SEOUL, Feb 12 (AJP) - Hoping to keep alive the sizzling momentum in the Korean stock market, now ranked among the world’s top 10 by valuation, Seoul has toughened rules to clean out zombie stock names.

According to a new set of delisting requirements unveiled Thursday by the Financial Services Commission (FSC), members of the KOSPI will face stronger market capitalization and financial health standards, similar to those applied to the smaller KOSDAQ.

As of September 2024, “zombie companies” accounted for nearly a quarter of KOSDAQ listings and around 10 percent of the KOSPI. Financial authorities estimate that the ratio of marginal firms across both markets remains at similar levels today. Zombie companies, also known as marginal firms, refer to businesses unable to cover even their interest expenses with operating profits, often falling into capital erosion.

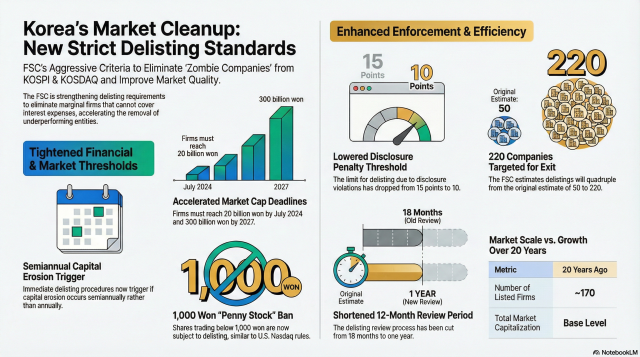

Previously, the FSC considered delisting only firms that were in a state of capital erosion at the end of a fiscal year. Under the new rules, however, companies that fall into capital erosion even on a semiannual basis will immediately face delisting procedures. The message is clear: firms that cannot — or will not — rapidly restore their financial standing will no longer be allowed to linger in the capital market.

The deadline for meeting minimum market capitalization requirements has also been sharply brought forward. Originally, listed firms were required to reach a market capitalization of 15 billion won ($10.4 million) by January this year, 20 billion won by January 2027, and 300 billion won by January 2028.

Under the revised plan, firms must reach 20 billion won by July this year and 300 billion won by January 2027.

Furthermore, share prices must be maintained at 1,000 won or higher.

“In the U.S. Nasdaq, being a ‘penny stock’ is grounds for delisting,” FSC Vice Chairman Lee Eog-won said during a regional meeting in Gwangju the previous day. “We intend to introduce similar provisions here.”

The threshold for delisting due to disclosure violations has also been lowered from 15 penalty points to 10. Disclosure violations are typically categorized into failure to disclose, changes in disclosure, and reversals of disclosure, with penalties ranging from 1 to 10 points depending on severity. This means a single major violation could now trigger immediate delisting proceedings.

A notable example is Kumyang, a KOSPI-listed firm that was handed 10 penalty points for allegedly inflating performance figures for a mine in Mongolia. While Kumyang accumulated a total of 17 points annually in that instance, under the new rules such a firm would enter delisting review immediately upon reaching the 10-point mark.

The review period itself has been shortened from 18 months to one year. To prevent firms from using injunction lawsuits to stall proceedings, the FSC plans to coordinate closely with relevant courts. The regulator has also launched an “Intensive Delisting Management Task Force,” led by the vice chairman of the KOSDAQ Market Division, which will operate for the next 17 months until July next year.

The FSC estimates that up to 220 companies could be delisted this year under the new regulations, far exceeding the original estimate of 50. Among them, 160 firms are classified as penny stocks trading below 1,000 won, representing 9 percent of all KOSDAQ-listed companies.

“For the past 20 years, the KOSDAQ market has maintained a structure of ‘many births and few deaths,’ with 1,353 entries and only 415 exits,” the FSC said. “While the number of listed firms grew eightfold, total market capitalization increased only 1.6 times.” After surpassing the 1,000 mark during the dot-com bubble on Sept. 14, 2000, the KOSDAQ remained trapped between 600 and 900 for more than 25 years before recently breaking above 1,000 again.

The FSC plans to apply the same strengthened standards to the benchmark KOSPI market.

On Thursday, the KOSDAQ closed at 1,125.99, up 1 percent. The modest gain contrasted with the KOSPI, which surged 3.13 percent to a record high of 5,522.27. While the KOSPI climbed 4.2 percent between Feb. 9 and Feb. 12, the KOSDAQ remained virtually flat, edging up just 0.14 percent.

Copyright ⓒ Aju Press All rights reserved.