Journalist

Seo Min-ji

-

South Korea posts record $123 billion current account surplus in 2025 SEOUL, February 06 (AJP) - South Korea’s current account surplus reached a record high last year, supported by robust semiconductor exports and rising dividend income from overseas investments, according to central bank data released on Friday. Preliminary balance-of-payments figures from the Bank of Korea showed the country recorded a $18.7 billion current account surplus in December, the largest monthly surplus on record. The surplus marked the 32nd consecutive month in positive territory and was sharply higher than November’s $12.9 billion and the $12.74 billion recorded in December a year earlier. For the full year, the current account surplus totaled $123 billion, exceeding the previous record of $105.1 billion set in 2015 and surpassing the bank’s November forecast of $115 billion. The goods account surplus widened to a record $18.85 billion in December from $14.7 billion in November. Exports rose 13.1 percent year-on-year to $71.65 billion, driven by strong shipments of semiconductors and communications devices. Non-IT items such as machinery, precision instruments and pharmaceuticals also posted gains for a second consecutive month. By destination, exports increased to Southeast Asia by 27.9 percent, to China by 10.1 percent and to the United States by 3.7 percent, while shipments to Japan dropped 7 percent. Imports rose 1.7 percent from a year earlier to $52.8 billion. Raw material imports continued to fall, down 1 percent, reflecting lower energy prices, while consumer goods imports jumped 17.9 percent, led by passenger cars and gold, marking a second straight monthly increase. The services account recorded a $3.69 billion deficit in December, widening from November’s $2.85 billion deficit and from $2.38 billion a year earlier. The travel account deficit expanded to $1.4 billion. * This article, published by Aju Business Daily, was translated by AI and edited by AJP. 2026-02-06 08:18:47

South Korea posts record $123 billion current account surplus in 2025 SEOUL, February 06 (AJP) - South Korea’s current account surplus reached a record high last year, supported by robust semiconductor exports and rising dividend income from overseas investments, according to central bank data released on Friday. Preliminary balance-of-payments figures from the Bank of Korea showed the country recorded a $18.7 billion current account surplus in December, the largest monthly surplus on record. The surplus marked the 32nd consecutive month in positive territory and was sharply higher than November’s $12.9 billion and the $12.74 billion recorded in December a year earlier. For the full year, the current account surplus totaled $123 billion, exceeding the previous record of $105.1 billion set in 2015 and surpassing the bank’s November forecast of $115 billion. The goods account surplus widened to a record $18.85 billion in December from $14.7 billion in November. Exports rose 13.1 percent year-on-year to $71.65 billion, driven by strong shipments of semiconductors and communications devices. Non-IT items such as machinery, precision instruments and pharmaceuticals also posted gains for a second consecutive month. By destination, exports increased to Southeast Asia by 27.9 percent, to China by 10.1 percent and to the United States by 3.7 percent, while shipments to Japan dropped 7 percent. Imports rose 1.7 percent from a year earlier to $52.8 billion. Raw material imports continued to fall, down 1 percent, reflecting lower energy prices, while consumer goods imports jumped 17.9 percent, led by passenger cars and gold, marking a second straight monthly increase. The services account recorded a $3.69 billion deficit in December, widening from November’s $2.85 billion deficit and from $2.38 billion a year earlier. The travel account deficit expanded to $1.4 billion. * This article, published by Aju Business Daily, was translated by AI and edited by AJP. 2026-02-06 08:18:47 -

Overseas stock buying drives record FX trading in South Korea in 2025 SEOUL, January 23 (AJP) - South Korean banks recorded a sharp rise in foreign exchange trading last year, with average daily volumes hitting a record high as overseas securities investment by residents surged and foreign investors stepped up purchases of South Korean assets. According to a Bank of Korea report released on Friday, average daily foreign exchange trading at domestic banks — including spot and derivatives transactions — totaled $80.71 billion in 2025, up 17 percent from $68.96 billion a year earlier. It marked the highest level since the data series was revised in 2008. The said the increase reflected the continued impact of extended foreign exchange trading hours, as well as a sharp rise in transactions linked to cross-border securities investment by both South Koreans and foreign investors. On a balance-of-payments basis, South Korean residents' overseas securities investment rose 79.2 percent year on year, from $72.2 billion in 2024 to $129.4 billion in the January–November period of last year. Over the same period, foreign investors’ purchases of South Korean securities jumped 129.1 percent, from $22 billion to $50.4 billion. By institution, foreign exchange trading by domestic banks increased 21.2 percent to an average of $37.54 billion per day, while trading by branches of foreign banks rose 13.6 percent to $43.17 billion. * This article, published by Aju Business Daily, was translated by AI and edited by AJP. 2026-01-23 15:32:18

