Toss is shutting down its fractional investment-linked service after operating it for about three years, despite the sector’s move into the regulated financial system. The decision reflects a broader assessment of market size and profitability, industry officials said.

According to the financial industry on the 19th, Viva Republica, the operator of Toss, will end the fractional investing service in its app starting on the 21st. Toss launched the service in the first half of 2023 and has since brokered related products. It did not issue or manage the products itself, instead introducing or linking offerings from partner firms on its platform.

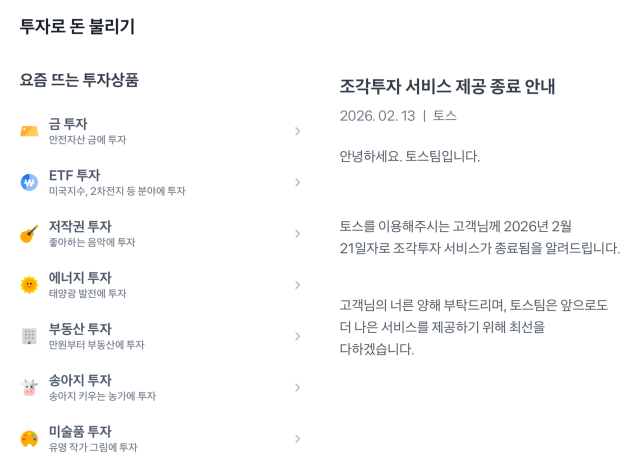

Fractional investing refers to products that split underlying assets into multiple shares so many investors can invest together. The assets can include physical items such as gold, real estate and art, as well as revenue rights tied to copyrights or energy projects. Toss has featured products tied to gold, exchange-traded funds and real estate, along with less common assets such as copyrights, renewable energy, calves and art.

But the market cooled quickly, with delays in formal regulation cited as a key factor. Financial authorities announced plans in early 2023 to build rules for new securities businesses such as fractional investing, but related bills only recently passed the National Assembly. On Jan. 15, lawmakers approved amendments to the Act on Electronic Registration of Stocks and Bonds and the Financial Investment Services and Capital Markets Act, a process that took about three years.

During that period, momentum weakened. Some operators scaled back or exited, and new product launches fell sharply. Toss’ service was also run in a limited way through specific partners, and there have been no recent new public offerings.

Even after regulation, industry participants say conditions remain challenging. On Feb. 13, the Financial Services Commission granted preliminary approval to two exchanges — the NXT consortium and KDX — to handle over-the-counter trading of fractional investment securities. The NXT consortium is led by alternative trading platform Nextrade (NXT) as its largest shareholder, while KDX is a consortium led by the Korea Exchange. With distribution channels likely limited to those exchanges for now, market expansion could be constrained.

For a platform operator like Toss, it may be difficult to generate meaningful revenue with a simple referral model under that structure, given the relatively small issuance size of individual products and a narrower investor base than in stock or crypto markets. Analysts said that even as rules are being finalized, the business is entering a transition period that is forcing strategic changes.

A Toss official said the company decided to end the service in its current form after reviewing regulatory changes and the business structure. The official added that the fractional investing market is being reshaped as legal and institutional frameworks are completed and distribution and issuance structures are reorganized, and that Toss will closely monitor conditions before deciding whether to pursue a new approach.

* This article has been translated by AI.

Copyright ⓒ Aju Press All rights reserved.