Journalist

Kim Yeon-jae

-

Asian markets rally as BOJ ends policy uncertainty SEOUL, December 19 (AJP) - Asian equities closed higher on Friday as investors welcomed signs of cooling U.S. inflation and the Bank of Japan’s long-anticipated interest rate hike, which helped clear a major policy overhang across the region. The BOJ’s move allowed markets to look past fears of a disorderly yen carry-trade unwind — at least for now — lifting benchmark indices across Asia. In Seoul, the KOSPI rose 0.65 percent to close at 4,020.55, reclaiming the 4,000 level. Institutional investors led the advance, snapping up a net 858.3 billion won ($580 million) in shares, more than offsetting combined selling by foreign and retail investors. The Korean won, however, remained fragile, ending the session at 1,479.3 per dollar, down 2.8 won as of 3:45 p.m., despite a brief intraday rebound. The BOJ raised its short-term policy rate from 0.5 percent to 0.75 percent — the highest level in 30 years — supporting the yen and exerting residual pressure on the won. A temporary suspension of South Korea’s foreign-exchange stability levy, aimed at encouraging FX inflows including dollars, has yet to show a meaningful impact. Bond yields in Seoul edged higher, with the 10-year government bond yield rising three basis points to 3.342 percent. Stocks within the Hyundai Motor Group saw sharp rotation. Hyundai AutoEver surged 18.45 percent to 305,000 won, fueled by investor optimism that the group will accelerate its push into robotics and software-defined vehicles (SDVs). Hyundai Motor gained 2.12 percent, while Hyundai Mobis rose 4.12 percent. Semiconductor heavyweights lagged the broader market. Samsung Electronics fell 1.21 percent to 106,300 won, and SK hynix declined 0.91 percent, as sentiment was weighed down by concerns over a looming supply glut from Chinese manufacturers flooding the market with legacy DRAM chips, potentially pressuring prices later this year. Hanwha Group also stood out. Hanwha Ocean climbed 5.8 percent on news of a new LNG carrier contract, while Hanwha Systems jumped 10.93 percent amid reports it will supply advanced electronic displays for Boeing’s F-15 fighter jets. The tech-heavy KOSDAQ rose 1.55 percent to 915.27, buoyed by renewed biotech momentum. Rznomics, an RNA-editing specialist, hit its daily 30 percent limit to close at 117,000 won on its second day of trading. Index heavyweight Alteogen gained 3.94 percent. In Tokyo, the Nikkei 225 advanced 1.03 percent to 49,507.21, as markets welcomed Governor Kazuo Ueda’s resolve to normalize monetary policy amid steady domestic inflation. Toyota rose 1.81 percent to 3,424 yen ($21.9), while Honda gained 0.91 percent despite lingering recall concerns. Japanese chip-equipment makers tracked gains in U.S. peers, with Ibiden surging 4.44 percent and Tokyo Electron climbing 2.94 percent. Taiwan’s TAIEX added 0.83 percent, led by a 2.55 percent jump in Foxconn, which ended at 221.5 Taiwan dollars ($7). TSMC was flat at 1,430 Taiwan dollars, while MediaTek slipped 0.7 percent to 1,410 Taiwan dollars amid worries over intensifying competition in legacy chips. Mainland Chinese markets edged higher, with the Shanghai Composite up 0.36 percent and the Shenzhen Component rising 0.66 percent. Hong Kong’s Hang Seng Index was up 0.73 percent in late trade. 2025-12-19 17:24:51

Asian markets rally as BOJ ends policy uncertainty SEOUL, December 19 (AJP) - Asian equities closed higher on Friday as investors welcomed signs of cooling U.S. inflation and the Bank of Japan’s long-anticipated interest rate hike, which helped clear a major policy overhang across the region. The BOJ’s move allowed markets to look past fears of a disorderly yen carry-trade unwind — at least for now — lifting benchmark indices across Asia. In Seoul, the KOSPI rose 0.65 percent to close at 4,020.55, reclaiming the 4,000 level. Institutional investors led the advance, snapping up a net 858.3 billion won ($580 million) in shares, more than offsetting combined selling by foreign and retail investors. The Korean won, however, remained fragile, ending the session at 1,479.3 per dollar, down 2.8 won as of 3:45 p.m., despite a brief intraday rebound. The BOJ raised its short-term policy rate from 0.5 percent to 0.75 percent — the highest level in 30 years — supporting the yen and exerting residual pressure on the won. A temporary suspension of South Korea’s foreign-exchange stability levy, aimed at encouraging FX inflows including dollars, has yet to show a meaningful impact. Bond yields in Seoul edged higher, with the 10-year government bond yield rising three basis points to 3.342 percent. Stocks within the Hyundai Motor Group saw sharp rotation. Hyundai AutoEver surged 18.45 percent to 305,000 won, fueled by investor optimism that the group will accelerate its push into robotics and software-defined vehicles (SDVs). Hyundai Motor gained 2.12 percent, while Hyundai Mobis rose 4.12 percent. Semiconductor heavyweights lagged the broader market. Samsung Electronics fell 1.21 percent to 106,300 won, and SK hynix declined 0.91 percent, as sentiment was weighed down by concerns over a looming supply glut from Chinese manufacturers flooding the market with legacy DRAM chips, potentially pressuring prices later this year. Hanwha Group also stood out. Hanwha Ocean climbed 5.8 percent on news of a new LNG carrier contract, while Hanwha Systems jumped 10.93 percent amid reports it will supply advanced electronic displays for Boeing’s F-15 fighter jets. The tech-heavy KOSDAQ rose 1.55 percent to 915.27, buoyed by renewed biotech momentum. Rznomics, an RNA-editing specialist, hit its daily 30 percent limit to close at 117,000 won on its second day of trading. Index heavyweight Alteogen gained 3.94 percent. In Tokyo, the Nikkei 225 advanced 1.03 percent to 49,507.21, as markets welcomed Governor Kazuo Ueda’s resolve to normalize monetary policy amid steady domestic inflation. Toyota rose 1.81 percent to 3,424 yen ($21.9), while Honda gained 0.91 percent despite lingering recall concerns. Japanese chip-equipment makers tracked gains in U.S. peers, with Ibiden surging 4.44 percent and Tokyo Electron climbing 2.94 percent. Taiwan’s TAIEX added 0.83 percent, led by a 2.55 percent jump in Foxconn, which ended at 221.5 Taiwan dollars ($7). TSMC was flat at 1,430 Taiwan dollars, while MediaTek slipped 0.7 percent to 1,410 Taiwan dollars amid worries over intensifying competition in legacy chips. Mainland Chinese markets edged higher, with the Shanghai Composite up 0.36 percent and the Shenzhen Component rising 0.66 percent. Hong Kong’s Hang Seng Index was up 0.73 percent in late trade. 2025-12-19 17:24:51 -