Overseas stock buying drives record FX trading in South Korea in 2025 SEOUL, January 23 (AJP) - South Korean banks recorded a sharp rise in foreign exchange trading last year, with average daily volumes hitting a record high as overseas securities investment by residents surged and foreign investors stepped up purchases of South Korean assets. According to a Bank of Korea report released on Friday, average daily foreign exchange trading at domestic banks — including spot and derivatives transactions — totaled $80.71 billion in 2025, up 17 percent from $68.96 billion a year earlier. It marked the highest level since the data series was revised in 2008. The said the increase reflected the continued impact of extended foreign exchange trading hours, as well as a sharp rise in transactions linked to cross-border securities investment by both South Koreans and foreign investors. On a balance-of-payments basis, South Korean residents' overseas securities investment rose 79.2 percent year on year, from $72.2 billion in 2024 to $129.4 billion in the January–November period of last year. Over the same period, foreign investors’ purchases of South Korean securities jumped 129.1 percent, from $22 billion to $50.4 billion. By institution, foreign exchange trading by domestic banks increased 21.2 percent to an average of $37.54 billion per day, while trading by branches of foreign banks rose 13.6 percent to $43.17 billion. * This article, published by Aju Business Daily, was translated by AI and edited by AJP. 2026-01-23 15:32:18 -

South Korea's 2025 growth slows to 1% as GDP contracts in 4Q SEOUL, January 22 (AJP) - South Korea’s economy expanded 1 percent last year, slowing sharply from the previous year as weak domestic demand, particularly in construction and investment, weighed on growth, according to central bank data released on Wednesday. The pace was about half of the 2 percent growth recorded a year earlier and fell well below the country’s estimated potential growth rate of 1.8 percent. Preliminary data from the Bank of Korea showed real gross domestic product contracted 0.3 percent in the fourth quarter of 2025 from the previous quarter. The result was 0.5 percentage points below the bank’s forecast of 0.2 percent growth and marked the weakest quarterly performance since the fourth quarter of 2022, when the economy shrank 0.4 percent. Quarterly growth has been volatile over the past two years. GDP expanded 1.2 percent in the first quarter of 2024, before slipping to a contraction of 0.2 percent in the second quarter, followed by modest growth of 0.1 percent in both the third and fourth quarters. Growth turned negative again in the first quarter of last year, falling 0.2 percent, then rebounded to 0.7 percent in the second quarter and 1.3 percent in the third, before returning to contraction in the final quarter. In the fourth quarter, private consumption rose 0.3 percent from the previous quarter, supported by services such as medical care, although spending on goods including passenger cars declined. Government consumption increased 0.6 percent, driven mainly by higher national health insurance benefits. Investment remained a drag on growth. Construction investment fell 3.9 percent as both building and civil engineering activity weakened, while facility investment declined 1.8 percent, led by lower spending on transport equipment such as automobiles. Exports dropped 2.1 percent, reflecting weaker shipments of automobiles, machinery and equipment. Imports fell 1.7 percent, largely due to declines in natural gas and automobile purchases. By industry, manufacturing output fell 1.5 percent, weighed down by transport equipment and machinery and equipment. Output in electricity, gas and water utilities plunged 9.2 percent, mainly due to lower electricity production, while construction activity contracted 5 percent. Agriculture, forestry and fisheries rose 4.6 percent, and services expanded 0.6 percent. Real gross domestic income increased 0.8 percent in the fourth quarter, outpacing the 0.3 percent contraction in real GDP. * This article, published by Aju Business Daily, was translated by AI and edited by AJP. 2026-01-22 08:45:58

