SEOUL, Jan. 14 (AJP) - South Korea’s import prices rose for a sixth consecutive month in December, though the pace of increase softened as falling global oil prices partially offset the impact of a weak won, data from the Bank of Korea (BOK) showed Wednesday — signaling lingering inflationary pressure likely to feed through to consumer prices with a lag.

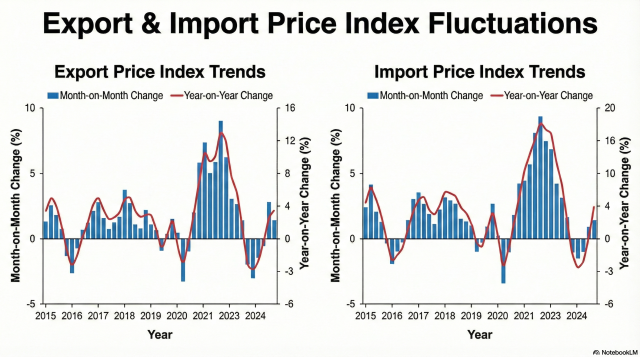

According to the BOK’s export-import price index (preliminary, in won terms; 2020=100), the import price index rose 0.7 percent from November to 142.39, marking a sharp deceleration from the 2.6 percent jump recorded the previous month. On a year-on-year basis, the index edged up 0.3 percent.

Import prices have risen every month since July, marking the longest streak since May–October 2021. While the recent slowdown reflects easing energy costs, the sustained uptrend underscores the continued influence of the weak Korean won.

Dubai crude oil prices fell 3.8 percent month on month and 15.3 percent on year to an average of $62.05 per barrel in December.

The relief would have been greater if not for a weaker won. The U.S. dollar averaged 1,467.40 won in December, up 0.7 percent on month and 2.3 percent on year.

“International oil prices declined, but the rise in the won-dollar exchange rate and higher prices for primary metal products pushed the import price index up,” said Lee Moon-hee, head of the BOK’s price statistics team.

By category, intermediate goods prices rose 1.0 percent on month, driven by gains in primary metal products. Refined copper prices increased 8.7 percent, while other refined precious metals surged 13.6 percent. Mining products rose 0.2 percent, with copper ore climbing 10.0 percent and ammonia gaining 11.6 percent.

Prices of "other" precious metal jumped 13.6 percent on month and as much as 89.5 percent on year, reflecting the spike in silver and gold prices.

Raw material prices rose 0.1 percent overall. While crude oil prices declined, natural gas — including LNG — trended higher. On a year-on-year basis, however, LNG import prices fell 11.8 percent, broadly in line with the 13.3 percent annual decline in crude oil prices.

Higher import prices tend to feed into consumer inflation after several months, keeping policymakers alert despite the recent moderation.

Export prices hit record high as trade conditions improve

Gains of exports prices benefited from the weak won and feverish demand for DRAM, helping to strengthen trade terms in Korea's favor.

The export price index rose 1.1 percent on month to 140.93 in December, marking a sixth consecutive monthly increase and a record high. The rise, however, represented a significant slowdown from November’s 3.7 percent surge.

DRAM export prices gained 5.2 percent on month and 57.5 percent on year amid dire shortage of mass-market memory due to capacity focus on high-performance memory by core producers Samsung Electronics and SK hynix.

In trade terms, export prices posted annualized gains of 5.4 percent, while income terms surged 17.9 percent — comfortably supporting the country's trade surplus streak.

The export volume index and export value index, which together underpin the export price index, rose to record highs of 141.88 and 162.25, respectively, indicating exports were sold in both larger volumes and at higher prices.

Silver recorded the steepest increase among export items, surging 27.7 percent in December and rising 116.1 percent over the course of 2025 — the fastest growth among major metals — buoyed by its dual role as a safe-haven asset and a key industrial input for semiconductors and secondary batteries. Refined copper prices climbed 10.4 percent, reflecting strong demand tied to power grids and AI infrastructure.

BOK officials noted that export volumes continued to rise, led by semiconductors and computer storage devices, with year-end shipment concentration amplifying the gains.

Despite easing commodity prices, the BOK stressed that the exchange rate remains the decisive factor. In December, export prices measured in contract currencies rose just 0.4 percent from the previous month, while import prices were flat — confirming that most of the increase in won-based indices stemmed from currency effects rather than underlying price pressures.

Looking ahead to January, Lee said both Dubai crude prices and the won-dollar exchange rate have so far declined from December averages, but cautioned that “uncertainty in both domestic and global conditions remains high.”

Copyright ⓒ Aju Press All rights reserved.