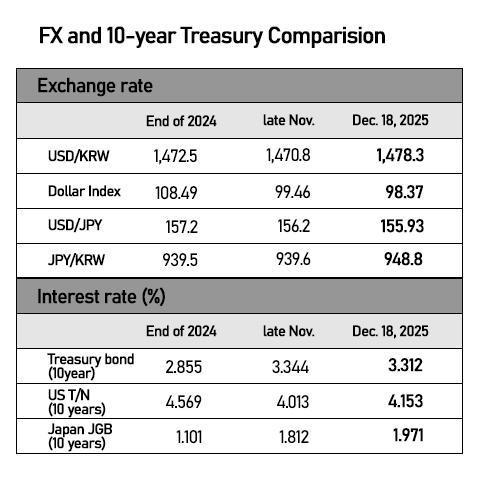

Korean markets price in Japan's rate hike to 30-year high, yen carry risk weighs SEOUL, December 19 (AJP) - Japan’s widely expected rate hike to 0.75 percent — the highest level in 30 years — delivered a mild upset to Korean markets, pressuring bond prices and the currency while lifting equities as investors positioned for a stronger yen environment. Although still low by global standards — compared with Korea’s 2.50 percent policy rate and the U.S. federal funds rate midpoint of about 3.6 percent — the Bank of Japan’s signal of further tightening to combat stubborn inflation near 3 percent marks a turning point for an economy long accustomed to deflation. For global investors, it also introduces an unfamiliar landscape in which Japanese yields are converging toward international levels. The benchmark 10-year Japanese government bond yield broke above 2.00 percent for the first time in 19 years following the decision. Korea’s 10-year government bond closed Friday at 3.342 percent, while the U.S. 10-year Treasury yielded 4.139 percent in early session. Equities advanced in Seoul, with the KOSPI ending Friday 0.65 percent up at 4,020.55 and the tech-heavy KOSDAQ gaining 1.55 percent to 915.27. The dollar rose 2.50 won to 1,479.00 won. “Given the sharp weakening of the yen, a December rate hike was widely expected, with BOJ officials openly discussing the possibility,” said Cho Yong-gu, an economist at Shinyoung Securities. Long positions in yen futures also reflected that market bet, and Korean bond and foreign-exchange markets were relieved that the period of uncertainty had ended, he added. Unlike the BOJ’s surprise first rate hike in August last year, Friday’s move — the second following a January increase — was largely anticipated. Still, Korean financial markets remain exposed to the potential unwinding of the yen carry trade, a strategy that quietly underpinned post-pandemic, liquidity-driven asset inflation. The trade involved borrowing in near-zero-cost yen to invest in higher-yielding assets abroad while Japan kept rates below or near zero even as other central banks tightened policy to curb inflation. That dynamic can reverse abruptly, with destabilizing consequences for emerging markets. According to Cho, the dollar is currently trading around 155 to 156 yen, and a move beyond 160 yen could trigger a rapid unwinding of carry trades — as seen in August last year when the dollar-yen pair briefly surged to 162. Korea, where the won has hovered near the 1,480-per-dollar level throughout December, is particularly sensitive to any sudden foreign capital outflows. The currency is already trading at levels associated with past crises. According to the Bank for International Settlements, Korea’s real effective exchange rate (REER) index fell to 87.05 at the end of November (2020=100), down 2.02 points from a month earlier. That marks the lowest level since April 2009, in the aftermath of the global financial crisis, and comes close to levels seen following the Asian financial crisis in November 1998. The REER measures a currency’s purchasing power against those of major trading partners. Korea ranked 63rd out of 64 countries in November, second only to Japan, whose REER stood at 69.4. The won has weakened steadily this year, slipping from the low-90s earlier in 2025 into the 80s by October. With the exchange rate lingering around the 1,480 range this month, analysts warn the REER could fall further. A weaker real exchange rate also raises the cost of essential imports such as wheat and gasoline, intensifying the burden on households. The Bank of Korea said the import price index rose 2.6 percent month on month in November, extending gains for a fifth consecutive month and marking the sharpest increase since April last year. Nor does currency weakness necessarily benefit exporters. The Korea Institute for Industrial Economics and Trade estimates that a 10 percent decline in the REER reduces large companies’ operating profit margins by 0.29 percentage points, reflecting Korea’s heavy reliance on imported raw materials and intermediate goods. As the won weakens, manufacturers must pay more dollars for inputs before re-exporting finished products. According to BOK on Friday, the producer price index rose 0.3 percent month on month and 1.9 percent year on year in November, with coal and fuel prices jumping 5 percent and memory chip prices rising in double digits, driven by higher import costs linked to the weak won. 2025-12-19 14:38:25

Korean markets price in Japan's rate hike to 30-year high, yen carry risk weighs SEOUL, December 19 (AJP) - Japan’s widely expected rate hike to 0.75 percent — the highest level in 30 years — delivered a mild upset to Korean markets, pressuring bond prices and the currency while lifting equities as investors positioned for a stronger yen environment. Although still low by global standards — compared with Korea’s 2.50 percent policy rate and the U.S. federal funds rate midpoint of about 3.6 percent — the Bank of Japan’s signal of further tightening to combat stubborn inflation near 3 percent marks a turning point for an economy long accustomed to deflation. For global investors, it also introduces an unfamiliar landscape in which Japanese yields are converging toward international levels. The benchmark 10-year Japanese government bond yield broke above 2.00 percent for the first time in 19 years following the decision. Korea’s 10-year government bond closed Friday at 3.342 percent, while the U.S. 10-year Treasury yielded 4.139 percent in early session. Equities advanced in Seoul, with the KOSPI ending Friday 0.65 percent up at 4,020.55 and the tech-heavy KOSDAQ gaining 1.55 percent to 915.27. The dollar rose 2.50 won to 1,479.00 won. “Given the sharp weakening of the yen, a December rate hike was widely expected, with BOJ officials openly discussing the possibility,” said Cho Yong-gu, an economist at Shinyoung Securities. Long positions in yen futures also reflected that market bet, and Korean bond and foreign-exchange markets were relieved that the period of uncertainty had ended, he added. Unlike the BOJ’s surprise first rate hike in August last year, Friday’s move — the second following a January increase — was largely anticipated. Still, Korean financial markets remain exposed to the potential unwinding of the yen carry trade, a strategy that quietly underpinned post-pandemic, liquidity-driven asset inflation. The trade involved borrowing in near-zero-cost yen to invest in higher-yielding assets abroad while Japan kept rates below or near zero even as other central banks tightened policy to curb inflation. That dynamic can reverse abruptly, with destabilizing consequences for emerging markets. According to Cho, the dollar is currently trading around 155 to 156 yen, and a move beyond 160 yen could trigger a rapid unwinding of carry trades — as seen in August last year when the dollar-yen pair briefly surged to 162. Korea, where the won has hovered near the 1,480-per-dollar level throughout December, is particularly sensitive to any sudden foreign capital outflows. The currency is already trading at levels associated with past crises. According to the Bank for International Settlements, Korea’s real effective exchange rate (REER) index fell to 87.05 at the end of November (2020=100), down 2.02 points from a month earlier. That marks the lowest level since April 2009, in the aftermath of the global financial crisis, and comes close to levels seen following the Asian financial crisis in November 1998. The REER measures a currency’s purchasing power against those of major trading partners. Korea ranked 63rd out of 64 countries in November, second only to Japan, whose REER stood at 69.4. The won has weakened steadily this year, slipping from the low-90s earlier in 2025 into the 80s by October. With the exchange rate lingering around the 1,480 range this month, analysts warn the REER could fall further. A weaker real exchange rate also raises the cost of essential imports such as wheat and gasoline, intensifying the burden on households. The Bank of Korea said the import price index rose 2.6 percent month on month in November, extending gains for a fifth consecutive month and marking the sharpest increase since April last year. Nor does currency weakness necessarily benefit exporters. The Korea Institute for Industrial Economics and Trade estimates that a 10 percent decline in the REER reduces large companies’ operating profit margins by 0.29 percentage points, reflecting Korea’s heavy reliance on imported raw materials and intermediate goods. As the won weakens, manufacturers must pay more dollars for inputs before re-exporting finished products. According to BOK on Friday, the producer price index rose 0.3 percent month on month and 1.9 percent year on year in November, with coal and fuel prices jumping 5 percent and memory chip prices rising in double digits, driven by higher import costs linked to the weak won. 2025-12-19 14:38:25 -

Asian markets in modest gains Friday ahead of BOJ rate decision SEOUL, December 19 (AJP) - Asian equity markets were moderately up early Friday as they await the rate decision from the Bank of Japan. In South Korea, the KOSPI was trading 0.4 percent up at 4,011 as of 10:30 a.m., retracing some of its earlier gains after rebounding 1 percent to track overnight Wall Street rise. Institutional investors led the buying with net purchases of 94 billion won, while retail investors added 33.8 billion won ($23 million). Conversely, foreign investors remained net sellers, offloading 117 billion won. The Korean won traded at 1,478.6 per dollar, down 2.1 won from the previous session. Concerns over potential volatility is looming in the morning session on the best on a rate hike in Japan. Leading stocks showed a marked divergence. Samsung Electronics fell 0.9 percent to 106,600 won amid concerns over increasing competition from Chinese DRAM producers. However, SK hynix gained 1.5 percent to 560,000 won, as its strategic focus on high-bandwidth memory (HBM) and cutting-edge chips continued to draw investor interest. The secondary battery sector remained under pressure. LG Energy Solution dropped 2.7 percent to 368,000 won, and Samsung SDI shed 1.8 percent to 272,000 won. SK Innovation, the parent of SK On, was also trading 1.35 percent lower at 103,400 won. The Hyundai Motor Group saw mixed results. Hyundai Motor and Kia fell 0.9 percent and 1.5 percent respectively, while Hyundai AutoEver, viewed as a key player in the group's transition to Software-Defined Vehicles (SDV), jumped 2.5 percent to 264,000 won. In the shipbuilding sector, Hanwha Ocean surged 4.7 percent to 108,500 won after announcing a 2.6 trillion won contract to build seven LNG carriers before the market open. The junior KOSDAQ was up 0.5 percent at 906. New listing Rznomics, an RNA-editing drug developer, hit its daily limit, trading at 117,000 won—a 30 percent jump from its IPO price. Satellite solution startup Nara Space Technology extended its rally, climbing 20.7 percent to 37,650 won in its second day of trading. In Tokyo, the Nikkei 225 rose 0.9 percent to 49,430, tracking overnight gains in the U.S. market. Toyota spearheaded the advance, gaining 1.8 percent to 3,425 yen ($22). Honda, however, remained flat at 1,544 yen due to ongoing supply chain issues and recall concerns in the U.S. Japanese semiconductor shares tracked their U.S. peers higher. Ibiden gained 3 percent, Tokyo Electron rose 2.8 percent, and Advantest was up 1.5 percent. Taiwan’s TAIEX advanced 1.3 percent to 27,820, with TSMC leading the charge, up 1.75 percent to 1,455 Taiwan dollars ($46.1). Mainland China markets remained largely flat as investors moved into a wait-and-watch mode ahead of the BOJ decision. The Shanghai Composite was little changed at 3,878, while the Hang Seng Index and Shenzhen Component edged up 0.2 percent and 0.3 percent respectively. 2025-12-19 11:18:04