South Korea's 2025 growth slows to 1% as GDP contracts in 4Q SEOUL, January 22 (AJP) - South Korea’s economy expanded 1 percent last year, slowing sharply from the previous year as weak domestic demand, particularly in construction and investment, weighed on growth, according to central bank data released on Wednesday. The pace was about half of the 2 percent growth recorded a year earlier and fell well below the country’s estimated potential growth rate of 1.8 percent. Preliminary data from the Bank of Korea showed real gross domestic product contracted 0.3 percent in the fourth quarter of 2025 from the previous quarter. The result was 0.5 percentage points below the bank’s forecast of 0.2 percent growth and marked the weakest quarterly performance since the fourth quarter of 2022, when the economy shrank 0.4 percent. Quarterly growth has been volatile over the past two years. GDP expanded 1.2 percent in the first quarter of 2024, before slipping to a contraction of 0.2 percent in the second quarter, followed by modest growth of 0.1 percent in both the third and fourth quarters. Growth turned negative again in the first quarter of last year, falling 0.2 percent, then rebounded to 0.7 percent in the second quarter and 1.3 percent in the third, before returning to contraction in the final quarter. In the fourth quarter, private consumption rose 0.3 percent from the previous quarter, supported by services such as medical care, although spending on goods including passenger cars declined. Government consumption increased 0.6 percent, driven mainly by higher national health insurance benefits. Investment remained a drag on growth. Construction investment fell 3.9 percent as both building and civil engineering activity weakened, while facility investment declined 1.8 percent, led by lower spending on transport equipment such as automobiles. Exports dropped 2.1 percent, reflecting weaker shipments of automobiles, machinery and equipment. Imports fell 1.7 percent, largely due to declines in natural gas and automobile purchases. By industry, manufacturing output fell 1.5 percent, weighed down by transport equipment and machinery and equipment. Output in electricity, gas and water utilities plunged 9.2 percent, mainly due to lower electricity production, while construction activity contracted 5 percent. Agriculture, forestry and fisheries rose 4.6 percent, and services expanded 0.6 percent. Real gross domestic income increased 0.8 percent in the fourth quarter, outpacing the 0.3 percent contraction in real GDP. * This article, published by Aju Business Daily, was translated by AI and edited by AJP. 2026-01-22 08:45:58 -

Korea's growth reliant on IT sector as inflation risks linger: BOK chief SEOUL, January 02 (AJP) - South Korea’s economy would grow just 1.4 percent this year if the information technology sector were excluded, the country’s central bank chief said Friday, warning that uneven recovery across industries could leave households feeling worse off than headline growth figures suggest. Bank of Korea Governor Rhee Chang-yong said in a New Year’s message that overall economic growth is projected at 1.8 percent this year, up from 1 percent last year and close to the economy’s potential growth rate. However, he cautioned that uncertainty remains high on both the upside and downside. Rhee said the outlook will hinge on factors including the global trade environment, the semiconductor cycle and the strength of the recovery in domestic demand. Describing the current rebound as “hardly sustainable or complete,” Rhee urged continued structural transformation to prevent economic expansion from becoming repeatedly concentrated in a single sector. He stressed the need to foster new industries to broaden the growth base. The governor also highlighted lingering uncertainty over an investment agreement with the United States, saying it is difficult to conclude the issue has been fully resolved as details on investment targets and implementation methods still require coordination. Addressing concerns that annual investment flows of about $20 billion to the United States could weaken the Korean won, Rhee said the funds would not flow out in a fixed or mechanical manner each year. He added that the BOK, together with the government, would not agree to any arrangement that undermines stability in the foreign-exchange market. On inflation, which has recently risen to the low-to-mid 2 percent range, Rhee warned that persistent weakness in the won could reignite inflationary pressure. He noted that cumulative price increases since the pandemic have significantly raised living costs, disproportionately burdening lower-income households. Rhee said stabilizing inflation cannot be achieved through monetary policy alone. He called for parallel structural reforms aimed at lowering overall price levels, including improving distribution systems and expanding import liberalization for goods that remain expensive by international standards. 2026-01-02 10:39:12

