SEOUL, January 19 (AJP) - South Korea’s foreign exchange vulnerability has drawn renewed scrutiny from the International Monetary Fund, not because of short-term external debt — the trigger during the late-1990s liquidity crisis — but due to the country’s unusually large foreign equity exposure relative to the depth of its FX market.

According to an IMF assessment released Sunday, South Korea’s foreign-exposed assets amount to roughly 25 times its average monthly foreign exchange trading volume, ranking it fourth globally. While the headline figure places Korea alongside advanced economies, a closer look reveals a structural imbalance that continues to weigh on the won.

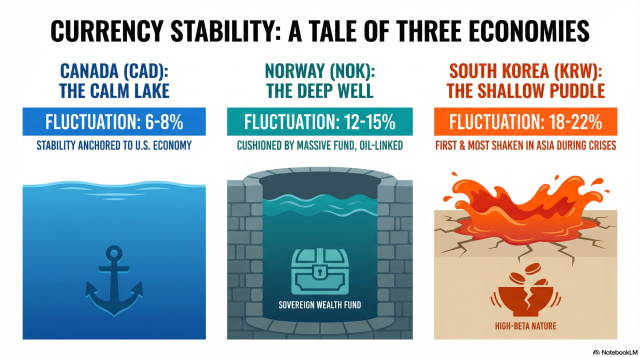

Data from the Bank of Korea and the Bank for International Settlements show that South Korea’s FX turnover averaged about $2.2 trillion per month last year. By comparison, Canada records roughly $11 trillion, Norway $2.8 trillion, while in the United Kingdom, around $2.7 trillion changes hands in a single day.

Liquidity matters. The deeper the market, the more easily it absorbs external shocks such as geopolitical risk or global monetary tightening. Shallow markets, by contrast, can react sharply to even modest disturbances.

Korea’s vulnerability is compounded by the composition of its foreign-exposed assets. Equities account for nearly 70 percent, far higher than in Taiwan, where stocks represent closer to 30 percent despite the island ranking first globally in total foreign exposure. Japan, benefiting from the yen’s safe-haven status, adheres to a de facto “1:1 rule,” keeping equity exposure below 50 percent.

Because equities are inherently more sensitive to shifts in market sentiment than debt instruments, this structural tilt leaves the won more exposed to sudden capital outflows.

Norway, often cited as a peer with high equity exposure, operates under a fundamentally different framework. Its overseas investments are managed by a sovereign wealth fund with no fixed payout obligations. Korea’s exposure, by contrast, is driven largely by the National Pension Service (NPS) — a pension fund with explicit future liabilities.

The NPS faces a looming outflow phase in which benefit payments will eventually exceed contributions. Although a 75 percent surge in the KOSPI last year, combined with strong U.S. equity performance, pushed back the projected depletion date to 2064, the fund remains under pressure to pursue higher-risk returns. Norway’s fund, meanwhile, mitigates domestic risk by investing 100 percent of its assets overseas, an option unavailable to the NPS.

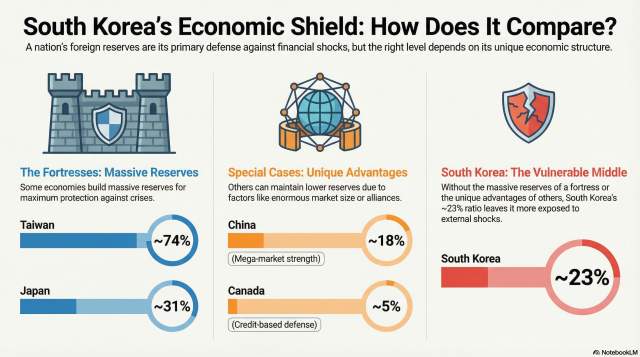

Foreign exchange reserves add another layer to the so-called “won discount.” While South Korea’s reserves stand at $428 billion, ranking ninth globally, its reserves-to-GDP ratio is below 23 percent, placing it outside the global top 30.

Among its four major Asian peers, Korea holds the smallest absolute reserves and the second-lowest ratio, ahead of only China. But China’s case is not directly comparable, given the yuan’s inclusion in the IMF’s Special Drawing Rights basket and the scale of its economy.

Taiwan, another top-four country in foreign exposure, maintains a reserves-to-GDP ratio above 70 percent, with holdings reaching $602.6 billion as of December. Canada’s ratio, by contrast, sits near 5 percent, a level sustained only because the Canadian dollar functions as a quasi-reserve currency.

Adding to concern, South Korea’s reserves fell by $260 million in December, bucking the trend among major economies and raising the prospect of being overtaken by Hong Kong in global rankings.

A roadmap for diversification

The IMF argues that expanding and diversifying Korea’s FX market structure is essential to reducing the won’s vulnerability. A key priority is extending trading hours. Korea’s FX market currently operates for 17 hours, from 9 a.m. to 2 a.m., following a recent extension from a 3:30 p.m. close to better align with London. By contrast, markets in Japan, Canada, Norway and Taiwan operate on a 24-hour basis.

Commercial banks have expressed support for a full transition.

“Banks have been monitoring the FX market in three shifts since last February, but because dollar-related shocks often occur after 2 a.m., our ability to respond remains limited,” said an FX trader, who requested anonymity.

Broadening participation by global investment banks is another priority. While Taiwan’s official trading hours are shorter, it benefits from active spot and forward trading by foreign institutions that act as shock absorbers during periods of stress. Korea’s market remains dominated by domestic banks, while foreign institutions are required to open local accounts — a barrier that limits participation.

In response, the government’s 2026 Economic Growth Strategy, unveiled on January 9, includes plans to introduce 24-hour FX trading by July and allow foreign financial institutions to participate without local accounts.

The goal, policymakers say, is simple: to deepen the pond, so that the won can better withstand the waves of global volatility.

Copyright ⓒ Aju Press All rights reserved.