Journalist

Kim Yeon-jae

-

Korean large firms turn confident about business prospects for the first time in nearly 4 yrs SEOUL, January 27 (AJP) -South Korea’s large manufacturers — most of them export-oriented — turned optimistic about business conditions on strong orders in semiconductors and shipbuilding, even as overall business sentiment softened at the start of 2026, a Bank of Korea survey showed Tuesday. The business sentiment index for large manufacturing firms rose to 101.8 in January, up from 97.7 a month earlier, marking the first time the reading topped the neutral 100 threshold in three years and seven months, according to the central bank’s January business survey and economic sentiment index. A reading above 100 signals optimism, while a figure below that level indicates pessimism. The rebound was led by shipbuilders, whose business conditions index climbed to 107, reflecting strong order books, while sentiment among electronic equipment makers stood at 97, supported by robust semiconductor exports. By contrast, sentiment among small manufacturers remained subdued. Their index rose 1.7 points month on month but stayed at 91.8, underscoring a widening confidence gap between large and small firms. The gap between the two expanded to 10.0 points, the widest since September 2023. “Sentiment improved among large firms led by primary metals, other machinery and equipment, and electronic, video and communications equipment,” said Lee Hye-young, head of the Bank of Korea’s economic sentiment survey team. Industry-level data showed sharp divergence. In terms of current business conditions, shipbuilding and other transportation equipment posted a reading of 112, the only manufacturing sector above 100, buoyed by expectations of increased exports linked to cooperation with the United States. Electronic, video and communications equipment recorded a relatively high reading of 87, reflecting sustained semiconductor demand. Across all industries, however, the composite business sentiment index edged down 0.2 points to 94.0, slipping after three consecutive monthly gains. Manufacturing and nonmanufacturing sectors moved in opposite directions. The manufacturing CBSI rose 2.8 points to 97.5, supported by improvements in production and new orders. The nonmanufacturing CBSI fell 2.1 points to 91.7, weighed down by weaker funding conditions and profitability. Looking ahead, the outlook index for February improved modestly, rising to 95.0 for manufacturing and 88.4 for nonmanufacturing, while the all-industry outlook stood at 91.0. Lee said sentiment in nonmanufacturing sectors often peaks at year-end due to seasonal order concentration, with a slowdown typically emerging early in the year. She added that signs of improvement are emerging for February, led by wholesale and retail trade and arts, sports and leisure-related services, reflecting the Lunar New Year holiday effect. The economic sentiment index, which combines corporate and consumer sentiment, rose 0.5 points to 94.0 in January, while the seasonally adjusted cyclical indicator increased 0.6 points to 95.8. The survey was conducted between Jan. 12 and 19 among 3,524 companies nationwide, with 3,255 firms responding, including 1,815 manufacturers and 1,440 nonmanufacturers. 2026-01-27 08:09:00

Korean large firms turn confident about business prospects for the first time in nearly 4 yrs SEOUL, January 27 (AJP) -South Korea’s large manufacturers — most of them export-oriented — turned optimistic about business conditions on strong orders in semiconductors and shipbuilding, even as overall business sentiment softened at the start of 2026, a Bank of Korea survey showed Tuesday. The business sentiment index for large manufacturing firms rose to 101.8 in January, up from 97.7 a month earlier, marking the first time the reading topped the neutral 100 threshold in three years and seven months, according to the central bank’s January business survey and economic sentiment index. A reading above 100 signals optimism, while a figure below that level indicates pessimism. The rebound was led by shipbuilders, whose business conditions index climbed to 107, reflecting strong order books, while sentiment among electronic equipment makers stood at 97, supported by robust semiconductor exports. By contrast, sentiment among small manufacturers remained subdued. Their index rose 1.7 points month on month but stayed at 91.8, underscoring a widening confidence gap between large and small firms. The gap between the two expanded to 10.0 points, the widest since September 2023. “Sentiment improved among large firms led by primary metals, other machinery and equipment, and electronic, video and communications equipment,” said Lee Hye-young, head of the Bank of Korea’s economic sentiment survey team. Industry-level data showed sharp divergence. In terms of current business conditions, shipbuilding and other transportation equipment posted a reading of 112, the only manufacturing sector above 100, buoyed by expectations of increased exports linked to cooperation with the United States. Electronic, video and communications equipment recorded a relatively high reading of 87, reflecting sustained semiconductor demand. Across all industries, however, the composite business sentiment index edged down 0.2 points to 94.0, slipping after three consecutive monthly gains. Manufacturing and nonmanufacturing sectors moved in opposite directions. The manufacturing CBSI rose 2.8 points to 97.5, supported by improvements in production and new orders. The nonmanufacturing CBSI fell 2.1 points to 91.7, weighed down by weaker funding conditions and profitability. Looking ahead, the outlook index for February improved modestly, rising to 95.0 for manufacturing and 88.4 for nonmanufacturing, while the all-industry outlook stood at 91.0. Lee said sentiment in nonmanufacturing sectors often peaks at year-end due to seasonal order concentration, with a slowdown typically emerging early in the year. She added that signs of improvement are emerging for February, led by wholesale and retail trade and arts, sports and leisure-related services, reflecting the Lunar New Year holiday effect. The economic sentiment index, which combines corporate and consumer sentiment, rose 0.5 points to 94.0 in January, while the seasonally adjusted cyclical indicator increased 0.6 points to 95.8. The survey was conducted between Jan. 12 and 19 among 3,524 companies nationwide, with 3,255 firms responding, including 1,815 manufacturers and 1,440 nonmanufacturers. 2026-01-27 08:09:00 -

Korea tops Japan in exports, but growth engine overly reliant on chips SEOUL, Jan 23 (AJP) - East Asia emerged as the standout winner in global trade last year, with the region’s major exporters all setting new records as demand surged for artificial intelligence–related hardware. South Korea posted a record $709.5 billion in exports in 2025, up 3.8 percent from the previous year and overtaking Japan’s $696 billion in data released Thursday by Japan’s Ministry of Finance. It marked the first time South Korea surpassed Japan in total export volume. Taiwan followed closely with $640.7 billion. China earlier reported a record $3.77 trillion in exports. Beneath the headline figures, however, South Korea’s performance warrants a more sober assessment. In Korea’s case, semiconductors accounted for roughly one-quarter of total exports, or $173.4 billion, underscoring the economy’s growing dependence on a single sector. That dominance becomes even more pronounced when viewed through the lens of economic growth. According to the Bank of Korea’s 2025 GDP data released Thursday, the semiconductor sector contributed 0.6 percentage points to last year’s annualized growth rate of 1 percent—more than half of the total expansion. Excluding chips, the economy would have grown by just 0.4 percent. This concentration highlights what economists increasingly describe as South Korea’s “K-shaped” growth structure, particularly when contrasted with China and Japan, both of which retain broader industrial and domestic demand bases. China’s National Bureau of Statistics reported Monday that its 2025 manufacturing GDP was widely diversified, with machinery and equipment accounting for 16 percent, steel 13 percent, and semiconductors a comparatively modest 8 percent. Japan, while not a direct competitor in memory chips, also maintains a broad industrial mix. Automobiles—the largest segment of Japan’s secondary industry—account for 17 percent of output, far below Korea’s concentration, where 25 percent of exports are tied to a single category. Domestic demand further exposes the gap. South Korea’s retail sales growth has remained below 1 percent, while Japan’s is projected to reach around 2 percent, and China’s approximately 4 percent. Korea and Taiwan: twin chip engines, shared vulnerabilities South Korea’s closest economic parallel is Taiwan, which has built a similarly semiconductor-centric growth model. Despite differences in scale, the two economies share striking structural weaknesses. Taiwan recorded 5.3 percent export growth last year, but that expansion was driven overwhelmingly by advanced chipmaking. According to research from the Economic and Social Research Council (ESRC), TSMC alone accounts for about 8 percent of Taiwan’s GDP. This mirrors South Korea’s dependence on corporate heavyweights, where Samsung Electronics contributes roughly 5 percent of GDP, and the broader Samsung Group nearly 13 percent. In both economies, high-end semiconductor manufacturing has generated limited spillover effects into consumption and services. The imbalance is reflected in persistently weak domestic demand. Taiwan’s Directorate-General of Budget, Accounting and Statistics (DGBAS) reported private consumption growth of around 1 percent as of August 2025. South Korea’s retail sales growth is estimated at a similar level for the year. 2026-01-23 17:12:16