Korea's growth reliant on IT sector as inflation risks linger: BOK chief SEOUL, January 02 (AJP) - South Korea’s economy would grow just 1.4 percent this year if the information technology sector were excluded, the country’s central bank chief said Friday, warning that uneven recovery across industries could leave households feeling worse off than headline growth figures suggest. Bank of Korea Governor Rhee Chang-yong said in a New Year’s message that overall economic growth is projected at 1.8 percent this year, up from 1 percent last year and close to the economy’s potential growth rate. However, he cautioned that uncertainty remains high on both the upside and downside. Rhee said the outlook will hinge on factors including the global trade environment, the semiconductor cycle and the strength of the recovery in domestic demand. Describing the current rebound as “hardly sustainable or complete,” Rhee urged continued structural transformation to prevent economic expansion from becoming repeatedly concentrated in a single sector. He stressed the need to foster new industries to broaden the growth base. The governor also highlighted lingering uncertainty over an investment agreement with the United States, saying it is difficult to conclude the issue has been fully resolved as details on investment targets and implementation methods still require coordination. Addressing concerns that annual investment flows of about $20 billion to the United States could weaken the Korean won, Rhee said the funds would not flow out in a fixed or mechanical manner each year. He added that the BOK, together with the government, would not agree to any arrangement that undermines stability in the foreign-exchange market. On inflation, which has recently risen to the low-to-mid 2 percent range, Rhee warned that persistent weakness in the won could reignite inflationary pressure. He noted that cumulative price increases since the pandemic have significantly raised living costs, disproportionately burdening lower-income households. Rhee said stabilizing inflation cannot be achieved through monetary policy alone. He called for parallel structural reforms aimed at lowering overall price levels, including improving distribution systems and expanding import liberalization for goods that remain expensive by international standards. 2026-01-02 10:39:12 -

Trading in dollar-pegged stablecoins surges as won weakens SEOUL, December 29 (AJP) - As the Korean won weakens against the greenback, trading in dollar-pegged stablecoins has surged, with volumes growing 2.4-fold over the past three months. Rising demand for dollars for overseas investment has boosted trading in stablecoins that can serve as a dollar substitute. According to data from the Bank of Korea, stablecoin trading rebounded sharply after hitting a low in June. Monthly trading value for dollar stablecoins (USDT, USDC and USDS) across South Korea's five major crypto exchanges - Upbit, Bithumb, Coinone, Korbit and Gopax - fell to 7.1 trillion won in June, the lowest since September 2024 (5.2 trillion won). But volumes then surged to 11.3 trillion won in July, 12.1 trillion won in August and 16.9 trillion won in September. September's trading volume was the highest since February (24.6 trillion won), though it remained well below December of last year (31.7 trillion won), when the broader crypto market surged on expectations for U.S. President Donald Trump's second term. Average daily trading showed a similar trend, falling to 238 billion won in June, the lowest since September 2024 (174.3 billion won) before climbing to 363.2 billion won in July, 391.1 billion won in August and 563.2 billion won in September. The BOK's latest figures do not include October, but trading that month is estimated to have risen further. Upbit's own tally showed October trading volume for USDT, a leading stablecoin, at about 6.9 billion tokens, up more than 30 percent from September's roughly 5.2 billion. The rebound has been attributed to the weakening won, which depreciated sharply against the dollar, from 1,366.95 in June to 1,423.36 in October. A crypto market insider said investors expecting further gains in exchange rates may have bought stablecoins to acquire dollars, boosting trading volumes. The broader crypto market rally, with bitcoin hitting an all-time high in October, also likely contributed as well. Meanwhile, discussions on introducing won-denominated stablecoins are likely to be delayed until next year, as related legislation remains pending at the National Assembly. The main focus of the debate is whether they should be limited to banks or extended to nonbank institutions such as fintech firms. 2025-12-29 09:52:06