Asian markets in modest gains Friday ahead of BOJ rate decision SEOUL, December 19 (AJP) - Asian equity markets were moderately up early Friday as they await the rate decision from the Bank of Japan. In South Korea, the KOSPI was trading 0.4 percent up at 4,011 as of 10:30 a.m., retracing some of its earlier gains after rebounding 1 percent to track overnight Wall Street rise. Institutional investors led the buying with net purchases of 94 billion won, while retail investors added 33.8 billion won ($23 million). Conversely, foreign investors remained net sellers, offloading 117 billion won. The Korean won traded at 1,478.6 per dollar, down 2.1 won from the previous session. Concerns over potential volatility is looming in the morning session on the best on a rate hike in Japan. Leading stocks showed a marked divergence. Samsung Electronics fell 0.9 percent to 106,600 won amid concerns over increasing competition from Chinese DRAM producers. However, SK hynix gained 1.5 percent to 560,000 won, as its strategic focus on high-bandwidth memory (HBM) and cutting-edge chips continued to draw investor interest. The secondary battery sector remained under pressure. LG Energy Solution dropped 2.7 percent to 368,000 won, and Samsung SDI shed 1.8 percent to 272,000 won. SK Innovation, the parent of SK On, was also trading 1.35 percent lower at 103,400 won. The Hyundai Motor Group saw mixed results. Hyundai Motor and Kia fell 0.9 percent and 1.5 percent respectively, while Hyundai AutoEver, viewed as a key player in the group's transition to Software-Defined Vehicles (SDV), jumped 2.5 percent to 264,000 won. In the shipbuilding sector, Hanwha Ocean surged 4.7 percent to 108,500 won after announcing a 2.6 trillion won contract to build seven LNG carriers before the market open. The junior KOSDAQ was up 0.5 percent at 906. New listing Rznomics, an RNA-editing drug developer, hit its daily limit, trading at 117,000 won—a 30 percent jump from its IPO price. Satellite solution startup Nara Space Technology extended its rally, climbing 20.7 percent to 37,650 won in its second day of trading. In Tokyo, the Nikkei 225 rose 0.9 percent to 49,430, tracking overnight gains in the U.S. market. Toyota spearheaded the advance, gaining 1.8 percent to 3,425 yen ($22). Honda, however, remained flat at 1,544 yen due to ongoing supply chain issues and recall concerns in the U.S. Japanese semiconductor shares tracked their U.S. peers higher. Ibiden gained 3 percent, Tokyo Electron rose 2.8 percent, and Advantest was up 1.5 percent. Taiwan’s TAIEX advanced 1.3 percent to 27,820, with TSMC leading the charge, up 1.75 percent to 1,455 Taiwan dollars ($46.1). Mainland China markets remained largely flat as investors moved into a wait-and-watch mode ahead of the BOJ decision. The Shanghai Composite was little changed at 3,878, while the Hang Seng Index and Shenzhen Component edged up 0.2 percent and 0.3 percent respectively. 2025-12-19 11:18:04 -

Korea's producer prices accelerate as fuel and chip cost jump SEOUL, December 19 (AJP) -South Korea’s producer prices accelerated in November despite easing international commodity prices, driven by a weaker won and a spike in semiconductor production costs. The producer price index (PPI) rose 0.3 percent from the previous month to 121.31 in November (2020 = 100), extending gains since September, the Bank of Korea said. From a year earlier, the index increased 1.9 percent, accelerating from a 1.6 percent rise in October. By category, prices of agricultural products fell 2.3 percent, while livestock products declined 2.6 percent, pulling the broader agriculture, forestry and fisheries group down 2.1 percent on the month. Lettuce prices plunged 42.7 percent, while beef prices fell 4.6 percent and pork prices dropped 4.1 percent. Prices of manufactured products climbed 0.8 percent from the previous month, led by coal and petroleum products, which jumped 5 percent — the largest increase since September 2023. Production prices for computers, electronic and optical equipment rose 2.3 percent, reflecting sharp increases in semiconductor costs. Prices of DRAM surged 15.5 percent on the month and 67.9 percent from a year earlier, while flash memory prices rose 23.4 percent on the month and 58.2 percent on the year. The increase reflects the broad impact of the won’s weakness on imported inputs and fuel costs, combined with rapid strengthening in memory prices amid tight supply conditions. The trend is expected to ripple through end products, including electronic devices and automobiles, both of which rely heavily on memory components. The domestic supply price index for November, which includes imports, rose 0.7 percent from the previous month. Intermediate goods prices climbed 1.1 percent and final goods rose 0.2 percent, offsetting a 0.5 percent decline in raw material prices. The total output price index for November, which includes exports as well as domestic shipments, increased 1.1 percent from the previous month, as manufactured products rose 1.9 percent and services edged up 0.1 percent. A weaker won against the U.S. dollar raises domestic production costs by making imported raw materials and intermediate goods more expensive, indirectly pushing up producer prices, the central bank said. The timing and extent of pass-through to producer prices can vary depending on business conditions, supply and demand, and government price-stabilization measures, it added. So far in December, Dubai crude prices have fallen 3.1 percent from the previous month, while the dollar-won exchange rate has risen 0.9 percent. In a separate report released Wednesday, the Bank of Korea warned that inflation could rise above this year’s estimated 2.1 percent level if the exchange rate remains near 1,500 won per dollar, given the two-to-four-week lag in the pass-through to consumer prices. It added the oversupply and soft international fuel prices will likely offset the inflationary pressure from the won's weakness. 2025-12-19 09:09:57

Korea's producer prices accelerate as fuel and chip cost jump SEOUL, December 19 (AJP) -South Korea’s producer prices accelerated in November despite easing international commodity prices, driven by a weaker won and a spike in semiconductor production costs. The producer price index (PPI) rose 0.3 percent from the previous month to 121.31 in November (2020 = 100), extending gains since September, the Bank of Korea said. From a year earlier, the index increased 1.9 percent, accelerating from a 1.6 percent rise in October. By category, prices of agricultural products fell 2.3 percent, while livestock products declined 2.6 percent, pulling the broader agriculture, forestry and fisheries group down 2.1 percent on the month. Lettuce prices plunged 42.7 percent, while beef prices fell 4.6 percent and pork prices dropped 4.1 percent. Prices of manufactured products climbed 0.8 percent from the previous month, led by coal and petroleum products, which jumped 5 percent — the largest increase since September 2023. Production prices for computers, electronic and optical equipment rose 2.3 percent, reflecting sharp increases in semiconductor costs. Prices of DRAM surged 15.5 percent on the month and 67.9 percent from a year earlier, while flash memory prices rose 23.4 percent on the month and 58.2 percent on the year. The increase reflects the broad impact of the won’s weakness on imported inputs and fuel costs, combined with rapid strengthening in memory prices amid tight supply conditions. The trend is expected to ripple through end products, including electronic devices and automobiles, both of which rely heavily on memory components. The domestic supply price index for November, which includes imports, rose 0.7 percent from the previous month. Intermediate goods prices climbed 1.1 percent and final goods rose 0.2 percent, offsetting a 0.5 percent decline in raw material prices. The total output price index for November, which includes exports as well as domestic shipments, increased 1.1 percent from the previous month, as manufactured products rose 1.9 percent and services edged up 0.1 percent. A weaker won against the U.S. dollar raises domestic production costs by making imported raw materials and intermediate goods more expensive, indirectly pushing up producer prices, the central bank said. The timing and extent of pass-through to producer prices can vary depending on business conditions, supply and demand, and government price-stabilization measures, it added. So far in December, Dubai crude prices have fallen 3.1 percent from the previous month, while the dollar-won exchange rate has risen 0.9 percent. In a separate report released Wednesday, the Bank of Korea warned that inflation could rise above this year’s estimated 2.1 percent level if the exchange rate remains near 1,500 won per dollar, given the two-to-four-week lag in the pass-through to consumer prices. It added the oversupply and soft international fuel prices will likely offset the inflationary pressure from the won's weakness. 2025-12-19 09:09:57 -