Korea tops Japan in exports, but growth engine overly reliant on chips SEOUL, Jan 23 (AJP) - East Asia emerged as the standout winner in global trade last year, with the region’s major exporters all setting new records as demand surged for artificial intelligence–related hardware. South Korea posted a record $709.5 billion in exports in 2025, up 3.8 percent from the previous year and overtaking Japan’s $696 billion in data released Thursday by Japan’s Ministry of Finance. It marked the first time South Korea surpassed Japan in total export volume. Taiwan followed closely with $640.7 billion. China earlier reported a record $3.77 trillion in exports. Beneath the headline figures, however, South Korea’s performance warrants a more sober assessment. In Korea’s case, semiconductors accounted for roughly one-quarter of total exports, or $173.4 billion, underscoring the economy’s growing dependence on a single sector. That dominance becomes even more pronounced when viewed through the lens of economic growth. According to the Bank of Korea’s 2025 GDP data released Thursday, the semiconductor sector contributed 0.6 percentage points to last year’s annualized growth rate of 1 percent—more than half of the total expansion. Excluding chips, the economy would have grown by just 0.4 percent. This concentration highlights what economists increasingly describe as South Korea’s “K-shaped” growth structure, particularly when contrasted with China and Japan, both of which retain broader industrial and domestic demand bases. China’s National Bureau of Statistics reported Monday that its 2025 manufacturing GDP was widely diversified, with machinery and equipment accounting for 16 percent, steel 13 percent, and semiconductors a comparatively modest 8 percent. Japan, while not a direct competitor in memory chips, also maintains a broad industrial mix. Automobiles—the largest segment of Japan’s secondary industry—account for 17 percent of output, far below Korea’s concentration, where 25 percent of exports are tied to a single category. Domestic demand further exposes the gap. South Korea’s retail sales growth has remained below 1 percent, while Japan’s is projected to reach around 2 percent, and China’s approximately 4 percent. Korea and Taiwan: twin chip engines, shared vulnerabilities South Korea’s closest economic parallel is Taiwan, which has built a similarly semiconductor-centric growth model. Despite differences in scale, the two economies share striking structural weaknesses. Taiwan recorded 5.3 percent export growth last year, but that expansion was driven overwhelmingly by advanced chipmaking. According to research from the Economic and Social Research Council (ESRC), TSMC alone accounts for about 8 percent of Taiwan’s GDP. This mirrors South Korea’s dependence on corporate heavyweights, where Samsung Electronics contributes roughly 5 percent of GDP, and the broader Samsung Group nearly 13 percent. In both economies, high-end semiconductor manufacturing has generated limited spillover effects into consumption and services. The imbalance is reflected in persistently weak domestic demand. Taiwan’s Directorate-General of Budget, Accounting and Statistics (DGBAS) reported private consumption growth of around 1 percent as of August 2025. South Korea’s retail sales growth is estimated at a similar level for the year. 2026-01-23 17:12:16 -

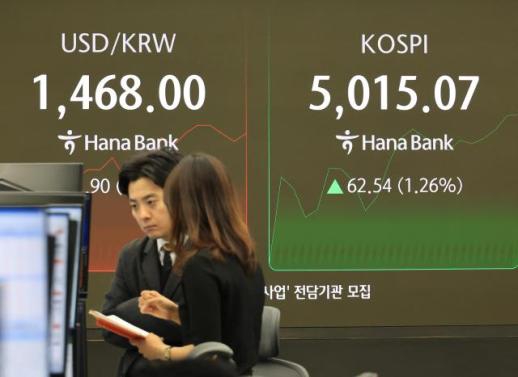

FX looms as Korea's top financial risk: BOK survey SEOUL, Jan 23 (AJP) - The Korean won has stabilized and edged higher against the U.S. dollar following explicit verbal intervention by authorities, but foreign exchange volatility remains the biggest financial risk facing South Korea, according to a new Bank of Korea (BOK) survey. Nearly seven in 10 financial experts flagged the exchange rate as a key source of risk, underscoring persistent unease despite recent market calm. According to the BOK survey of 75 professionals from international investment banks, research institutes and academia released Friday, 66.7 percent cited foreign exchange fluctuations as one of the top five risks to the economy, while 26.7 percent identified it as the single most significant threat. The won’s prolonged weakness against the dollar — still hovering near levels seen during past crisis periods — has overtaken household debt, a longstanding concern, which was cited by 16 percent of respondents in the latest survey. Other major risk factors included elevated housing prices in the Seoul metropolitan area and sluggish domestic economic growth. Despite the heightened focus on the exchange rate, economists did not see an imminent financial crisis. The perceived probability of a financial shock occurring within one year declined to 12.0 percent last year from 15.4 percent in 2024. Medium-term risk perceptions also eased, with the estimated probability over a one- to three-year horizon falling sharply from 34.6 percent to 24.0 percent. Confidence in the resilience of Korea’s financial system showed a corresponding improvement. The share of respondents rating their confidence as “high” or above rose to 54.7 percent last year, up from 50.0 percent in 2024. “Respondents called for enhanced risk management against both domestic and external uncertainties, alongside stronger policy credibility and predictability,” the BOK said in a statement. To bolster financial stability, experts urged authorities to stabilize foreign exchange and asset markets through closer monitoring and “clear and transparent communication.” The report also emphasized the need for a consistent policy mix to manage household debt and institutional efforts to address structural vulnerabilities across borrower segments, including the “orderly restructuring” of marginal firms. The BOK said it plans to use the survey results to guide its analysis and monitoring of financial system vulnerabilities throughout the year. As of 2 p.m. Friday, the won was trading at 1,468.10 per dollar, down 3.1 won from the previous session. 2026-01-23 13:58:48

FX looms as Korea's top financial risk: BOK survey SEOUL, Jan 23 (AJP) - The Korean won has stabilized and edged higher against the U.S. dollar following explicit verbal intervention by authorities, but foreign exchange volatility remains the biggest financial risk facing South Korea, according to a new Bank of Korea (BOK) survey. Nearly seven in 10 financial experts flagged the exchange rate as a key source of risk, underscoring persistent unease despite recent market calm. According to the BOK survey of 75 professionals from international investment banks, research institutes and academia released Friday, 66.7 percent cited foreign exchange fluctuations as one of the top five risks to the economy, while 26.7 percent identified it as the single most significant threat. The won’s prolonged weakness against the dollar — still hovering near levels seen during past crisis periods — has overtaken household debt, a longstanding concern, which was cited by 16 percent of respondents in the latest survey. Other major risk factors included elevated housing prices in the Seoul metropolitan area and sluggish domestic economic growth. Despite the heightened focus on the exchange rate, economists did not see an imminent financial crisis. The perceived probability of a financial shock occurring within one year declined to 12.0 percent last year from 15.4 percent in 2024. Medium-term risk perceptions also eased, with the estimated probability over a one- to three-year horizon falling sharply from 34.6 percent to 24.0 percent. Confidence in the resilience of Korea’s financial system showed a corresponding improvement. The share of respondents rating their confidence as “high” or above rose to 54.7 percent last year, up from 50.0 percent in 2024. “Respondents called for enhanced risk management against both domestic and external uncertainties, alongside stronger policy credibility and predictability,” the BOK said in a statement. To bolster financial stability, experts urged authorities to stabilize foreign exchange and asset markets through closer monitoring and “clear and transparent communication.” The report also emphasized the need for a consistent policy mix to manage household debt and institutional efforts to address structural vulnerabilities across borrower segments, including the “orderly restructuring” of marginal firms. The BOK said it plans to use the survey results to guide its analysis and monitoring of financial system vulnerabilities throughout the year. As of 2 p.m. Friday, the won was trading at 1,468.10 per dollar, down 3.1 won from the previous session. 2026-01-23 13:58:48 -

