnage (CGT).

Low-carbon container vessels stood out as the strongest segment. Orders for such ships rose 5.1 percent year-on-year, accounting for 45.6 percent of total orders, while backlogs surged 31.5 percent as shipping lines accelerated fleet renewals to meet tightening environmental regulations.

Despite softer ordering, shipbuilding remains one of South Korea's brightest export sectors heading into 2026, supported by prolonged geopolitical disruptions — including the Red Sea crisis and the Russia-Ukraine war — that continue to sustain replacement demand.

LNG and container pipelines stay robust

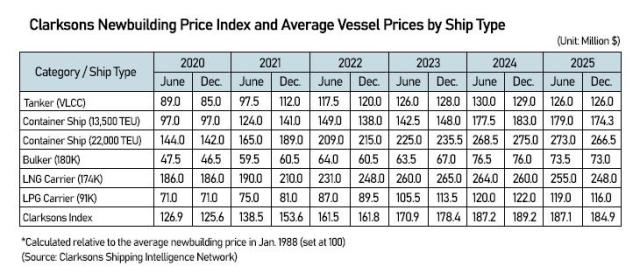

LNG carriers, a traditional stronghold for Korean builders, are showing signs of recovery.

HD Hyundai Heavy Industries has reportedly signed a letter of intent with Japanese shipping group NYK for up to eight 174,000-cubic-meter LNG carriers worth an estimated $2.08 billion, linked to Cheniere Energy's Texas projects. Hanwha Ocean is also expected to finalize separate deals with Norway's Knutsen and Equinor totaling around $1 billion.

"Interest in new LNG carrier builds has grown," said Georgios Plevrakis, head of Hanwha Ocean's European business development, at the World LNG Summit in Türkiye. "Delivery slots for 2029 are filling quickly, and from mid-next year, availability will shift to 2030."

MASGA and U.S. naval ties lift sentiment

A Korea–U.S. memorandum of understanding signed in November has further buoyed sentiment. Under the agreement, Seoul committed roughly $150 billion in shipbuilding-related investments to upgrade U.S. shipyards, while Washington publicly backed Korea's ambitions in nuclear-powered submarines.

Cooperation is already materializing. Hanwha Ocean became the first Korean builder to secure a U.S. Navy maintenance contract and has undertaken multiple repair projects, including work on the dry cargo vessel Charles Drew. Its $100 million acquisition of Philly Shipyard last year has emerged as a flagship project under the "Make American Shipbuilding Great Again" initiative.

HD Hyundai Heavy Industries, meanwhile, won a maintenance contract in August for the 41,000-ton USNS Alan Shepard and completed its merger with HD Hyundai Mipo on Dec. 1 to streamline operations.

2026 outlook: LNG rebound, tankers next

Clarkson Research projects global ship orders of 49.78 million CGT across 1,952 vessels in 2026. LNG carrier orders are expected to rebound to 115 units as major projects — including Plaquemines LNG Phase 2, Port Arthur and Rio Grande LNG Phase 1 — reach final investment decisions. Qatar's fleet renewal program could add another 15 to 30 LNG carrier orders.

Tankers may emerge as the next growth driver once containership ordering cools. Clarkson forecasts 442 tanker orders next year, including 115 crude carriers and 215 product carriers.

"U.S. naval vessel and nuclear submarine themes that drove share prices in 2025 will continue to support the sector next year as MASGA details emerge," said Byun Yong-jin, analyst at iM Securities. "But earnings will take time to materialize. Nuclear submarines, in particular, are long-cycle projects, and expectations should be tempered."

Copyright ⓒ Aju Press All rights reserved.