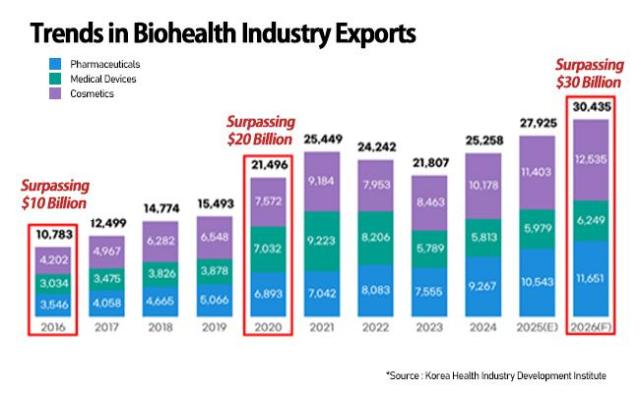

SEOUL, December 23 (AJP) - South Korea’s bio-health industry — spanning pharmaceuticals, medical devices and cosmetics — is set for a record year in 2026, with total exports expected to surpass the $30 billion mark, powered by the country’s strength in contract manufacturing and the global expansion of K-beauty.

According to the Korea Health Industry Development Institute (KHIDI), bio-health exports are estimated to have risen 10.6 percent to $27.9 billion in 2025, and are forecast to grow a further 9 percent to $30.4 billion in 2026.

Biopharmaceuticals remain the key growth engine. Products in the category — accounting for 65.7 percent of total exports — are estimated to have jumped 25.7 percent this year, driven by rising demand in the United States and Europe. Cumulative biopharmaceutical exports from January to October climbed 17.1 percent year on year to $5.39 billion, up from $4.6 billion in 2024.

The growth streak is expected to accelerate in 2026, with biopharmaceutical exports projected to reach $8.5 billion, taking up 81.1 percent of shipments within the category.

The Korea Chamber of Commerce and Industry (KCCI) also struck an upbeat tone, citing the ramp-up of large-scale CDMO facilities in Korea and the likelihood of major outsourcing contracts, particularly in the wake of tightening U.S. biosecurity rules.

The White House said President Donald Trump has signed the National Defense Authorization Act (NDAA) for fiscal 2026, which incorporates the Biosecurity Act. The law restricts transactions with Chinese companies involved in genome analysis, CDMO operations and bio-related materials.

“The U.S. Department of Defense regularly updates its ‘1260H list,’ and foreign media have reported that China’s Wuxi could be added in January,” said Oh Gi-hwan, executive director at KoreaBio. “Competition among Korean, Indian, Japanese and European firms to fill the market gaps left by Chinese companies is expected to intensify.”

The Biotechnology Innovation Organization (BIO) noted that the 1260H list already includes Forensic Genomics International, a subsidiary of China’s BGI Group, and OriginCell Technology, a Shanghai-based cell-storage company.

As Washington tightens scrutiny of Chinese biotechnology firms, analysts expect Korean companies — including Samsung Biologics, ST Pharm, Binex, 3billion and Macrogen — to benefit from shifting supply chains.

“The outlook for next year is positive, and a rebound in investment is overdue after two weak years,” said Lee Seung-Kyou, vice president of KoreaBio. “Government efforts to promote venture investment are beginning to show results. In 2025, Korea demonstrated its competitiveness through technology transfers and successes such as SK Biopharm. In 2026, more Korean firms are expected to establish a global presence.”

Lee cautioned, however, that tariffs, U.S.-China relations and U.S. biotechnology policy remain key uncertainties requiring close coordination between government and industry.

KHIDI echoed the optimism. “In 2025, the bio-health industry posted record exports as recognition of major products increased, especially in the U.S. and Europe,” said Lee Byung-kwan, head of KHIDI’s Bio-health Innovation Planning Division. “In 2026, exports are again expected to break records, driven by market diversification, pharmaceutical growth and a recovery in medical-device shipments.”

Cosmetics exports surged in 2025, particularly in advanced markets. As of October, exports to North America rose 19.5 percent to $2.01 billion, while shipments to Europe jumped 41.1 percent to $1.87 billion. Growth in the Asia-Pacific region, by contrast, was muted amid competition from low-cost Chinese products, with exports edging up 1.2 percent to $4.98 billion.

Looking ahead, pharmaceutical exports are expected to benefit from stronger biopharmaceutical demand in the U.S. and Europe, expanded CDMO capacity and wider overseas approvals. Medical-device exports are also seen rising, supported by aging populations, chronic-disease prevalence and growing demand for diagnostic equipment, including ultrasound and X-ray systems, as well as aesthetic laser devices tied to K-beauty trends.

South Korea currently ranks around 10th globally in biopharmaceutical exports, at about $5.8 billion, and aims to double shipments within five years. To accelerate market entry, the government plans to shorten biosimilar review times from 406 days to 295 days, and cut reimbursement listing periods under the national health-insurance program from 330 days to 150 days.

The global pharmaceutical market reached $1.74 trillion last year — roughly three times the size of the semiconductor market — and is growing at an average annual rate of 4.7 percent, according to government data. Biopharmaceuticals are expanding even faster, at 11.9 percent a year.

Copyright ⓒ Aju Press All rights reserved.