Blunt FX language fuels speculation, but steadies the won — for now SEOUL, January 22 (AJP) - Alongside South Korea’s blistering equity rally, the foreign-exchange market has emerged as the economy’s most sensitive fault line, dominating monetary policy briefings and even the president’s New Year’s press conference. From U.S. Treasury Secretary Scott Bessent’s remark that the won’s level is “not in line with Korea’s strong economic fundamentals,” to Bank of Korea Governor Rhee Chang-yong’s blunt assertion that the currency’s slide has been “excessive,” policymakers have adopted unusually direct language to deter one-sided bets that could distort trade conditions and undermine financial stability. President Lee Jae Myung joined the verbal defense in a televised New Year’s news conference — and went a step further. What stirred markets was a rare attempt to sketch a future trading range for the won. Citing compound external factors behind the currency’s weakness, Lee said that if the won were to track the Japanese yen closely, it would be trading near 1,600 per dollar. He then predicted that the won would stabilize around 1,400 within one or two months, without elaborating on the basis for the forecast. The comment abruptly halted short positions and triggered a reversal, pulling the won back from near 1,480 to below 1,470. As of Thursday, the dollar was quoted at 1,469.30. Earlier on Thursday, Governor Rhee reinforced the message with his own forceful verbal intervention at an AI conference co-hosted with Naver. “By any objective measure, the dollar-won exchange rate is too high and has ample room for adjustment,” he said. Where does the confidence come from? Some point to the roaring stock market, with the KOSPI briefly breaching the 5,000-point threshold — a level increasingly discussed as a symbolic gateway toward eventual MSCI developed-market status. Others focus on the bond market. South Korean sovereign debt is set to enter the World Government Bond Index (WGBI) in stages from April through November. WGBI inclusion requires a minimum maturity of one year, excluding short-term debt entirely. More importantly, the index’s credibility attracts long-duration capital: its average holding period is about 9.6 years, far longer than that of most global bond benchmarks. Longer duration typically translates into lower volatility and higher perceived credit quality. With inclusion beginning in April — precisely one to two months from now — President Lee’s timeline has not gone unnoticed. “As the government expects capital inflows of $50 billion or more from WGBI inclusion, it likely views this as a key catalyst for won appreciation,” said a foreign-exchange trader, speaking on condition of anonymity. Potential inclusion in the MSCI Developed Markets (DM) Index is also viewed as a strategic defensive line. If upgraded, South Korea would likely carry a weight of around 2 percent, potentially drawing between $250 billion and $350 billion in inflows. Crucially, DM capital is “sticky”: funds typically remain invested for five to ten years, compared with roughly three years for emerging-market flows. That durability helps dampen capital flight and stabilize the exchange rate. “DM inclusion would anchor capital flows and enhance Korea’s international credibility, which would be supportive for the won,” said Kim Jong-young, a researcher at NH Investment & Securities. Still, few expect an immediate boost. South Korea must first be placed on MSCI’s watch list this June and maintain that status for at least a year. Realistic inclusion is widely seen as a 2028 story at the earliest. Temporary relief from delayed U.S. investment Another theory circulating in markets is that the government may be implicitly defending the won by slowing the execution of a $350 billion investment package promised to the United States during tariff negotiations. The package includes $200 billion in direct investment and $150 billion in shipbuilding cooperation. Deputy Prime Minister and Finance Minister Koo Yun-cheol hinted at such delays in an interview with Reuters last Friday. “It will be difficult to execute major investments in the U.S. during the first half of this year,” Koo said, adding that “given current foreign-exchange market conditions, it is unlikely that these investments will materialize within the year.” Whether President Lee and Governor Rhee had this specific lever in mind remains unclear. “The remarks likely refer to measures such as Repatriation Incentive Accounts (RIA), but as Minister Koo noted, deploying U.S. investment funds within the first half appears difficult,” a Ministry of Economy and Finance official said, requesting anonymity. The comments follow an earlier signal of “pace adjustment” from Trade Minister Kim Jung-kwan on Nov. 14, when he clarified: “The commitment was to proceed with investments by January 2029 — not necessarily to disburse the full amount by then.” 2026-01-22 17:55:42

Blunt FX language fuels speculation, but steadies the won — for now SEOUL, January 22 (AJP) - Alongside South Korea’s blistering equity rally, the foreign-exchange market has emerged as the economy’s most sensitive fault line, dominating monetary policy briefings and even the president’s New Year’s press conference. From U.S. Treasury Secretary Scott Bessent’s remark that the won’s level is “not in line with Korea’s strong economic fundamentals,” to Bank of Korea Governor Rhee Chang-yong’s blunt assertion that the currency’s slide has been “excessive,” policymakers have adopted unusually direct language to deter one-sided bets that could distort trade conditions and undermine financial stability. President Lee Jae Myung joined the verbal defense in a televised New Year’s news conference — and went a step further. What stirred markets was a rare attempt to sketch a future trading range for the won. Citing compound external factors behind the currency’s weakness, Lee said that if the won were to track the Japanese yen closely, it would be trading near 1,600 per dollar. He then predicted that the won would stabilize around 1,400 within one or two months, without elaborating on the basis for the forecast. The comment abruptly halted short positions and triggered a reversal, pulling the won back from near 1,480 to below 1,470. As of Thursday, the dollar was quoted at 1,469.30. Earlier on Thursday, Governor Rhee reinforced the message with his own forceful verbal intervention at an AI conference co-hosted with Naver. “By any objective measure, the dollar-won exchange rate is too high and has ample room for adjustment,” he said. Where does the confidence come from? Some point to the roaring stock market, with the KOSPI briefly breaching the 5,000-point threshold — a level increasingly discussed as a symbolic gateway toward eventual MSCI developed-market status. Others focus on the bond market. South Korean sovereign debt is set to enter the World Government Bond Index (WGBI) in stages from April through November. WGBI inclusion requires a minimum maturity of one year, excluding short-term debt entirely. More importantly, the index’s credibility attracts long-duration capital: its average holding period is about 9.6 years, far longer than that of most global bond benchmarks. Longer duration typically translates into lower volatility and higher perceived credit quality. With inclusion beginning in April — precisely one to two months from now — President Lee’s timeline has not gone unnoticed. “As the government expects capital inflows of $50 billion or more from WGBI inclusion, it likely views this as a key catalyst for won appreciation,” said a foreign-exchange trader, speaking on condition of anonymity. Potential inclusion in the MSCI Developed Markets (DM) Index is also viewed as a strategic defensive line. If upgraded, South Korea would likely carry a weight of around 2 percent, potentially drawing between $250 billion and $350 billion in inflows. Crucially, DM capital is “sticky”: funds typically remain invested for five to ten years, compared with roughly three years for emerging-market flows. That durability helps dampen capital flight and stabilize the exchange rate. “DM inclusion would anchor capital flows and enhance Korea’s international credibility, which would be supportive for the won,” said Kim Jong-young, a researcher at NH Investment & Securities. Still, few expect an immediate boost. South Korea must first be placed on MSCI’s watch list this June and maintain that status for at least a year. Realistic inclusion is widely seen as a 2028 story at the earliest. Temporary relief from delayed U.S. investment Another theory circulating in markets is that the government may be implicitly defending the won by slowing the execution of a $350 billion investment package promised to the United States during tariff negotiations. The package includes $200 billion in direct investment and $150 billion in shipbuilding cooperation. Deputy Prime Minister and Finance Minister Koo Yun-cheol hinted at such delays in an interview with Reuters last Friday. “It will be difficult to execute major investments in the U.S. during the first half of this year,” Koo said, adding that “given current foreign-exchange market conditions, it is unlikely that these investments will materialize within the year.” Whether President Lee and Governor Rhee had this specific lever in mind remains unclear. “The remarks likely refer to measures such as Repatriation Incentive Accounts (RIA), but as Minister Koo noted, deploying U.S. investment funds within the first half appears difficult,” a Ministry of Economy and Finance official said, requesting anonymity. The comments follow an earlier signal of “pace adjustment” from Trade Minister Kim Jung-kwan on Nov. 14, when he clarified: “The commitment was to proceed with investments by January 2029 — not necessarily to disburse the full amount by then.” 2026-01-22 17:55:42 -