Hyundai Motor still at the starting line as Tesla races toward autonomous finish SEOUL, December 18 (AJP) - Tesla’s shares surged to a record high last Tuesday on CEO Elon Musk’s renewed push toward fully autonomous robotaxis — a breakthrough that drew cool look at Hyundai Motor’s lag in self-driving technology. Tesla has been testing its robotaxi service in Austin, Texas since early this year. What began as supervised trials has moved further, with Musk signaling over the weekend that vehicles are now operating without a driver in the seat, reinforcing investor confidence that Tesla is nearing true autonomy. The reaction in South Korea was notably different. Hyundai Motor shares slid 6 percent over the week to close Thursday at 282,500 won ($193.3), even as the benchmark KOSPI gained 1.4 percent on the day. Hyundai AutoEver, the group’s software and autonomous-driving arm, fell 3.37 percent to 272,500 won, extending losses after a sharp sell-off earlier in the week. Autonomous driving — or the perceived lack of progress in it — is increasingly cited by investors as a structural drag on Hyundai’s valuation. While Hyundai Motor shares have risen 33.6 percent this year, the gain is still less than half of the broader market’s advance. Hyundai’s autonomous-driving subsidiary 42dot has been testing self-driving buses in downtown Seoul, but the technology embedded in Hyundai and Kia production vehicles remains largely limited to basic driver-assistance functions such as acceleration, braking and lane-keeping. By global benchmarks, Hyundai has yet to reach the midpoint of the autonomy race. Tesla, by contrast, demonstrated a fully autonomous 296-mile drive from Seoul to Busan in November without human intervention, though the journey was supervised. General Motors has also showcased its “Super Cruise” system on new Cadillac electric vehicles, a technology often compared to Tesla’s Full Self-Driving. Both systems are generally classified as Level 2+ autonomy — legally requiring driver supervision but capable of lane changes, speed control and destination-based navigation. Hyundai has said it aims to deploy Level 3 autonomous driving technology, which handles all driving tasks until the system requests human intervention, by 2027. Leadership reshuffle adds uncertainty Confidence in that timeline has been dented by recent leadership changes. On December 3, Song Chang-hyun, founder and CEO of 42dot and head of Hyundai’s Advanced Vehicle Platform division, resigned. He was followed by Yang Hee-won, president overseeing research and development at both Hyundai and Kia. Yang’s role was filled by Manfred Harrer, a former Apple executive involved in the now-defunct Apple Car project. Following the reshuffle, Hyundai Motor Group Chairman Chung Euisun said the group would “prioritize stability over speed” in autonomous-driving development — a remark widely interpreted as an acknowledgment of setbacks in Hyundai’s transition toward software-defined vehicles. Strategic bet on LiDAR under pressure Beyond leadership churn, Hyundai faces a strategic dilemma rooted in its reliance on LiDAR technology, just as industry momentum pivots away from it. On December 16, U.S.-based LiDAR supplier Luminar Technologies filed for bankruptcy protection following contract cancellations and weakening demand, shortly after Tesla confirmed successful robotaxi tests using only cameras and satellite data. Industry consensus is increasingly shifting toward end-to-end deep learning models that emulate human decision-making rather than rule-based systems, paired with satellite-based data instead of costly LiDAR sensors. Chinese automakers are moving quickly in the same direction. Xpeng recently launched the P7+, the world’s second electric vehicle after Tesla to achieve autonomous driving using cameras alone. Geely affiliate Geespace plans to deploy 72 low-earth orbit satellites by year-end to support high-precision driving data collection. 42dot presses on, but questions linger Despite the shifting landscape, 42dot continues to project confidence. This week, it unveiled Ateria AI, a camera-based end-to-end autonomous-driving system. The announcement follows Hyundai Motor Group’s plan to build an AI factory equipped with 50,000 next-generation Nvidia Blackwell chips to accelerate so-called “Physical AI” initiatives across the group. Still, uncertainty surrounds 42dot’s standing within Hyundai. In Thursday's sweeping year-end reshuffle that replaced more than 200 executives, no successor was named for Song — a signal some analysts interpret as a possible downgrade in strategic priority. “The core reason Hyundai trades at a chronic discount is the fragmentation of its software capabilities across affiliates such as 42dot, Hyundai Mobis, Hyundai AutoEver and Boston Dynamics,” said Choi Tae-young, an analyst at DS Investment & Securities. Analysts argue Hyundai must replicate the model it used to centralize its hydrogen business under the HTWO brand and establish a single command structure for AI and autonomous driving. “Buying 50,000 GPUs or adopting Nvidia’s Drive platform is the easy part,” said Lee Hyun-wook, a researcher at IBK Securities. “The real challenge is empowering one lead entity to standardize data and fundamentally change how the organization works.” The pressure is also mounting on Motional, Hyundai’s joint venture with U.S.-based Aptiv, which has yet to deliver a commercial robotaxi despite aggressive talent recruitment from rivals such as Amazon-backed Zoox. 2025-12-18 17:00:17

Hyundai Motor still at the starting line as Tesla races toward autonomous finish SEOUL, December 18 (AJP) - Tesla’s shares surged to a record high last Tuesday on CEO Elon Musk’s renewed push toward fully autonomous robotaxis — a breakthrough that drew cool look at Hyundai Motor’s lag in self-driving technology. Tesla has been testing its robotaxi service in Austin, Texas since early this year. What began as supervised trials has moved further, with Musk signaling over the weekend that vehicles are now operating without a driver in the seat, reinforcing investor confidence that Tesla is nearing true autonomy. The reaction in South Korea was notably different. Hyundai Motor shares slid 6 percent over the week to close Thursday at 282,500 won ($193.3), even as the benchmark KOSPI gained 1.4 percent on the day. Hyundai AutoEver, the group’s software and autonomous-driving arm, fell 3.37 percent to 272,500 won, extending losses after a sharp sell-off earlier in the week. Autonomous driving — or the perceived lack of progress in it — is increasingly cited by investors as a structural drag on Hyundai’s valuation. While Hyundai Motor shares have risen 33.6 percent this year, the gain is still less than half of the broader market’s advance. Hyundai’s autonomous-driving subsidiary 42dot has been testing self-driving buses in downtown Seoul, but the technology embedded in Hyundai and Kia production vehicles remains largely limited to basic driver-assistance functions such as acceleration, braking and lane-keeping. By global benchmarks, Hyundai has yet to reach the midpoint of the autonomy race. Tesla, by contrast, demonstrated a fully autonomous 296-mile drive from Seoul to Busan in November without human intervention, though the journey was supervised. General Motors has also showcased its “Super Cruise” system on new Cadillac electric vehicles, a technology often compared to Tesla’s Full Self-Driving. Both systems are generally classified as Level 2+ autonomy — legally requiring driver supervision but capable of lane changes, speed control and destination-based navigation. Hyundai has said it aims to deploy Level 3 autonomous driving technology, which handles all driving tasks until the system requests human intervention, by 2027. Leadership reshuffle adds uncertainty Confidence in that timeline has been dented by recent leadership changes. On December 3, Song Chang-hyun, founder and CEO of 42dot and head of Hyundai’s Advanced Vehicle Platform division, resigned. He was followed by Yang Hee-won, president overseeing research and development at both Hyundai and Kia. Yang’s role was filled by Manfred Harrer, a former Apple executive involved in the now-defunct Apple Car project. Following the reshuffle, Hyundai Motor Group Chairman Chung Euisun said the group would “prioritize stability over speed” in autonomous-driving development — a remark widely interpreted as an acknowledgment of setbacks in Hyundai’s transition toward software-defined vehicles. Strategic bet on LiDAR under pressure Beyond leadership churn, Hyundai faces a strategic dilemma rooted in its reliance on LiDAR technology, just as industry momentum pivots away from it. On December 16, U.S.-based LiDAR supplier Luminar Technologies filed for bankruptcy protection following contract cancellations and weakening demand, shortly after Tesla confirmed successful robotaxi tests using only cameras and satellite data. Industry consensus is increasingly shifting toward end-to-end deep learning models that emulate human decision-making rather than rule-based systems, paired with satellite-based data instead of costly LiDAR sensors. Chinese automakers are moving quickly in the same direction. Xpeng recently launched the P7+, the world’s second electric vehicle after Tesla to achieve autonomous driving using cameras alone. Geely affiliate Geespace plans to deploy 72 low-earth orbit satellites by year-end to support high-precision driving data collection. 42dot presses on, but questions linger Despite the shifting landscape, 42dot continues to project confidence. This week, it unveiled Ateria AI, a camera-based end-to-end autonomous-driving system. The announcement follows Hyundai Motor Group’s plan to build an AI factory equipped with 50,000 next-generation Nvidia Blackwell chips to accelerate so-called “Physical AI” initiatives across the group. Still, uncertainty surrounds 42dot’s standing within Hyundai. In Thursday's sweeping year-end reshuffle that replaced more than 200 executives, no successor was named for Song — a signal some analysts interpret as a possible downgrade in strategic priority. “The core reason Hyundai trades at a chronic discount is the fragmentation of its software capabilities across affiliates such as 42dot, Hyundai Mobis, Hyundai AutoEver and Boston Dynamics,” said Choi Tae-young, an analyst at DS Investment & Securities. Analysts argue Hyundai must replicate the model it used to centralize its hydrogen business under the HTWO brand and establish a single command structure for AI and autonomous driving. “Buying 50,000 GPUs or adopting Nvidia’s Drive platform is the easy part,” said Lee Hyun-wook, a researcher at IBK Securities. “The real challenge is empowering one lead entity to standardize data and fundamentally change how the organization works.” The pressure is also mounting on Motional, Hyundai’s joint venture with U.S.-based Aptiv, which has yet to deliver a commercial robotaxi despite aggressive talent recruitment from rivals such as Amazon-backed Zoox. 2025-12-18 17:00:17 -