Trading in dollar-pegged stablecoins surges as won weakens SEOUL, December 29 (AJP) - As the Korean won weakens against the greenback, trading in dollar-pegged stablecoins has surged, with volumes growing 2.4-fold over the past three months. Rising demand for dollars for overseas investment has boosted trading in stablecoins that can serve as a dollar substitute. According to data from the Bank of Korea, stablecoin trading rebounded sharply after hitting a low in June. Monthly trading value for dollar stablecoins (USDT, USDC and USDS) across South Korea's five major crypto exchanges - Upbit, Bithumb, Coinone, Korbit and Gopax - fell to 7.1 trillion won in June, the lowest since September 2024 (5.2 trillion won). But volumes then surged to 11.3 trillion won in July, 12.1 trillion won in August and 16.9 trillion won in September. September's trading volume was the highest since February (24.6 trillion won), though it remained well below December of last year (31.7 trillion won), when the broader crypto market surged on expectations for U.S. President Donald Trump's second term. Average daily trading showed a similar trend, falling to 238 billion won in June, the lowest since September 2024 (174.3 billion won) before climbing to 363.2 billion won in July, 391.1 billion won in August and 563.2 billion won in September. The BOK's latest figures do not include October, but trading that month is estimated to have risen further. Upbit's own tally showed October trading volume for USDT, a leading stablecoin, at about 6.9 billion tokens, up more than 30 percent from September's roughly 5.2 billion. The rebound has been attributed to the weakening won, which depreciated sharply against the dollar, from 1,366.95 in June to 1,423.36 in October. A crypto market insider said investors expecting further gains in exchange rates may have bought stablecoins to acquire dollars, boosting trading volumes. The broader crypto market rally, with bitcoin hitting an all-time high in October, also likely contributed as well. Meanwhile, discussions on introducing won-denominated stablecoins are likely to be delayed until next year, as related legislation remains pending at the National Assembly. The main focus of the debate is whether they should be limited to banks or extended to nonbank institutions such as fintech firms. 2025-12-29 09:52:06 -

Bank of Korea flags growing investor preference for overseas stocks SEOUL, December 23 (AJP) - South Korean retail investors have been taking profits when local share prices rise while continuing to buy overseas stocks, a shift the central bank linked to differences in long-term return expectations. In its Financial Stability Report released on Tuesday, the Bank of Korea (BOK) said that from July to October — when both South Korean and U.S. equity markets were rising — individual investors were net sellers of 23 trillion won in domestic stocks and net buyers of $10.3 billion, or about 15.28 trillion won, in overseas shares. The central bank said retail investment in domestic and overseas stocks previously tended to move in tandem, but since 2020 the relationship has increasingly become one of substitution, with buying in one market accompanied by selling in the other. During 2020–2021, when overseas stock investment surged, individual investors also made large net purchases of South Korean shares, seeking diversification benefits. More recently, however, the bank said the tendency has strengthened, with overseas stock purchases increasingly accompanied by sales of domestic shares. The report said that when short-term returns rise both at home and abroad, retail investors often lock in gains in South Korean stocks while chasing overseas investments. This pattern became more pronounced in September and October, when the KOSPI outperformed the U.S. S&P 500, rising 28.9 percent compared with 5.9 percent. The BOK said the growing substitution reflects low expectations for long-term returns in South Korea’s stock market. “Because the long-term return gap between the South Korean and U.S. markets has fixed investors’ expectations at low for South Korea and high for the United States, a pattern has emerged of selling domestic stocks and buying overseas stocks when short-term returns rise,” the bank said in the report. It added expectations of foreign-exchange gains amid a recent rise in the won-dollar rate appeared to reinforce the preference for overseas stocks. The bank said that because the return-expectation gap has formed over a long period, temporary improvements in returns are unlikely to alter investor behavior. The bank called for policy efforts such as improving corporate governance and expanding shareholder returns to strengthen the long-term performance and stability of South Korea’s capital markets. Jang Yong-seong, a member of the bank’s Monetary Policy Board who led the report, said easier financial conditions have boosted risk-taking and pushed asset prices up rapidly, warning that vulnerabilities could increase if a shock triggers a sharp market adjustment. 2025-12-23 13:58:02