Japanese bond yields trigger global tantrum, South Korea most sensitive SEOUL, Jan 21 (AJP) - Major sovereign bond yields, including South Korean treasuries, jumped on Tuesday after a sharp surge in Japanese government bond yields — bringing the elephant in the room back into focus: the massive yen carry trade. The benchmark 10-year JGB yield closed up 7 basis points at 2.34 percent, its highest level in nearly three decades. The move quickly spilled over abroad, pushing the U.S. 10-year Treasury yield up 7.5 basis points to 4.295 percent and Australia’s 10-year yield up 6.9 basis points to 4.799 percent. South Korea proved particularly sensitive. The 10-year Korean government bond yield surged 8.8 basis points to 3.653 percent, marking its highest level in almost two years. Japan has long functioned as a global liquidity provider, with near-zero borrowing costs encouraging yen-funded carry trades for decades. The recent rise in JGB yields is now prompting capital repatriation, as Japanese investors pull funds back home to capture higher domestic returns. Because the yen serves as a major funding and reserve currency, this reversal has acted as a destabilizing force for global bond markets. Notably, the latest spike in yields was driven less by monetary policy than by fiscal concerns. The Bank of Japan is set to announce its interest rate decision on Friday, and the advanced trigger came from political developments surrounding Prime Minister Sanae Takaichi’s policy agenda. On Tuesday, Takaichi announced plans to dissolve parliament on Jan. 23 and call snap elections for Feb. 8. Although the ruling coalition of the Liberal Democratic Party and Nippon Ishin no Kai already controls 233 seats, she is seeking at least 240 seats to consolidate legislative dominance. Markets reacted sharply to her populist stimulus pledges, particularly proposals to cut consumption taxes on food and beverages to 8 percent — a move estimated to create a 5 trillion yen ($31.6 billion) revenue shortfall — without clear funding measures. Bond yields retreated after Takaichi later pledged that “there will be no additional debt issuance,” with the 10-year JGB yield falling about 8 basis points by Wednesday morning. However, skepticism remains, as yields continue to hover above 2.3 percent and investors question whether stimulus can be financed without new borrowing. Demand for Japanese debt has already weakened. A recent 20-year JGB auction recorded a record-low bid-to-cover ratio, underscoring investor caution. The rise in government yields has filtered through to consumer lending. As of Wednesday, 10-year fixed mortgage rates at Japan’s megabanks — Mizuho, MUFG and SMBC — were approaching 3.8 percent, nearly double the roughly 2 percent ceiling seen a year earlier. Analysts have compared the episode to the U.K.’s 2022 “Truss Shock,” when unfunded tax cuts proposed by then–Prime Minister Liz Truss sent 10-year gilt yields soaring from about 3.5 percent to 4.5 percent in less than a week. After Japanese Finance Minister Satsuki Katayama urged markets to “maintain calm,” the 10-year JGB yield slipped further, down 8.6 basis points to 2.29 percent. The recovery in Korea has lagged. The 10-year Korean yield stood at 3.619 percent on Wednesday morning, still up 3.4 basis points and failing to fully reverse the previous day’s sharp jump. Part of the drag stemmed from Korea's own fiscal stimulus agenda. On Tuesday, President Lee Jae-myung mentioned the possibility of a supplementary budget, instructing Culture Minister Choi Hwi-young to review potential increases in arts and culture spending. Although Lee later clarified at a Wednesday press conference that there would be “no reckless supplementary budget,” the initial comment had already unsettled the bond market. U.S. Treasury yields also eased slightly, with the 10-year yield ending Wednesday at 4.275 percent, down 2 basis points, but still short of a full recovery. Persistent geopolitical risks — including Washington’s threat to impose a 10 percent tariff on countries opposing its push to acquire Greenland — continued to weigh on sentiment. Caution urged over expansionary fiscal trends While analysts say fears of a systemic shock in South Korea are overstated, they warn that a broader global tilt toward fiscal expansion among major currency issuers poses ongoing risks. “Mentioning a supplementary budget in January is unusual, but South Korea is likely to exceed its tax revenue targets this year, making large-scale bond issuance unlikely,” said Kang Seung-won, a researcher at NH Securities. Kang added that a projected 30 percent increase in earnings among KOSPI and KOSDAQ-listed companies should help buffer the domestic bond market. Still, expansionary fiscal policies elsewhere remain a concern. “We are seeing a recurring pattern where fiscal concerns push up bond yields and market rates, which then weigh on currencies,” said Kwon Ah-min, another researcher at NH Securities. Kwon pointed to Japan’s record 122.3 trillion yen budget for fiscal 2026 — with 29.6 trillion yen expected to be financed through debt — as a key risk factor. “Rising bond issuance among major economies remains a volatile variable for global financial markets,” she said. 2026-01-21 17:20:01

Japanese bond yields trigger global tantrum, South Korea most sensitive SEOUL, Jan 21 (AJP) - Major sovereign bond yields, including South Korean treasuries, jumped on Tuesday after a sharp surge in Japanese government bond yields — bringing the elephant in the room back into focus: the massive yen carry trade. The benchmark 10-year JGB yield closed up 7 basis points at 2.34 percent, its highest level in nearly three decades. The move quickly spilled over abroad, pushing the U.S. 10-year Treasury yield up 7.5 basis points to 4.295 percent and Australia’s 10-year yield up 6.9 basis points to 4.799 percent. South Korea proved particularly sensitive. The 10-year Korean government bond yield surged 8.8 basis points to 3.653 percent, marking its highest level in almost two years. Japan has long functioned as a global liquidity provider, with near-zero borrowing costs encouraging yen-funded carry trades for decades. The recent rise in JGB yields is now prompting capital repatriation, as Japanese investors pull funds back home to capture higher domestic returns. Because the yen serves as a major funding and reserve currency, this reversal has acted as a destabilizing force for global bond markets. Notably, the latest spike in yields was driven less by monetary policy than by fiscal concerns. The Bank of Japan is set to announce its interest rate decision on Friday, and the advanced trigger came from political developments surrounding Prime Minister Sanae Takaichi’s policy agenda. On Tuesday, Takaichi announced plans to dissolve parliament on Jan. 23 and call snap elections for Feb. 8. Although the ruling coalition of the Liberal Democratic Party and Nippon Ishin no Kai already controls 233 seats, she is seeking at least 240 seats to consolidate legislative dominance. Markets reacted sharply to her populist stimulus pledges, particularly proposals to cut consumption taxes on food and beverages to 8 percent — a move estimated to create a 5 trillion yen ($31.6 billion) revenue shortfall — without clear funding measures. Bond yields retreated after Takaichi later pledged that “there will be no additional debt issuance,” with the 10-year JGB yield falling about 8 basis points by Wednesday morning. However, skepticism remains, as yields continue to hover above 2.3 percent and investors question whether stimulus can be financed without new borrowing. Demand for Japanese debt has already weakened. A recent 20-year JGB auction recorded a record-low bid-to-cover ratio, underscoring investor caution. The rise in government yields has filtered through to consumer lending. As of Wednesday, 10-year fixed mortgage rates at Japan’s megabanks — Mizuho, MUFG and SMBC — were approaching 3.8 percent, nearly double the roughly 2 percent ceiling seen a year earlier. Analysts have compared the episode to the U.K.’s 2022 “Truss Shock,” when unfunded tax cuts proposed by then–Prime Minister Liz Truss sent 10-year gilt yields soaring from about 3.5 percent to 4.5 percent in less than a week. After Japanese Finance Minister Satsuki Katayama urged markets to “maintain calm,” the 10-year JGB yield slipped further, down 8.6 basis points to 2.29 percent. The recovery in Korea has lagged. The 10-year Korean yield stood at 3.619 percent on Wednesday morning, still up 3.4 basis points and failing to fully reverse the previous day’s sharp jump. Part of the drag stemmed from Korea's own fiscal stimulus agenda. On Tuesday, President Lee Jae-myung mentioned the possibility of a supplementary budget, instructing Culture Minister Choi Hwi-young to review potential increases in arts and culture spending. Although Lee later clarified at a Wednesday press conference that there would be “no reckless supplementary budget,” the initial comment had already unsettled the bond market. U.S. Treasury yields also eased slightly, with the 10-year yield ending Wednesday at 4.275 percent, down 2 basis points, but still short of a full recovery. Persistent geopolitical risks — including Washington’s threat to impose a 10 percent tariff on countries opposing its push to acquire Greenland — continued to weigh on sentiment. Caution urged over expansionary fiscal trends While analysts say fears of a systemic shock in South Korea are overstated, they warn that a broader global tilt toward fiscal expansion among major currency issuers poses ongoing risks. “Mentioning a supplementary budget in January is unusual, but South Korea is likely to exceed its tax revenue targets this year, making large-scale bond issuance unlikely,” said Kang Seung-won, a researcher at NH Securities. Kang added that a projected 30 percent increase in earnings among KOSPI and KOSDAQ-listed companies should help buffer the domestic bond market. Still, expansionary fiscal policies elsewhere remain a concern. “We are seeing a recurring pattern where fiscal concerns push up bond yields and market rates, which then weigh on currencies,” said Kwon Ah-min, another researcher at NH Securities. Kwon pointed to Japan’s record 122.3 trillion yen budget for fiscal 2026 — with 29.6 trillion yen expected to be financed through debt — as a key risk factor. “Rising bond issuance among major economies remains a volatile variable for global financial markets,” she said. 2026-01-21 17:20:01 -