Tech slump drags Asian markets lower as investors eye BOJ SEOUL, December 18 (AJP) - Asian equity markets ended broadly lower on Thursday as fallout from an “Oracle shock” weighed on technology shares and investors stayed cautious ahead of the Bank of Japan’s (BOJ) interest rate decision. Most major benchmarks declined, though mainland China’s Shanghai Composite showed relative resilience, appearing largely insulated from weakness in U.S. technology stocks. South Korea’s benchmark KOSPI fell 1.53 percent to 3,994.51, slipping back below the psychologically important 4,000 level and posting one of the steepest losses among major Asian markets, alongside the Shenzhen Component. Foreign investors were heavy sellers, offloading 356.3 billion won ($241 million), while institutional investors sold 101.2 billion won. Retail investors bucked the trend, buying a net 424.2 billion won. The Korean won extended its weakness, trading at 1,478.7 per dollar at 4:10 p.m. local time, down 0.2 won from the previous session. The currency remains under pressure from sustained foreign outflows and expectations of a BOJ rate hike. Heavyweight stocks outperformed the broader market. Samsung Electronics slipped 0.28 percent to 107,600 won. Losses linked to Oracle-related sentiment were partly offset by strong earnings from Micron Technology, which lifted the outlook for the memory chip sector. SK hynix edged up to 552,000 won but pared earlier gains after hitting a session high of 563,000 won. The secondary battery sector suffered sharp losses after Ford, a key customer for South Korean manufacturers, scrapped contract plans and dissolved a joint venture, citing the electric vehicle market “chasm.” LG Energy Solution plunged 8.9 percent to 378,500 won, Samsung SDI fell 6.1 percent to 277,000 won, and SK Innovation, the parent of SK On, dropped 5.16 percent to 104,800 won. Materials supplier EcoPro Materials slid 6.35 percent. Korea Zinc sank 5.7 percent to 1,306,000 won amid controversy surrounding its joint venture with the U.S. Department of Defense. Investor sentiment deteriorated following reports that warrants issued during the process carried an exercise price of just 1 cent, while the U.S. side is set to receive more than $100 million a year in fees. In Japan, the Nikkei 225 dropped 1.03 percent to 49,001.5, pressured by technology weakness and caution ahead of the BOJ policy meeting. Semiconductor-related stocks led declines, with Advantest falling 3.32 percent to 18,805 yen ($120.6), Tokyo Electron down 3.22 percent, and Ibiden sliding 4.33 percent. Automakers showed mixed performance. Honda fell 2.53 percent to 1,543 yen following news of a brake-related recall in the U.S., while Toyota rose 0.42 percent to 3,363 yen, benefiting from apparent rotation within the sector. Financial stocks posted more moderate losses, with Mitsubishi UFJ Financial Group and Mizuho Financial Group down about 1 percent. Taiwan’s TAIEX was relatively steady, slipping 0.21 percent to 27,468.53. TSMC ended flat at 1,430 Taiwan dollars ($45.3), while MediaTek and Hon Hai Precision Industry (Foxconn) recorded modest declines. Mainland Chinese markets were mixed. The Shanghai Composite rose 0.16 percent to 3,876.37, while Hong Kong’s Hang Seng Index edged down 0.25 percent. Technology shares underperformed, with the Shenzhen Component falling 1.29 percent. Battery maker CATL dropped 2.98 percent and automaker BYD slid 1.76 percent. 2025-12-18 16:47:20

Tech slump drags Asian markets lower as investors eye BOJ SEOUL, December 18 (AJP) - Asian equity markets ended broadly lower on Thursday as fallout from an “Oracle shock” weighed on technology shares and investors stayed cautious ahead of the Bank of Japan’s (BOJ) interest rate decision. Most major benchmarks declined, though mainland China’s Shanghai Composite showed relative resilience, appearing largely insulated from weakness in U.S. technology stocks. South Korea’s benchmark KOSPI fell 1.53 percent to 3,994.51, slipping back below the psychologically important 4,000 level and posting one of the steepest losses among major Asian markets, alongside the Shenzhen Component. Foreign investors were heavy sellers, offloading 356.3 billion won ($241 million), while institutional investors sold 101.2 billion won. Retail investors bucked the trend, buying a net 424.2 billion won. The Korean won extended its weakness, trading at 1,478.7 per dollar at 4:10 p.m. local time, down 0.2 won from the previous session. The currency remains under pressure from sustained foreign outflows and expectations of a BOJ rate hike. Heavyweight stocks outperformed the broader market. Samsung Electronics slipped 0.28 percent to 107,600 won. Losses linked to Oracle-related sentiment were partly offset by strong earnings from Micron Technology, which lifted the outlook for the memory chip sector. SK hynix edged up to 552,000 won but pared earlier gains after hitting a session high of 563,000 won. The secondary battery sector suffered sharp losses after Ford, a key customer for South Korean manufacturers, scrapped contract plans and dissolved a joint venture, citing the electric vehicle market “chasm.” LG Energy Solution plunged 8.9 percent to 378,500 won, Samsung SDI fell 6.1 percent to 277,000 won, and SK Innovation, the parent of SK On, dropped 5.16 percent to 104,800 won. Materials supplier EcoPro Materials slid 6.35 percent. Korea Zinc sank 5.7 percent to 1,306,000 won amid controversy surrounding its joint venture with the U.S. Department of Defense. Investor sentiment deteriorated following reports that warrants issued during the process carried an exercise price of just 1 cent, while the U.S. side is set to receive more than $100 million a year in fees. In Japan, the Nikkei 225 dropped 1.03 percent to 49,001.5, pressured by technology weakness and caution ahead of the BOJ policy meeting. Semiconductor-related stocks led declines, with Advantest falling 3.32 percent to 18,805 yen ($120.6), Tokyo Electron down 3.22 percent, and Ibiden sliding 4.33 percent. Automakers showed mixed performance. Honda fell 2.53 percent to 1,543 yen following news of a brake-related recall in the U.S., while Toyota rose 0.42 percent to 3,363 yen, benefiting from apparent rotation within the sector. Financial stocks posted more moderate losses, with Mitsubishi UFJ Financial Group and Mizuho Financial Group down about 1 percent. Taiwan’s TAIEX was relatively steady, slipping 0.21 percent to 27,468.53. TSMC ended flat at 1,430 Taiwan dollars ($45.3), while MediaTek and Hon Hai Precision Industry (Foxconn) recorded modest declines. Mainland Chinese markets were mixed. The Shanghai Composite rose 0.16 percent to 3,876.37, while Hong Kong’s Hang Seng Index edged down 0.25 percent. Technology shares underperformed, with the Shenzhen Component falling 1.29 percent. Battery maker CATL dropped 2.98 percent and automaker BYD slid 1.76 percent. 2025-12-18 16:47:20 -

Asian markets subdued by Wall Street slide, BOJ rate anticipation SEOUL, December 18 (AJP) - Asian markets opened subdued on Thursday, taking cues from two key drivers — an overnight sell-off on Wall Street and anticipation ahead of the Bank of Japan’s rate decision. In New York, renewed concerns over an “AI bubble” resurfaced after a major financier reportedly withdrew from an Oracle-led AI data-center project. The gloom was partially offset by Micron Technology’s strong earnings and upbeat guidance, which sent its shares surging more than 7 percent in after-hours trading and provided modest relief to chip-heavy markets in South Korea and Taiwan. In Seoul, the benchmark KOSPI fell 1.3 percent to 4,004 as of 10:30 a.m., with institutional and foreign investors leading the sell-off. Foreigners offloaded a net 71.5 billion won ($48.5 million), while institutions sold 17 billion won. Retail investors stepped in to buy the dip, net purchasing 71.5 billion won. The Korean won weakened to 1,475.1 per U.S. dollar, down 3.4 won from the previous session. Market sentiment remained fragile after the currency briefly breached the 1,480 level a day earlier, prompting an emergency morning meeting among finance ministry, financial regulator and central bank officials. Samsung Electronics slipped 0.9 percent to 107,000 won, reflecting spillover concerns from the Oracle-related AI pullback. SK hynix, however, rose 1.8 percent to 560,000 won, buoyed by Micron’s strong results. The secondary battery sector came under heavy pressure. LG Energy Solution plunged 6 percent to 390,500 won following news of the termination of a battery supply contract with Ford Motor. SK Innovation, the largest shareholder of SK On, fell 3.3 percent to 107,000 won amid reports that its U.S. joint venture with Ford is being dissolved. Samsung SDI dropped 4.6 percent to 282,000 won, while materials producer EcoPro Materials slid 4 percent to 57,500 won. The tech-heavy KOSDAQ declined 0.5 percent to 905, with the psychologically important 900 level again under threat. Foreign selling of 45 billion won weighed on the index, particularly EcoPro-related stocks. EcoPro fell 3.2 percent to 100,000 won, while EcoPro BM sank 4.7 percent to 158,000 won. In contrast, recent market debutants remained resilient. Nara Space Technology jumped 14 percent to 30,800 won, extending its post-listing rally. Aimed Bio and Alteogen each edged up about 2 percent, with Alteogen supported by expectations surrounding its planned transfer to the KOSPI in 2026. Japan’s Nikkei 225 fell 0.75 percent to 49,145, tracking the tech-led decline in U.S. equities. Among major stocks, Toyota Motor edged up 0.24 percent to 3,357 yen ($21.6), while Honda Motor slid 1.7 percent to 1,556 yen. The divergence followed reports that U.S. safety regulators ordered a recall of about 70,000 units of Honda’s Acura ILX due to potential software defects, prompting some rotation into Toyota. Semiconductor shares in Tokyo faced what traders described as a “cold winter” sentiment. Advantest fell 3.15 percent, Tokyo Electron dropped 2.7 percent, and Ibiden declined 2 percent. Taiwan’s TAIEX posted a milder decline, slipping 0.3 percent to 27,448. TSMC edged down 0.35 percent to 1,425 Taiwan dollars ($45.1), while MediaTek rose 0.35 percent to 1,435 Taiwan dollars. Mainland China and Hong Kong markets also opened weaker. The Shanghai Composite fell a modest 0.25 percent, but tech-heavy indices underperformed, with the Shenzhen Component down 0.95 percent and the Hang Seng Index sliding 0.75 percent to 25,277. 2025-12-18 11:13:39