Bank of Korea flags growing investor preference for overseas stocks SEOUL, December 23 (AJP) - South Korean retail investors have been taking profits when local share prices rise while continuing to buy overseas stocks, a shift the central bank linked to differences in long-term return expectations. In its Financial Stability Report released on Tuesday, the Bank of Korea (BOK) said that from July to October — when both South Korean and U.S. equity markets were rising — individual investors were net sellers of 23 trillion won in domestic stocks and net buyers of $10.3 billion, or about 15.28 trillion won, in overseas shares. The central bank said retail investment in domestic and overseas stocks previously tended to move in tandem, but since 2020 the relationship has increasingly become one of substitution, with buying in one market accompanied by selling in the other. During 2020–2021, when overseas stock investment surged, individual investors also made large net purchases of South Korean shares, seeking diversification benefits. More recently, however, the bank said the tendency has strengthened, with overseas stock purchases increasingly accompanied by sales of domestic shares. The report said that when short-term returns rise both at home and abroad, retail investors often lock in gains in South Korean stocks while chasing overseas investments. This pattern became more pronounced in September and October, when the KOSPI outperformed the U.S. S&P 500, rising 28.9 percent compared with 5.9 percent. The BOK said the growing substitution reflects low expectations for long-term returns in South Korea’s stock market. “Because the long-term return gap between the South Korean and U.S. markets has fixed investors’ expectations at low for South Korea and high for the United States, a pattern has emerged of selling domestic stocks and buying overseas stocks when short-term returns rise,” the bank said in the report. It added expectations of foreign-exchange gains amid a recent rise in the won-dollar rate appeared to reinforce the preference for overseas stocks. The bank said that because the return-expectation gap has formed over a long period, temporary improvements in returns are unlikely to alter investor behavior. The bank called for policy efforts such as improving corporate governance and expanding shareholder returns to strengthen the long-term performance and stability of South Korea’s capital markets. Jang Yong-seong, a member of the bank’s Monetary Policy Board who led the report, said easier financial conditions have boosted risk-taking and pushed asset prices up rapidly, warning that vulnerabilities could increase if a shock triggers a sharp market adjustment. 2025-12-23 13:58:02 -

INTERVIEW: Korea's weak won reflects structural dollar imbalance, not crisis conditions South Korea’s won has weakened past 1,470 per dollar, a level that evokes memories of past currency crises. But strong external fundamentals suggest the current situation differs sharply from previous episodes of financial turmoil, according to Jeon Kwang-woo, chairman of the World Economic Research Institute and a former head of the Financial Services Commission (FSC) and the National Pension Service (NPS). Despite record current account surpluses and a stock market rally that has pushed the KOSPI above 4,000 points, the won has remained under pressure for months. Foreign exchange authorities have stepped in through verbal intervention and coordination with the NPS on currency hedging, but the exchange rate has shown little sustained improvement. “The won's weakness is unlikely to reverse quickly,” Jeon said in an interview, attributing the situation primarily to a structural imbalance in dollar supply and demand rather than financial instability. Jeon said demand for dollars has surged as individuals, corporations, and institutional investors increase overseas investments, particularly in the United States following bilateral economic agreements. Bank of Korea data underscore the imbalance. In October, South Korea recorded a current account surplus of $6.81 billion, while overseas investment by South Koreans jumped $17.27 billion — more than two-and-a-half times the surplus. In contrast, foreign investment inflows into South Korea totaled $5.2 billion, less than one-third of the outflow. As a result, the won has weakened steadily for seven months, rising 7.6 percent against the dollar since June to reach around 1,470 in December. Jeon stressed that the current environment bears little resemblance to the 1997 Asian financial crisis or the 2008 global financial crisis. “Back then, instability was systemic,” he said. “Today, the pressure is concentrated in the foreign exchange market. Without resolving the underlying supply-demand structure, policy measures alone cannot change the trend.” Authorities recently extended a $65 billion currency swap arrangement with the National Pension Service as part of stabilization efforts. Still, the won opened at 1,469 per dollar and later weakened to as much as 1,477, highlighting the limits of intervention. While acknowledging the government’s efforts, Jeon said policymakers have limited control over the growing scale of overseas investment, which continues to fuel dollar demand. A “four-party consultative body” comprising the Ministry of Economy and Finance, the Ministry of Health and Welfare, the National Pension Service, and the Bank of Korea has been discussing measures to stabilize the exchange rate. The central bank has suggested strengthening the domestic stock market and encouraging pension funds to allocate more assets at home to curb capital outflows. Jeon, who was the longest-serving chairman in NPS history, strongly criticized efforts to enlist the pension fund as a policy tool. “The National Pension is the people’s asset,” he said. “It should not be mobilized for political or short-term policy objectives.” He argued that while exchange rate stability and a buoyant stock market are legitimate government goals, the overriding mandate of the pension fund must remain maximizing long-term returns for beneficiaries — citing Canada’s pension system as a model of institutional independence. Jeon did not entirely rule out a limited role for the NPS, noting that given the size and strong performance of its overseas portfolio, some dollar inflows could occur naturally as profits are realized. However, he emphasized that any such moves must be based on autonomous investment decisions, not government pressure. For longer-term solutions, Jeon called for structural reforms to raise South Korea’s potential growth rate. In the short term, he suggested temporary tax incentives, expanded currency swap lines by the Bank of Korea, and independently issued foreign-currency bonds by the NPS. He cautioned that short-term measures carry inherent risks. “Every quick fix has two sides,” Jeon said. “If policymakers move too fast, they risk unsettling the market. Preserving trust is ultimately the most important factor.” * This article, published by Aju Business Daily, was translated by AI and edited by AJP. 2025-12-17 08:46:39