Korean won rebounds after president signals KRW–USD range SEOUL, January 21 (AJP) - The Korean won, which briefly revisited the perceived government defense line of 1,480 per dollar before markets opened Wednesday, rebounded sharply after President Lee Jae Myung publicly referred to a specific range for the exchange rate. During a televised New Year’s press conference, Lee addressed the won’s prolonged weakness, noting that the depreciation was not “a uniquely Korean phenomenon” but reflected broader geopolitical and global currency trends. Some market participants have described the won’s recent level around 1,470 per dollar as a “new normal,” Lee said. He added that if the Korean currency were strictly moving in line with the Japanese yen against the dollar, it would be trading closer to 1,600 won. Lee said authorities are continuing to explore measures to stabilize the currency, adding that officials expect the dollar-won rate to fall toward the 1,400 range within one to two months, though he did not specify the basis for the forecast. The president’s reference to a specific range had an immediate impact on the market. The dollar fell 11.1 won to 1,468.7 won in afternoon trading. “If there had been a quick fix, we would have already used it,” Lee said. “The government is implementing many useful policies that it can. But at the end of the day, the market is determined by supply and demand.” The won averaged a record-low 1,423.32 per dollar last year and has remained under pressure since the start of this year amid strong global demand for U.S. assets and lingering uncertainty over South Korea’s foreign exchange outlook. Concerns have also persisted over Seoul’s commitment to invest $350 billion in the United States under a sweeping tariff agreement with Washington. While the pledge has eased trade tensions, uncertainty over how the government will deliver the roughly $20 billion in annual funding has weighed on the local foreign-exchange market, according to a trader at SK Securities. U.S. officials are expected to visit Seoul as early as next month or in March to discuss the details of the investment framework, the trader said. 2026-01-21 14:59:53

Korean won rebounds after president signals KRW–USD range SEOUL, January 21 (AJP) - The Korean won, which briefly revisited the perceived government defense line of 1,480 per dollar before markets opened Wednesday, rebounded sharply after President Lee Jae Myung publicly referred to a specific range for the exchange rate. During a televised New Year’s press conference, Lee addressed the won’s prolonged weakness, noting that the depreciation was not “a uniquely Korean phenomenon” but reflected broader geopolitical and global currency trends. Some market participants have described the won’s recent level around 1,470 per dollar as a “new normal,” Lee said. He added that if the Korean currency were strictly moving in line with the Japanese yen against the dollar, it would be trading closer to 1,600 won. Lee said authorities are continuing to explore measures to stabilize the currency, adding that officials expect the dollar-won rate to fall toward the 1,400 range within one to two months, though he did not specify the basis for the forecast. The president’s reference to a specific range had an immediate impact on the market. The dollar fell 11.1 won to 1,468.7 won in afternoon trading. “If there had been a quick fix, we would have already used it,” Lee said. “The government is implementing many useful policies that it can. But at the end of the day, the market is determined by supply and demand.” The won averaged a record-low 1,423.32 per dollar last year and has remained under pressure since the start of this year amid strong global demand for U.S. assets and lingering uncertainty over South Korea’s foreign exchange outlook. Concerns have also persisted over Seoul’s commitment to invest $350 billion in the United States under a sweeping tariff agreement with Washington. While the pledge has eased trade tensions, uncertainty over how the government will deliver the roughly $20 billion in annual funding has weighed on the local foreign-exchange market, according to a trader at SK Securities. U.S. officials are expected to visit Seoul as early as next month or in March to discuss the details of the investment framework, the trader said. 2026-01-21 14:59:53 -

More young Koreans abandon job searches: BOK SEOUL, January 20 (AJP) - The number of economically inactive or “idled” young people in South Korea has risen sharply, with a growing share abandoning job searches, underscoring mounting risks to the country’s long-term growth potential, the central bank said on Tuesday. According to a report from the Bank of Korea (BOK), the proportion of the idled population within the economically inactive group climbed to 15.8 percent in 2025, up from 12.8 percent in 2019. The trend is most pronounced among young people, where the idled share surged to 22.3 percent last year from 14.6 percent in 2019. The report showed that the number of idled individuals with prior work experience jumped 32.5 percent over the period, rising from 360,000 in 2019 to 477,000 in 2025. By contrast, the number of young people without any work experience who fall into the "NEET" category — not in education, employment or training — remained broadly unchanged at around 100,000. The data suggest that those who have already entered the labor market are increasingly likely to exit and fail to return. The number of so-called “resting” youth — individuals who reported having no desire to work — also rose sharply, reaching 450,000 last year, a 56.8 percent increase from 287,000 in 2019. While people with an associate degree or lower continue to account for about 60 percent of the idled youth population, the number of university graduates and those with higher education who are “just resting” has been steadily increasing, the BOK said. The central bank found a strong link between prolonged unemployment and permanent labor market exit. Each additional year of unemployment raises the probability of a young person becoming idled by an average of 4 percent, while reducing the likelihood of finding a job by 3.1 percent. “The increase in the idled youth population poses a risk of shrinking the long-term labor supply and weakening South Korea’s potential growth,” the BOK report said. “As the likelihood of labor market exit rises with the length of unemployment, it is crucial to implement measures that prevent prolonged stagnation among job seekers.” 2026-01-20 17:45:24