Asian markets subdued by Wall Street slide, BOJ rate anticipation SEOUL, December 18 (AJP) - Asian markets opened subdued on Thursday, taking cues from two key drivers — an overnight sell-off on Wall Street and anticipation ahead of the Bank of Japan’s rate decision. In New York, renewed concerns over an “AI bubble” resurfaced after a major financier reportedly withdrew from an Oracle-led AI data-center project. The gloom was partially offset by Micron Technology’s strong earnings and upbeat guidance, which sent its shares surging more than 7 percent in after-hours trading and provided modest relief to chip-heavy markets in South Korea and Taiwan. In Seoul, the benchmark KOSPI fell 1.3 percent to 4,004 as of 10:30 a.m., with institutional and foreign investors leading the sell-off. Foreigners offloaded a net 71.5 billion won ($48.5 million), while institutions sold 17 billion won. Retail investors stepped in to buy the dip, net purchasing 71.5 billion won. The Korean won weakened to 1,475.1 per U.S. dollar, down 3.4 won from the previous session. Market sentiment remained fragile after the currency briefly breached the 1,480 level a day earlier, prompting an emergency morning meeting among finance ministry, financial regulator and central bank officials. Samsung Electronics slipped 0.9 percent to 107,000 won, reflecting spillover concerns from the Oracle-related AI pullback. SK hynix, however, rose 1.8 percent to 560,000 won, buoyed by Micron’s strong results. The secondary battery sector came under heavy pressure. LG Energy Solution plunged 6 percent to 390,500 won following news of the termination of a battery supply contract with Ford Motor. SK Innovation, the largest shareholder of SK On, fell 3.3 percent to 107,000 won amid reports that its U.S. joint venture with Ford is being dissolved. Samsung SDI dropped 4.6 percent to 282,000 won, while materials producer EcoPro Materials slid 4 percent to 57,500 won. The tech-heavy KOSDAQ declined 0.5 percent to 905, with the psychologically important 900 level again under threat. Foreign selling of 45 billion won weighed on the index, particularly EcoPro-related stocks. EcoPro fell 3.2 percent to 100,000 won, while EcoPro BM sank 4.7 percent to 158,000 won. In contrast, recent market debutants remained resilient. Nara Space Technology jumped 14 percent to 30,800 won, extending its post-listing rally. Aimed Bio and Alteogen each edged up about 2 percent, with Alteogen supported by expectations surrounding its planned transfer to the KOSPI in 2026. Japan’s Nikkei 225 fell 0.75 percent to 49,145, tracking the tech-led decline in U.S. equities. Among major stocks, Toyota Motor edged up 0.24 percent to 3,357 yen ($21.6), while Honda Motor slid 1.7 percent to 1,556 yen. The divergence followed reports that U.S. safety regulators ordered a recall of about 70,000 units of Honda’s Acura ILX due to potential software defects, prompting some rotation into Toyota. Semiconductor shares in Tokyo faced what traders described as a “cold winter” sentiment. Advantest fell 3.15 percent, Tokyo Electron dropped 2.7 percent, and Ibiden declined 2 percent. Taiwan’s TAIEX posted a milder decline, slipping 0.3 percent to 27,448. TSMC edged down 0.35 percent to 1,425 Taiwan dollars ($45.1), while MediaTek rose 0.35 percent to 1,435 Taiwan dollars. Mainland China and Hong Kong markets also opened weaker. The Shanghai Composite fell a modest 0.25 percent, but tech-heavy indices underperformed, with the Shenzhen Component down 0.95 percent and the Hang Seng Index sliding 0.75 percent to 25,277. 2025-12-18 11:13:39 -

Asian markets mixed as investors weigh U.S. jobs data, await ECB and BOJ decisions SEOUL, December 17 (AJP) - Asian equity markets traded mixed in early Tuesday session, digesting overnight U.S. employment data while bracing for imminent rate decisions in Europe and Japan. In the United States, nonfarm payrolls rose more than expected, but the unemployment rate also came in higher than forecasts, adding uncertainty over the strength and trajectory of the U.S. economy. Investors are now focused on the European Central Bank’s policy decision on Thursday and the Bank of Japan’s meeting on Friday, where a rate hike is widely anticipated. South Korea’s currency remained fragile, with the won weakening 3 won to 1,477.6 per dollar as of 11 a.m. The KOSPI rebounded 0.65 percent to 4,025 as of 11 a.m., staging a technical recovery after plunging more than 2 percent in the previous session. Retail investors led the rebound with net purchases of 143.5 billion won ($97.2 million), joined by institutions buying 104.2 billion won. Foreign investors, however, continued to sell, unloading 253 billion won worth of shares. Samsung Electronics rose 2.14 percent to 105,000 won, while SK hynix gained 1.5 percent to 538,000 won. The market’s two largest stocks benefited from a technical rebound in AI-related semiconductor shares on Wall Street, including Broadcom. Investor attention is also building ahead of Micron Technology’s earnings release after the Nasdaq close on Tuesday. Micron is the world’s third-largest DRAM producer. Vehicle software-related stocks remained under pressure. Hyundai AutoEver slid 3.9 percent to 270,000 won following reports of Tesla’s progress in Robotaxi development. Hyundai Motor lagged the broader market rebound, rising just 0.2 percent to 286,000 won. Nuclear energy stocks showed mixed performance despite news of a 5.6 trillion won contract to supply a nuclear steam supply system for the Dukovany nuclear power plant in the Czech Republic. Korea Electric Power Corp., the project’s lead contractor, jumped 3.2 percent to 52,000 won. In contrast, equipment supplier Doosan Enerbility fell 2.2 percent to 75,600 won after being designated an “investment warning stock.” The tech-heavy KOSDAQ traded nearly flat, edging up 0.2 percent to 918. Despite a steady stream of new IPOs, their impact on lifting the overall index has remained limited. Nara Space Technology, a satellite manufacturer and data solutions provider, surged 164 percent from its IPO price of 16,500 won to 43,300 won on its debut. The sharp rise reflects growing investor interest in the private space industry. In Japan, the Nikkei 225 was little changed at 49,400. Semiconductor-related stocks tracked gains in U.S. peers, with Advantest rising 1.7 percent to 19,500 yen ($126.1) and Ibiden up 1.8 percent to 11,600 yen. Export-oriented stocks were largely subdued ahead of the BOJ’s expected rate hike. Toyota was flat at 3,330 yen, while Honda slipped 0.75 percent to 1,573 yen. Taiwan’s TAIEX climbed 0.56 percent to 27,691.5. TSMC rose 0.35 percent to 1,440 Taiwan dollars ($45.7), while MediaTek advanced 1.75 percent to 1,445. MediaTek has extended its rally this week on rising smartphone sales in China and positive benchmark reviews of its latest chipset. Chinese markets remained cautious. Indices tied to traditional industries hovered near previous closing levels, with the Shanghai Composite at 3,823 and Hong Kong’s Hang Seng at 25,245. The tech-heavy Shenzhen Component outperformed, rising 0.4 percent to 12,968. 2025-12-17 11:23:45