INTERVIEW: Korea's weak won reflects structural dollar imbalance, not crisis conditions South Korea’s won has weakened past 1,470 per dollar, a level that evokes memories of past currency crises. But strong external fundamentals suggest the current situation differs sharply from previous episodes of financial turmoil, according to Jeon Kwang-woo, chairman of the World Economic Research Institute and a former head of the Financial Services Commission (FSC) and the National Pension Service (NPS). Despite record current account surpluses and a stock market rally that has pushed the KOSPI above 4,000 points, the won has remained under pressure for months. Foreign exchange authorities have stepped in through verbal intervention and coordination with the NPS on currency hedging, but the exchange rate has shown little sustained improvement. “The won's weakness is unlikely to reverse quickly,” Jeon said in an interview, attributing the situation primarily to a structural imbalance in dollar supply and demand rather than financial instability. Jeon said demand for dollars has surged as individuals, corporations, and institutional investors increase overseas investments, particularly in the United States following bilateral economic agreements. Bank of Korea data underscore the imbalance. In October, South Korea recorded a current account surplus of $6.81 billion, while overseas investment by South Koreans jumped $17.27 billion — more than two-and-a-half times the surplus. In contrast, foreign investment inflows into South Korea totaled $5.2 billion, less than one-third of the outflow. As a result, the won has weakened steadily for seven months, rising 7.6 percent against the dollar since June to reach around 1,470 in December. Jeon stressed that the current environment bears little resemblance to the 1997 Asian financial crisis or the 2008 global financial crisis. “Back then, instability was systemic,” he said. “Today, the pressure is concentrated in the foreign exchange market. Without resolving the underlying supply-demand structure, policy measures alone cannot change the trend.” Authorities recently extended a $65 billion currency swap arrangement with the National Pension Service as part of stabilization efforts. Still, the won opened at 1,469 per dollar and later weakened to as much as 1,477, highlighting the limits of intervention. While acknowledging the government’s efforts, Jeon said policymakers have limited control over the growing scale of overseas investment, which continues to fuel dollar demand. A “four-party consultative body” comprising the Ministry of Economy and Finance, the Ministry of Health and Welfare, the National Pension Service, and the Bank of Korea has been discussing measures to stabilize the exchange rate. The central bank has suggested strengthening the domestic stock market and encouraging pension funds to allocate more assets at home to curb capital outflows. Jeon, who was the longest-serving chairman in NPS history, strongly criticized efforts to enlist the pension fund as a policy tool. “The National Pension is the people’s asset,” he said. “It should not be mobilized for political or short-term policy objectives.” He argued that while exchange rate stability and a buoyant stock market are legitimate government goals, the overriding mandate of the pension fund must remain maximizing long-term returns for beneficiaries — citing Canada’s pension system as a model of institutional independence. Jeon did not entirely rule out a limited role for the NPS, noting that given the size and strong performance of its overseas portfolio, some dollar inflows could occur naturally as profits are realized. However, he emphasized that any such moves must be based on autonomous investment decisions, not government pressure. For longer-term solutions, Jeon called for structural reforms to raise South Korea’s potential growth rate. In the short term, he suggested temporary tax incentives, expanded currency swap lines by the Bank of Korea, and independently issued foreign-currency bonds by the NPS. He cautioned that short-term measures carry inherent risks. “Every quick fix has two sides,” Jeon said. “If policymakers move too fast, they risk unsettling the market. Preserving trust is ultimately the most important factor.” * This article, published by Aju Business Daily, was translated by AI and edited by AJP. 2025-12-17 08:46:39 -