More young Koreans abandon job searches: BOK SEOUL, January 20 (AJP) - The number of economically inactive or “idled” young people in South Korea has risen sharply, with a growing share abandoning job searches, underscoring mounting risks to the country’s long-term growth potential, the central bank said on Tuesday. According to a report from the Bank of Korea (BOK), the proportion of the idled population within the economically inactive group climbed to 15.8 percent in 2025, up from 12.8 percent in 2019. The trend is most pronounced among young people, where the idled share surged to 22.3 percent last year from 14.6 percent in 2019. The report showed that the number of idled individuals with prior work experience jumped 32.5 percent over the period, rising from 360,000 in 2019 to 477,000 in 2025. By contrast, the number of young people without any work experience who fall into the "NEET" category — not in education, employment or training — remained broadly unchanged at around 100,000. The data suggest that those who have already entered the labor market are increasingly likely to exit and fail to return. The number of so-called “resting” youth — individuals who reported having no desire to work — also rose sharply, reaching 450,000 last year, a 56.8 percent increase from 287,000 in 2019. While people with an associate degree or lower continue to account for about 60 percent of the idled youth population, the number of university graduates and those with higher education who are “just resting” has been steadily increasing, the BOK said. The central bank found a strong link between prolonged unemployment and permanent labor market exit. Each additional year of unemployment raises the probability of a young person becoming idled by an average of 4 percent, while reducing the likelihood of finding a job by 3.1 percent. “The increase in the idled youth population poses a risk of shrinking the long-term labor supply and weakening South Korea’s potential growth,” the BOK report said. “As the likelihood of labor market exit rises with the length of unemployment, it is crucial to implement measures that prevent prolonged stagnation among job seekers.” 2026-01-20 17:45:24 -

Korea Exchange cleans out zombie stocks as KOSPI rallies to new heights SEOUL, January 20 (AJP) - South Korea’s stock market is extending its red-hot rally into the new year while quietly pushing out near-defunct companies, using favorable market momentum to rationalize both its main and secondary bourses. According to data from the Korea Exchange (KRX) as of Tuesday, five companies — Pureunsonamu, Intromedic, Well Biotec, Kukbo and PharmAbcine — are currently undergoing delisting procedures. Of the five, Well Biotec and Kukbo are listed on the KOSPI, while the remaining three trade on the KOSDAQ. Including NKMAX, which was delisted earlier this month, and AMCG, which entered liquidation on the dormant KONEX board, the total number of exits from the Seoul bourse in January rises to seven. Such activity is highly unusual for January, traditionally considered a grace period as deadlines for annual audit reports typically fall in March. In the history of South Korea’s securities market, liquidation trading in January has occurred only twice — Seunghwa Pretech in 2016 and SL Energy in 2025. Outside of those exceptions, there have been no recorded cases of January liquidation trading. The cleanup reflects a broader government-led initiative to remove non-viable firms from the market. A year ago, the Financial Services Commission (FSC) and the KRX unveiled a sweeping reform plan covering initial public offerings and delisting procedures. The most notable change was a significant streamlining of the delisting review process. Under the revised framework, authorities eliminated the second stage of the traditional three-tier review system — which previously consisted of a Corporate Review Committee followed by two consecutive Market Committees. As a result, the maximum delisting review period has been cut in half, from four years to two. In addition, companies receiving a “disclaimer of opinion” from auditors for two consecutive years are now subject to immediate delisting without a grace period. From this year through 2028, listed companies must also meet progressively higher thresholds for market capitalization and revenue to retain their listings. KOSPI-listed firms are required to maintain a minimum market capitalization of 50 billion won ($33.8 million) and annual revenue of 20 billion won, while KOSDAQ-listed firms must meet thresholds of 30 billion won in market capitalization and 7.5 billion won in revenue to avoid delisting review. The primary driver behind the regulatory overhaul was the rapid deterioration of the tech-heavy KOSDAQ market. Data from the Bank of Korea and the KRX show that the proportion of so-called “marginal firms” — commonly referred to as zombie companies that fail to generate sufficient operating profit to cover interest expenses — on the KOSDAQ rose nearly 50 percent, from 16.5 percent in 2021 to about 24.5 percent in 2025. While the KOSPI has historically been subject to stricter oversight, the share of marginal firms on the main board also increased from 9.8 percent to an estimated 11.2 percent over the same period. The combined market average is now approaching the 20 percent threshold, a level exceeded only by U.S. markets. This trend contrasts sharply with regional peers: Japan’s Nikkei 225 maintains a marginal-firm ratio below 15 percent, while Taiwan’s TAIEX remains below 10 percent. The weak quality of listed firms has long been cited as a key driver of the so-called “Korea Discount,” discouraging foreign investor inflows and prompting the government’s more aggressive intervention. Market experts say tighter listing and delisting standards are likely to support the ongoing rally. “There is a clear expectation that stricter delisting criteria will restructure the market around healthier companies,” said Na Jeong-hwan, a researcher at NH Securities. “When the government unveiled its KOSDAQ support measures late last year, attention focused on the potential for market normalization through the exit of distressed firms.” Indeed, the KOSDAQ index rose about 10.3 percent in January last year following the initial announcement of tougher standards. After a renewed pledge on Dec. 19 to accelerate the removal of zombie firms, the index has gained more than 6 percent as of Tuesday’s close, suggesting that prolonged inaction on non-viable companies had been a major drag on investor sentiment. “Establishing clear guidelines for managing distressed firms could have a positive impact not only on the KOSDAQ but across the entire securities market, including the KOSPI,” Na added. Still, skepticism remains over whether the latest measures will translate into sustained enforcement. “The government has repeatedly announced plans to manage and clean up distressed firms, but those statements have rarely resulted in meaningful action,” said Kim Hak-kyun, head of research at Shinyoung Securities. “We need to watch closely whether this policy produces tangible results," said an official at the KRX, speaking on condition of anonymity. On Tuesday, the KOSPI closed at 4,885.75 and the KOSDAQ at 976.37. Compared with the same day a year earlier, the KOSPI has nearly doubled, posting a 94 percent gain, while the KOSDAQ has risen more than 34 percent. 2026-01-20 16:58:55