Asian markets mixed as investors weigh U.S. jobs data, await ECB and BOJ decisions SEOUL, December 17 (AJP) - Asian equity markets traded mixed in early Tuesday session, digesting overnight U.S. employment data while bracing for imminent rate decisions in Europe and Japan. In the United States, nonfarm payrolls rose more than expected, but the unemployment rate also came in higher than forecasts, adding uncertainty over the strength and trajectory of the U.S. economy. Investors are now focused on the European Central Bank’s policy decision on Thursday and the Bank of Japan’s meeting on Friday, where a rate hike is widely anticipated. South Korea’s currency remained fragile, with the won weakening 3 won to 1,477.6 per dollar as of 11 a.m. The KOSPI rebounded 0.65 percent to 4,025 as of 11 a.m., staging a technical recovery after plunging more than 2 percent in the previous session. Retail investors led the rebound with net purchases of 143.5 billion won ($97.2 million), joined by institutions buying 104.2 billion won. Foreign investors, however, continued to sell, unloading 253 billion won worth of shares. Samsung Electronics rose 2.14 percent to 105,000 won, while SK hynix gained 1.5 percent to 538,000 won. The market’s two largest stocks benefited from a technical rebound in AI-related semiconductor shares on Wall Street, including Broadcom. Investor attention is also building ahead of Micron Technology’s earnings release after the Nasdaq close on Tuesday. Micron is the world’s third-largest DRAM producer. Vehicle software-related stocks remained under pressure. Hyundai AutoEver slid 3.9 percent to 270,000 won following reports of Tesla’s progress in Robotaxi development. Hyundai Motor lagged the broader market rebound, rising just 0.2 percent to 286,000 won. Nuclear energy stocks showed mixed performance despite news of a 5.6 trillion won contract to supply a nuclear steam supply system for the Dukovany nuclear power plant in the Czech Republic. Korea Electric Power Corp., the project’s lead contractor, jumped 3.2 percent to 52,000 won. In contrast, equipment supplier Doosan Enerbility fell 2.2 percent to 75,600 won after being designated an “investment warning stock.” The tech-heavy KOSDAQ traded nearly flat, edging up 0.2 percent to 918. Despite a steady stream of new IPOs, their impact on lifting the overall index has remained limited. Nara Space Technology, a satellite manufacturer and data solutions provider, surged 164 percent from its IPO price of 16,500 won to 43,300 won on its debut. The sharp rise reflects growing investor interest in the private space industry. In Japan, the Nikkei 225 was little changed at 49,400. Semiconductor-related stocks tracked gains in U.S. peers, with Advantest rising 1.7 percent to 19,500 yen ($126.1) and Ibiden up 1.8 percent to 11,600 yen. Export-oriented stocks were largely subdued ahead of the BOJ’s expected rate hike. Toyota was flat at 3,330 yen, while Honda slipped 0.75 percent to 1,573 yen. Taiwan’s TAIEX climbed 0.56 percent to 27,691.5. TSMC rose 0.35 percent to 1,440 Taiwan dollars ($45.7), while MediaTek advanced 1.75 percent to 1,445. MediaTek has extended its rally this week on rising smartphone sales in China and positive benchmark reviews of its latest chipset. Chinese markets remained cautious. Indices tied to traditional industries hovered near previous closing levels, with the Shanghai Composite at 3,823 and Hong Kong’s Hang Seng at 25,245. The tech-heavy Shenzhen Component outperformed, rising 0.4 percent to 12,968. 2025-12-17 11:23:45 -

Member-heavy KOSDAQ limps as KOSPI flies on thin venture financing SEOUL, December 16 (AJP) - There is a Korean saying that the younger is better than the elder. That adage hardly applies to the KOSDAQ, which has struggled to outperform its bigger sibling, the KOSPI, even with a steady stream of government stimulus measures. The “younger brother” showed a brief revival in the final two months of the year as foreign investors returned. Overseas investors bought a net 128.7 billion won ($93 million) worth of KOSDAQ shares as of last week — a sharp reversal from the 1.4 trillion won in net selling recorded between January and November. Daily turnover averaged more than 1 trillion won, double the level seen in August. Even so, gains remained modest. The KOSDAQ rose 1.8 percent over the period, compared with a 4.3 percent increase in the KOSPI. Last month, the pattern briefly reversed, with the KOSDAQ gaining 1.4 percent while the KOSPI fell 4 percent. Longer-term charts tell a less flattering story. The KOSDAQ has been largely sidelined in Korea’s broader exit-strategy debate tied to the so-called “Korea discount.” As of Monday, the KOSDAQ was up 36.7 percent this year — respectable, but far behind the KOSPI’s 70.5 percent surge. The gap widens further over five years: the KOSDAQ has gained just 9 percent, versus a roughly 50 percent rise for the KOSPI. It is not that authorities have done little. In the latest policy push, the government is reportedly considering separating the KOSDAQ from the Korea Exchange (KRX) to establish it as an independent entity, modeled after the U.S. Nasdaq. Yet despite aggressive support measures, companies continue to leave the market. The KOSDAQ’s deeper problem is its failure to persuade successful firms to stay once they scale up. On Dec. 8, shareholders of Alteogen — the KOSDAQ’s largest biotech by market capitalization — approved a plan to move its listing to the KOSPI. Alteogen’s market value stands at around 25 trillion won, accounting for roughly 5 percent of the KOSDAQ’s total capitalization. It is far from the first high-profile departure. Naver voluntarily delisted from the KOSDAQ to move to the KOSPI in 2008, followed by Kakao in 2017 and Celltrion in 2018. Size matters As of Tuesday, 1,822 companies were listed on the KOSDAQ, nearly double the 958 firms on the KOSPI. Trading volume on the KOSDAQ is roughly three times higher, yet trading value tells a different story: KOSPI transactions totaled 16.3 trillion won, surpassing the KOSDAQ’s 13 trillion won. Park Soon-jae, chief executive of Alteogen, said the move is expected to “increase the stockholding ratio of institutional investors,” noting that both domestic and foreign institutions tend to favor KOSPI-listed firms. Confidence problem The Federation of Korean Industries (FKI) points to the high share of “marginal” or “zombie” companies — firms unable to cover even their interest expenses — as a core weakness. As of 2024, such companies accounted for 23.7 percent of KOSDAQ listings, more than double the roughly 10 percent share on the KOSPI. Still, new listings continue to appear almost daily this month, highlighting the lack of financing alternatives for startups and early-stage companies. A survey released last Friday by the Korea Venture Business Association (KOVA) found that 85 percent of unlisted venture firms planning an IPO hoped to list on the KOSDAQ rather than the KOSPI. Respondents agreed that fundamental structural reform is needed to revitalize the market. Many emphasized prioritizing the “technology special listing” system, under which technological capability and growth potential are the main criteria. While more than a third of KOSDAQ-listed firms already use the system, standards remain ambiguous, with marketability sometimes outweighing technological merit. Market discipline was another recurring theme. About 84 percent of surveyed companies said the KOSDAQ could only be revitalized by expelling insolvent firms, including zombie companies, arguing that financial soundness is as critical as technological strength in restoring investor confidence. “The KOSDAQ can only function as a proper securities market when its identity is clearly defined and its soundness is strengthened,” said Lee Jung-min, secretary-general of KOVA, adding that the government’s “KOSDAQ 1,000” goal would only be achievable with a clear, national-level roadmap. 2025-12-16 17:53:06

