*Updated with additional information

SEOUL, February 03 (AJP) - South Korea’s inflation eased back to the central bank’s target level in January, as softer fuel prices and subdued domestic demand outweighed lingering pressures from a weak currency.

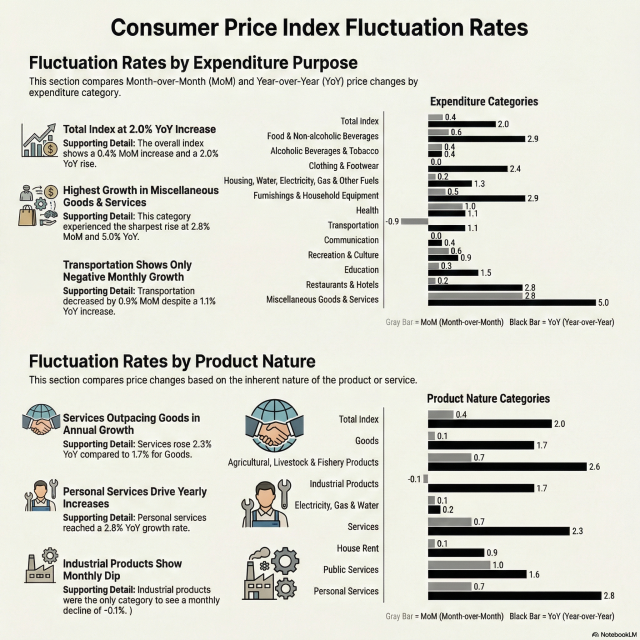

According to the Ministry of Data and Statistics, the consumer price index (CPI) rose 2.0 percent in January from a year earlier, slowing from 2.3 percent in December and 2.4 percent in both October and November.

The moderation partly reflected seasonal factors. The Lunar New Year holiday falls in February this year, unlike last year when it came in January and pushed up food prices due to family gatherings and ceremonial demand.

Energy prices also helped contain inflation despite the won’s prolonged weakness against the U.S. dollar. Gasoline and diesel prices fell 2.4 percent and 3.5 percent, respectively, easing pressure on utility costs during the winter peak season.

The data suggest that sluggish domestic demand has so far offset inflationary pass-through effects from currency depreciation and global price volatility.

The exchange rate remained a key inflationary factor, though pressures softened slightly. The won averaged 1,458.19 per dollar in January, strengthening modestly from 1,467.35 in December.

The stabilization was supported by government intervention in the foreign exchange market and a broader softening of the U.S. dollar through January, allowing the won to recover part of its recent losses. The easing helped reduce energy import costs.

Dubai crude oil traded in a narrow range of $58 to $62 per barrel in January, broadly unchanged from December. Fuel prices, however, reversed the sharp increases seen late last year, when gasoline and diesel surged 5.7 percent and 10.8 percent, respectively.

Reflecting the fuel decline, transportation costs fell 0.9 percent month-on-month.

Month-on-month price movements underscore restrained consumption behavior amid still-elevated price levels.

Food and beverages rose 0.6 percent from December, household goods increased 0.5 percent, and recreation and culture climbed 0.6 percent.

Prices for “miscellaneous goods and services” rose 2.8 percent on the month and 5.0 percent year-on-year, largely due to annual price adjustments at the start of the year.

Insurance service fees surged 15.3 percent from a year earlier, the steepest increase among all CPI items. Household goods and domestic services also rose 2.9 percent year-on-year, outpacing most other categories.

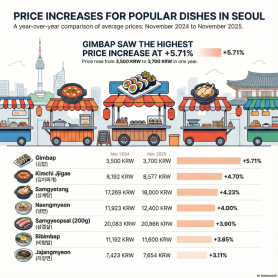

A breakdown by item type confirms the subdued demand trend. Dining-out prices rose just 0.3 percent, while non-dining personal services increased 1.0 percent.

In contrast, price growth for agricultural and industrial products either slowed or shifted toward contraction. Prices of agricultural, livestock and fishery products rose 0.7 percent year-on-year, easing from 1.0 percent in December. Overall goods inflation narrowed sharply from 0.4 percent to 0.1 percent.

Notably, manufactured goods prices fell 0.1 percent month-on-month, helped by the won’s relative stabilization.

The Ministry of Economy and Finance assessed in a press release that inflation remained relatively stable in January but warned of potential upward pressure during the Lunar New Year holiday in mid-February.

“Given lingering uncertainties such as international oil price volatility and winter weather conditions, the government plans to devote all its resources to stabilizing perceived inflation for the public,” the ministry said.

Copyright ⓒ Aju Press All rights reserved.