Korea Exchange cleans out zombie stocks as KOSPI rallies to new heights SEOUL, January 20 (AJP) - South Korea’s stock market is extending its red-hot rally into the new year while quietly pushing out near-defunct companies, using favorable market momentum to rationalize both its main and secondary bourses. According to data from the Korea Exchange (KRX) as of Tuesday, five companies — Pureunsonamu, Intromedic, Well Biotec, Kukbo and PharmAbcine — are currently undergoing delisting procedures. Of the five, Well Biotec and Kukbo are listed on the KOSPI, while the remaining three trade on the KOSDAQ. Including NKMAX, which was delisted earlier this month, and AMCG, which entered liquidation on the dormant KONEX board, the total number of exits from the Seoul bourse in January rises to seven. Such activity is highly unusual for January, traditionally considered a grace period as deadlines for annual audit reports typically fall in March. In the history of South Korea’s securities market, liquidation trading in January has occurred only twice — Seunghwa Pretech in 2016 and SL Energy in 2025. Outside of those exceptions, there have been no recorded cases of January liquidation trading. The cleanup reflects a broader government-led initiative to remove non-viable firms from the market. A year ago, the Financial Services Commission (FSC) and the KRX unveiled a sweeping reform plan covering initial public offerings and delisting procedures. The most notable change was a significant streamlining of the delisting review process. Under the revised framework, authorities eliminated the second stage of the traditional three-tier review system — which previously consisted of a Corporate Review Committee followed by two consecutive Market Committees. As a result, the maximum delisting review period has been cut in half, from four years to two. In addition, companies receiving a “disclaimer of opinion” from auditors for two consecutive years are now subject to immediate delisting without a grace period. From this year through 2028, listed companies must also meet progressively higher thresholds for market capitalization and revenue to retain their listings. KOSPI-listed firms are required to maintain a minimum market capitalization of 50 billion won ($33.8 million) and annual revenue of 20 billion won, while KOSDAQ-listed firms must meet thresholds of 30 billion won in market capitalization and 7.5 billion won in revenue to avoid delisting review. The primary driver behind the regulatory overhaul was the rapid deterioration of the tech-heavy KOSDAQ market. Data from the Bank of Korea and the KRX show that the proportion of so-called “marginal firms” — commonly referred to as zombie companies that fail to generate sufficient operating profit to cover interest expenses — on the KOSDAQ rose nearly 50 percent, from 16.5 percent in 2021 to about 24.5 percent in 2025. While the KOSPI has historically been subject to stricter oversight, the share of marginal firms on the main board also increased from 9.8 percent to an estimated 11.2 percent over the same period. The combined market average is now approaching the 20 percent threshold, a level exceeded only by U.S. markets. This trend contrasts sharply with regional peers: Japan’s Nikkei 225 maintains a marginal-firm ratio below 15 percent, while Taiwan’s TAIEX remains below 10 percent. The weak quality of listed firms has long been cited as a key driver of the so-called “Korea Discount,” discouraging foreign investor inflows and prompting the government’s more aggressive intervention. Market experts say tighter listing and delisting standards are likely to support the ongoing rally. “There is a clear expectation that stricter delisting criteria will restructure the market around healthier companies,” said Na Jeong-hwan, a researcher at NH Securities. “When the government unveiled its KOSDAQ support measures late last year, attention focused on the potential for market normalization through the exit of distressed firms.” Indeed, the KOSDAQ index rose about 10.3 percent in January last year following the initial announcement of tougher standards. After a renewed pledge on Dec. 19 to accelerate the removal of zombie firms, the index has gained more than 6 percent as of Tuesday’s close, suggesting that prolonged inaction on non-viable companies had been a major drag on investor sentiment. “Establishing clear guidelines for managing distressed firms could have a positive impact not only on the KOSDAQ but across the entire securities market, including the KOSPI,” Na added. Still, skepticism remains over whether the latest measures will translate into sustained enforcement. “The government has repeatedly announced plans to manage and clean up distressed firms, but those statements have rarely resulted in meaningful action,” said Kim Hak-kyun, head of research at Shinyoung Securities. “We need to watch closely whether this policy produces tangible results," said an official at the KRX, speaking on condition of anonymity. On Tuesday, the KOSPI closed at 4,885.75 and the KOSDAQ at 976.37. Compared with the same day a year earlier, the KOSPI has nearly doubled, posting a 94 percent gain, while the KOSDAQ has risen more than 34 percent. 2026-01-20 16:58:55 -

Korea's producer prices rise nearly 2% on year amid weak won, surging memory chip costs SEOUL, January 20 (AJP) -South Korea’s producer prices rose for a fourth consecutive month in December, as a weak won lifted prices across a broad range of goods and services, while sharply higher memory chip costs added further upward pressure. According to data released Tuesday by the Bank of Korea, the producer price index for December stood at 121.76 (2020 = 100), up 0.4 percent from the previous month and 1.9 percent from a year earlier. For the full year of 2025, producer prices rose a relatively modest 1.2 percent. Fresh food prices jumped 7.5 percent on month, reflecting cold-weather conditions, while energy prices fell 0.9 percent on softer international prices despite unfavorable exchange-rate conditions. Raw material prices increased 1.8 percent on month, reversing a 0.5 percent decline recorded in November. Manufactured goods rose 0.4 percent. Gains in computer, electronic and optical equipment, which climbed 2.3 percent, and primary metal products, up 1.1 percent, were partly offset by a 3.7-percent drop in coal and petroleum products. Prices for electricity, gas, water and waste services rose 0.2 percent, led by increases in industrial city gas, up 1.6 percent, and sewage treatment services, up 2.3 percent. Service prices also rose 0.2 percent, driven by restaurants and lodging, which increased 0.4 percent, and financial and insurance services, up 0.7 percent. Among key cost drivers, production costs for DRAM surged 15.1 percent from the previous month and 91.2 percent from a year earlier. Costs for assembling flash memory rose 6 percent on month and 72.4 percent on year. By contrast, naphtha cracking costs fell 3.8 percent on month and 17.4 percent on year, reflecting a prolonged downturn in the petrochemical sector and ongoing capacity reductions under industrial restructuring. Lee Moon-hee, head of the Bank of Korea’s price statistics team, said farm product prices were influenced by seasonal supply-and-demand factors and temporary supply disruptions caused by harvest delays for certain fruit items. “Farm product prices typically tend to rise from the previous month in summer and winter, so this is not unusual,” Lee said. On the potential impact on consumer inflation, Lee said the recent rise in producer prices has been driven largely by higher prices for intermediate goods such as semiconductors and primary metals, suggesting the pass-through to consumer prices may take time. He added that international oil prices remain lower than the previous month’s average and could exert downward pressure on consumer prices through petroleum products. The won weakened overnight, with the dollar briefly rising above 1,480 won—widely viewed as a government defense line—before retreating to around 1,474.5 won. 2026-01-20 09:35:03

Korea's producer prices rise nearly 2% on year amid weak won, surging memory chip costs SEOUL, January 20 (AJP) -South Korea’s producer prices rose for a fourth consecutive month in December, as a weak won lifted prices across a broad range of goods and services, while sharply higher memory chip costs added further upward pressure. According to data released Tuesday by the Bank of Korea, the producer price index for December stood at 121.76 (2020 = 100), up 0.4 percent from the previous month and 1.9 percent from a year earlier. For the full year of 2025, producer prices rose a relatively modest 1.2 percent. Fresh food prices jumped 7.5 percent on month, reflecting cold-weather conditions, while energy prices fell 0.9 percent on softer international prices despite unfavorable exchange-rate conditions. Raw material prices increased 1.8 percent on month, reversing a 0.5 percent decline recorded in November. Manufactured goods rose 0.4 percent. Gains in computer, electronic and optical equipment, which climbed 2.3 percent, and primary metal products, up 1.1 percent, were partly offset by a 3.7-percent drop in coal and petroleum products. Prices for electricity, gas, water and waste services rose 0.2 percent, led by increases in industrial city gas, up 1.6 percent, and sewage treatment services, up 2.3 percent. Service prices also rose 0.2 percent, driven by restaurants and lodging, which increased 0.4 percent, and financial and insurance services, up 0.7 percent. Among key cost drivers, production costs for DRAM surged 15.1 percent from the previous month and 91.2 percent from a year earlier. Costs for assembling flash memory rose 6 percent on month and 72.4 percent on year. By contrast, naphtha cracking costs fell 3.8 percent on month and 17.4 percent on year, reflecting a prolonged downturn in the petrochemical sector and ongoing capacity reductions under industrial restructuring. Lee Moon-hee, head of the Bank of Korea’s price statistics team, said farm product prices were influenced by seasonal supply-and-demand factors and temporary supply disruptions caused by harvest delays for certain fruit items. “Farm product prices typically tend to rise from the previous month in summer and winter, so this is not unusual,” Lee said. On the potential impact on consumer inflation, Lee said the recent rise in producer prices has been driven largely by higher prices for intermediate goods such as semiconductors and primary metals, suggesting the pass-through to consumer prices may take time. He added that international oil prices remain lower than the previous month’s average and could exert downward pressure on consumer prices through petroleum products. The won weakened overnight, with the dollar briefly rising above 1,480 won—widely viewed as a government defense line—before retreating to around 1,474.5 won. 2026-01-20 09:35:03 -