Member-heavy KOSDAQ limps as KOSPI flies on thin venture financing SEOUL, December 16 (AJP) - There is a Korean saying that the younger is better than the elder. That adage hardly applies to the KOSDAQ, which has struggled to outperform its bigger sibling, the KOSPI, even with a steady stream of government stimulus measures. The “younger brother” showed a brief revival in the final two months of the year as foreign investors returned. Overseas investors bought a net 128.7 billion won ($93 million) worth of KOSDAQ shares as of last week — a sharp reversal from the 1.4 trillion won in net selling recorded between January and November. Daily turnover averaged more than 1 trillion won, double the level seen in August. Even so, gains remained modest. The KOSDAQ rose 1.8 percent over the period, compared with a 4.3 percent increase in the KOSPI. Last month, the pattern briefly reversed, with the KOSDAQ gaining 1.4 percent while the KOSPI fell 4 percent. Longer-term charts tell a less flattering story. The KOSDAQ has been largely sidelined in Korea’s broader exit-strategy debate tied to the so-called “Korea discount.” As of Monday, the KOSDAQ was up 36.7 percent this year — respectable, but far behind the KOSPI’s 70.5 percent surge. The gap widens further over five years: the KOSDAQ has gained just 9 percent, versus a roughly 50 percent rise for the KOSPI. It is not that authorities have done little. In the latest policy push, the government is reportedly considering separating the KOSDAQ from the Korea Exchange (KRX) to establish it as an independent entity, modeled after the U.S. Nasdaq. Yet despite aggressive support measures, companies continue to leave the market. The KOSDAQ’s deeper problem is its failure to persuade successful firms to stay once they scale up. On Dec. 8, shareholders of Alteogen — the KOSDAQ’s largest biotech by market capitalization — approved a plan to move its listing to the KOSPI. Alteogen’s market value stands at around 25 trillion won, accounting for roughly 5 percent of the KOSDAQ’s total capitalization. It is far from the first high-profile departure. Naver voluntarily delisted from the KOSDAQ to move to the KOSPI in 2008, followed by Kakao in 2017 and Celltrion in 2018. Size matters As of Tuesday, 1,822 companies were listed on the KOSDAQ, nearly double the 958 firms on the KOSPI. Trading volume on the KOSDAQ is roughly three times higher, yet trading value tells a different story: KOSPI transactions totaled 16.3 trillion won, surpassing the KOSDAQ’s 13 trillion won. Park Soon-jae, chief executive of Alteogen, said the move is expected to “increase the stockholding ratio of institutional investors,” noting that both domestic and foreign institutions tend to favor KOSPI-listed firms. Confidence problem The Federation of Korean Industries (FKI) points to the high share of “marginal” or “zombie” companies — firms unable to cover even their interest expenses — as a core weakness. As of 2024, such companies accounted for 23.7 percent of KOSDAQ listings, more than double the roughly 10 percent share on the KOSPI. Still, new listings continue to appear almost daily this month, highlighting the lack of financing alternatives for startups and early-stage companies. A survey released last Friday by the Korea Venture Business Association (KOVA) found that 85 percent of unlisted venture firms planning an IPO hoped to list on the KOSDAQ rather than the KOSPI. Respondents agreed that fundamental structural reform is needed to revitalize the market. Many emphasized prioritizing the “technology special listing” system, under which technological capability and growth potential are the main criteria. While more than a third of KOSDAQ-listed firms already use the system, standards remain ambiguous, with marketability sometimes outweighing technological merit. Market discipline was another recurring theme. About 84 percent of surveyed companies said the KOSDAQ could only be revitalized by expelling insolvent firms, including zombie companies, arguing that financial soundness is as critical as technological strength in restoring investor confidence. “The KOSDAQ can only function as a proper securities market when its identity is clearly defined and its soundness is strengthened,” said Lee Jung-min, secretary-general of KOVA, adding that the government’s “KOSDAQ 1,000” goal would only be achievable with a clear, national-level roadmap. 2025-12-16 17:53:06 -

South Korea leads Asian market losses ahead of BOJ, ECB meetings SEOUL, December 16 (AJP) - Asian stock markets closed lower on Tuesday as skepticism over artificial intelligence valuations spread from Wall Street and investors braced for key interest rate decisions from the Bank of Japan (BOJ) and the European Central Bank (ECB). South Korean equities posted the steepest losses in the region. The benchmark KOSPI index tumbled 2.24 percent to 3,999.13, while the tech-heavy KOSDAQ fell 2.42 percent to 916.11. Foreign investors were net sellers of 1.4 trillion won ($95 million) across the two markets. The Korean won strengthened for a second session, ending at 1,475.4 per dollar, up 4.6 won from the previous close. Government bond yields edged lower, with the three-year yield down 0.1 basis point to 2.999 percent and the 10-year yield falling 1.2 basis points to 3.313 percent. Losses were broad-based across large-cap stocks. Samsung Electronics, which had recently drawn buying interest ahead of its year-end dividend, fell 1.91 percent to 102,800 won. Chipmaker SK hynix dropped 4.33 percent to 530,000 won, marking one of its worst weekly performances this year. Shares in Hyundai Motor Group companies also declined. Hyundai Engineering & Construction slid 4.92 percent to 69,500 won following negative news related to business partners. Hyundai Motor fell 2.56 percent to 286,000 won, weighed down by concerns over its autonomous driving competitiveness and the fallout from its affiliate. Secondary battery-related stocks led the selloff after reports that SK On and Ford plan to dissolve their joint venture, BlueOval SK, amid a slowdown in electric vehicle demand. LG Energy Solution plunged 5.54 percent to 418,000 won, while Samsung SDI lost 3.14 percent to 293,500 won. Cathode material maker Posco Future M tumbled 7.49 percent to 210,000 won, and SK Innovation fell 2.75 percent to 109,800 won. Biotechnology stocks provided rare pockets of strength on expectations that earnings may exceed forecasts. Samsung Biologics rose 1.02 percent to 1,790,000 won, while Samsung Episholding added 0.42 percent to 712,000 won. In the KOSDAQ market, battery-related names were again among the biggest laggards, with EcoPro sliding 8.08 percent to 101,300 won. Robot-related stocks also weakened, as Rainbow Robotics fell 3.87 percent to 460,000 won. Biotech firm Aimed Bio gained 2.7 percent to 72,400 won. Elsewhere in Asia, Japan’s Nikkei 225 fell 1.56 percent to 49,383.29. Battery and robotics stocks underperformed, with Panasonic Holdings down 4.67 percent to 2,054 yen ($13.26) and Fanuc sliding 6.04 percent to 5,708 yen. Taiwan’s TAIEX dropped 1.19 percent to 27,536.66. Chip heavyweight TSMC declined 1.03 percent to 1,435 Taiwan dollars ($45.59), while Hon Hai Precision Industry (Foxconn) fell 1.58 percent to 218 Taiwan dollars. MediaTek closed flat, helping limit broader losses. Mainland Chinese shares also ended lower. The Shanghai Composite Index fell 1.11 percent to 3,824.81, with investors wary of a potential unwind in yen carry trades ahead of the BOJ’s policy announcement later this month. The Shenzhen Component dropped 1.51 percent to 12,914.67, while Hong Kong’s Hang Seng Index was down 1.7 percent at 25,195 as of late afternoon. 2025-12-16 17:02:39

South Korea leads Asian market losses ahead of BOJ, ECB meetings SEOUL, December 16 (AJP) - Asian stock markets closed lower on Tuesday as skepticism over artificial intelligence valuations spread from Wall Street and investors braced for key interest rate decisions from the Bank of Japan (BOJ) and the European Central Bank (ECB). South Korean equities posted the steepest losses in the region. The benchmark KOSPI index tumbled 2.24 percent to 3,999.13, while the tech-heavy KOSDAQ fell 2.42 percent to 916.11. Foreign investors were net sellers of 1.4 trillion won ($95 million) across the two markets. The Korean won strengthened for a second session, ending at 1,475.4 per dollar, up 4.6 won from the previous close. Government bond yields edged lower, with the three-year yield down 0.1 basis point to 2.999 percent and the 10-year yield falling 1.2 basis points to 3.313 percent. Losses were broad-based across large-cap stocks. Samsung Electronics, which had recently drawn buying interest ahead of its year-end dividend, fell 1.91 percent to 102,800 won. Chipmaker SK hynix dropped 4.33 percent to 530,000 won, marking one of its worst weekly performances this year. Shares in Hyundai Motor Group companies also declined. Hyundai Engineering & Construction slid 4.92 percent to 69,500 won following negative news related to business partners. Hyundai Motor fell 2.56 percent to 286,000 won, weighed down by concerns over its autonomous driving competitiveness and the fallout from its affiliate. Secondary battery-related stocks led the selloff after reports that SK On and Ford plan to dissolve their joint venture, BlueOval SK, amid a slowdown in electric vehicle demand. LG Energy Solution plunged 5.54 percent to 418,000 won, while Samsung SDI lost 3.14 percent to 293,500 won. Cathode material maker Posco Future M tumbled 7.49 percent to 210,000 won, and SK Innovation fell 2.75 percent to 109,800 won. Biotechnology stocks provided rare pockets of strength on expectations that earnings may exceed forecasts. Samsung Biologics rose 1.02 percent to 1,790,000 won, while Samsung Episholding added 0.42 percent to 712,000 won. In the KOSDAQ market, battery-related names were again among the biggest laggards, with EcoPro sliding 8.08 percent to 101,300 won. Robot-related stocks also weakened, as Rainbow Robotics fell 3.87 percent to 460,000 won. Biotech firm Aimed Bio gained 2.7 percent to 72,400 won. Elsewhere in Asia, Japan’s Nikkei 225 fell 1.56 percent to 49,383.29. Battery and robotics stocks underperformed, with Panasonic Holdings down 4.67 percent to 2,054 yen ($13.26) and Fanuc sliding 6.04 percent to 5,708 yen. Taiwan’s TAIEX dropped 1.19 percent to 27,536.66. Chip heavyweight TSMC declined 1.03 percent to 1,435 Taiwan dollars ($45.59), while Hon Hai Precision Industry (Foxconn) fell 1.58 percent to 218 Taiwan dollars. MediaTek closed flat, helping limit broader losses. Mainland Chinese shares also ended lower. The Shanghai Composite Index fell 1.11 percent to 3,824.81, with investors wary of a potential unwind in yen carry trades ahead of the BOJ’s policy announcement later this month. The Shenzhen Component dropped 1.51 percent to 12,914.67, while Hong Kong’s Hang Seng Index was down 1.7 percent at 25,195 as of late afternoon. 2025-12-16 17:02:39