IMF flags structural FX fragility in Korea, citing shallow market and equity-heavy exposure SEOUL, January 19 (AJP) - South Korea’s foreign exchange vulnerability has drawn renewed scrutiny from the International Monetary Fund, not because of short-term external debt — the trigger during the late-1990s liquidity crisis — but due to the country’s unusually large foreign equity exposure relative to the depth of its FX market. According to an IMF assessment released Sunday, South Korea’s foreign-exposed assets amount to roughly 25 times its average monthly foreign exchange trading volume, ranking it fourth globally. While the headline figure places Korea alongside advanced economies, a closer look reveals a structural imbalance that continues to weigh on the won. Data from the Bank of Korea and the Bank for International Settlements show that South Korea’s FX turnover averaged about $2.2 trillion per month last year. By comparison, Canada records roughly $11 trillion, Norway $2.8 trillion, while in the United Kingdom, around $2.7 trillion changes hands in a single day. Liquidity matters. The deeper the market, the more easily it absorbs external shocks such as geopolitical risk or global monetary tightening. Shallow markets, by contrast, can react sharply to even modest disturbances. Korea’s vulnerability is compounded by the composition of its foreign-exposed assets. Equities account for nearly 70 percent, far higher than in Taiwan, where stocks represent closer to 30 percent despite the island ranking first globally in total foreign exposure. Japan, benefiting from the yen’s safe-haven status, adheres to a de facto “1:1 rule,” keeping equity exposure below 50 percent. Because equities are inherently more sensitive to shifts in market sentiment than debt instruments, this structural tilt leaves the won more exposed to sudden capital outflows. Norway, often cited as a peer with high equity exposure, operates under a fundamentally different framework. Its overseas investments are managed by a sovereign wealth fund with no fixed payout obligations. Korea’s exposure, by contrast, is driven largely by the National Pension Service (NPS) — a pension fund with explicit future liabilities. The NPS faces a looming outflow phase in which benefit payments will eventually exceed contributions. Although a 75 percent surge in the KOSPI last year, combined with strong U.S. equity performance, pushed back the projected depletion date to 2064, the fund remains under pressure to pursue higher-risk returns. Norway’s fund, meanwhile, mitigates domestic risk by investing 100 percent of its assets overseas, an option unavailable to the NPS. Foreign exchange reserves add another layer to the so-called “won discount.” While South Korea’s reserves stand at $428 billion, ranking ninth globally, its reserves-to-GDP ratio is below 23 percent, placing it outside the global top 30. Among its four major Asian peers, Korea holds the smallest absolute reserves and the second-lowest ratio, ahead of only China. But China’s case is not directly comparable, given the yuan’s inclusion in the IMF’s Special Drawing Rights basket and the scale of its economy. Taiwan, another top-four country in foreign exposure, maintains a reserves-to-GDP ratio above 70 percent, with holdings reaching $602.6 billion as of December. Canada’s ratio, by contrast, sits near 5 percent, a level sustained only because the Canadian dollar functions as a quasi-reserve currency. Adding to concern, South Korea’s reserves fell by $260 million in December, bucking the trend among major economies and raising the prospect of being overtaken by Hong Kong in global rankings. A roadmap for diversification The IMF argues that expanding and diversifying Korea’s FX market structure is essential to reducing the won’s vulnerability. A key priority is extending trading hours. Korea’s FX market currently operates for 17 hours, from 9 a.m. to 2 a.m., following a recent extension from a 3:30 p.m. close to better align with London. By contrast, markets in Japan, Canada, Norway and Taiwan operate on a 24-hour basis. Commercial banks have expressed support for a full transition. “Banks have been monitoring the FX market in three shifts since last February, but because dollar-related shocks often occur after 2 a.m., our ability to respond remains limited,” said an FX trader, who requested anonymity. Broadening participation by global investment banks is another priority. While Taiwan’s official trading hours are shorter, it benefits from active spot and forward trading by foreign institutions that act as shock absorbers during periods of stress. Korea’s market remains dominated by domestic banks, while foreign institutions are required to open local accounts — a barrier that limits participation. In response, the government’s 2026 Economic Growth Strategy, unveiled on January 9, includes plans to introduce 24-hour FX trading by July and allow foreign financial institutions to participate without local accounts. The goal, policymakers say, is simple: to deepen the pond, so that the won can better withstand the waves of global volatility. 2026-01-19 17:02:24

IMF flags structural FX fragility in Korea, citing shallow market and equity-heavy exposure SEOUL, January 19 (AJP) - South Korea’s foreign exchange vulnerability has drawn renewed scrutiny from the International Monetary Fund, not because of short-term external debt — the trigger during the late-1990s liquidity crisis — but due to the country’s unusually large foreign equity exposure relative to the depth of its FX market. According to an IMF assessment released Sunday, South Korea’s foreign-exposed assets amount to roughly 25 times its average monthly foreign exchange trading volume, ranking it fourth globally. While the headline figure places Korea alongside advanced economies, a closer look reveals a structural imbalance that continues to weigh on the won. Data from the Bank of Korea and the Bank for International Settlements show that South Korea’s FX turnover averaged about $2.2 trillion per month last year. By comparison, Canada records roughly $11 trillion, Norway $2.8 trillion, while in the United Kingdom, around $2.7 trillion changes hands in a single day. Liquidity matters. The deeper the market, the more easily it absorbs external shocks such as geopolitical risk or global monetary tightening. Shallow markets, by contrast, can react sharply to even modest disturbances. Korea’s vulnerability is compounded by the composition of its foreign-exposed assets. Equities account for nearly 70 percent, far higher than in Taiwan, where stocks represent closer to 30 percent despite the island ranking first globally in total foreign exposure. Japan, benefiting from the yen’s safe-haven status, adheres to a de facto “1:1 rule,” keeping equity exposure below 50 percent. Because equities are inherently more sensitive to shifts in market sentiment than debt instruments, this structural tilt leaves the won more exposed to sudden capital outflows. Norway, often cited as a peer with high equity exposure, operates under a fundamentally different framework. Its overseas investments are managed by a sovereign wealth fund with no fixed payout obligations. Korea’s exposure, by contrast, is driven largely by the National Pension Service (NPS) — a pension fund with explicit future liabilities. The NPS faces a looming outflow phase in which benefit payments will eventually exceed contributions. Although a 75 percent surge in the KOSPI last year, combined with strong U.S. equity performance, pushed back the projected depletion date to 2064, the fund remains under pressure to pursue higher-risk returns. Norway’s fund, meanwhile, mitigates domestic risk by investing 100 percent of its assets overseas, an option unavailable to the NPS. Foreign exchange reserves add another layer to the so-called “won discount.” While South Korea’s reserves stand at $428 billion, ranking ninth globally, its reserves-to-GDP ratio is below 23 percent, placing it outside the global top 30. Among its four major Asian peers, Korea holds the smallest absolute reserves and the second-lowest ratio, ahead of only China. But China’s case is not directly comparable, given the yuan’s inclusion in the IMF’s Special Drawing Rights basket and the scale of its economy. Taiwan, another top-four country in foreign exposure, maintains a reserves-to-GDP ratio above 70 percent, with holdings reaching $602.6 billion as of December. Canada’s ratio, by contrast, sits near 5 percent, a level sustained only because the Canadian dollar functions as a quasi-reserve currency. Adding to concern, South Korea’s reserves fell by $260 million in December, bucking the trend among major economies and raising the prospect of being overtaken by Hong Kong in global rankings. A roadmap for diversification The IMF argues that expanding and diversifying Korea’s FX market structure is essential to reducing the won’s vulnerability. A key priority is extending trading hours. Korea’s FX market currently operates for 17 hours, from 9 a.m. to 2 a.m., following a recent extension from a 3:30 p.m. close to better align with London. By contrast, markets in Japan, Canada, Norway and Taiwan operate on a 24-hour basis. Commercial banks have expressed support for a full transition. “Banks have been monitoring the FX market in three shifts since last February, but because dollar-related shocks often occur after 2 a.m., our ability to respond remains limited,” said an FX trader, who requested anonymity. Broadening participation by global investment banks is another priority. While Taiwan’s official trading hours are shorter, it benefits from active spot and forward trading by foreign institutions that act as shock absorbers during periods of stress. Korea’s market remains dominated by domestic banks, while foreign institutions are required to open local accounts — a barrier that limits participation. In response, the government’s 2026 Economic Growth Strategy, unveiled on January 9, includes plans to introduce 24-hour FX trading by July and allow foreign financial institutions to participate without local accounts. The goal, policymakers say, is simple: to deepen the pond, so that the won can better withstand the waves of global volatility. 2026-01-19 17:02:24