Bank of Korea likely to extend rate freeze despite Fed rate cut SEOUL, December 11 (AJP) - The U.S. Federal Reserve’s third consecutive interest-rate cut is expected to have little immediate impact on South Korea’s monetary stance, with the Bank of Korea likely to keep its policy rate unchanged amid persistent won volatility, elevated housing prices and uncertainty over the U.S. policy path, industry sources said Thursday. The Fed lowered its benchmark range to 3.50–3.75 percent at its Wednesday meeting. Its latest dot plot left the year-end projection unchanged at 3.4 percent, implying only one additional 25-basis-point cut next year. Chair Jerome Powell signaled a more cautious easing trajectory, saying the policy rate is now within a “neutral range.” The Fed has cut rates by 25 basis points in each of September, October and December, shrinking the U.S.–Korea rate differential to 1.25 percentage points. The narrower gap has eased pressure on capital outflows and the won-dollar exchange rate, though foreign-exchange volatility remains significant. The won hit 1,477.1 per dollar on Nov. 24 — the weakest level since April — and has since shown unstable movements. Bank of Korea official Kim Jong-hwa said about 70 percent of recent exchange-rate upward pressure stems from dollar demand related to outbound investments rather than interest-rate differentials alone. BOK Governor Lee Chang-yong has stressed the won’s depreciation is partly driven by increased foreign stock purchases. With the weak currency pushing up import prices and inflation rising to 2.4 percent last month, analysts say the central bank may prefer to maintain its rate at the Jan. 15 policy meeting. Housing market conditions remain another key concern. While prices in the broader Seoul metropolitan area appear to be stabilizing, a Bank of Korea official said certain districts still show declines that warrant continued monitoring. Deputy Governor Park Jong-woo said external risks — including expectations of rate hikes in Japan and ongoing U.S.–China trade tensions — call for a cautious policy stance. “We will closely monitor market conditions and adjust as needed,” he said. * This article, published by Aju Business Daily, was translated by AI and edited by AJP. 2025-12-11 14:45:24

Bank of Korea likely to extend rate freeze despite Fed rate cut SEOUL, December 11 (AJP) - The U.S. Federal Reserve’s third consecutive interest-rate cut is expected to have little immediate impact on South Korea’s monetary stance, with the Bank of Korea likely to keep its policy rate unchanged amid persistent won volatility, elevated housing prices and uncertainty over the U.S. policy path, industry sources said Thursday. The Fed lowered its benchmark range to 3.50–3.75 percent at its Wednesday meeting. Its latest dot plot left the year-end projection unchanged at 3.4 percent, implying only one additional 25-basis-point cut next year. Chair Jerome Powell signaled a more cautious easing trajectory, saying the policy rate is now within a “neutral range.” The Fed has cut rates by 25 basis points in each of September, October and December, shrinking the U.S.–Korea rate differential to 1.25 percentage points. The narrower gap has eased pressure on capital outflows and the won-dollar exchange rate, though foreign-exchange volatility remains significant. The won hit 1,477.1 per dollar on Nov. 24 — the weakest level since April — and has since shown unstable movements. Bank of Korea official Kim Jong-hwa said about 70 percent of recent exchange-rate upward pressure stems from dollar demand related to outbound investments rather than interest-rate differentials alone. BOK Governor Lee Chang-yong has stressed the won’s depreciation is partly driven by increased foreign stock purchases. With the weak currency pushing up import prices and inflation rising to 2.4 percent last month, analysts say the central bank may prefer to maintain its rate at the Jan. 15 policy meeting. Housing market conditions remain another key concern. While prices in the broader Seoul metropolitan area appear to be stabilizing, a Bank of Korea official said certain districts still show declines that warrant continued monitoring. Deputy Governor Park Jong-woo said external risks — including expectations of rate hikes in Japan and ongoing U.S.–China trade tensions — call for a cautious policy stance. “We will closely monitor market conditions and adjust as needed,” he said. * This article, published by Aju Business Daily, was translated by AI and edited by AJP. 2025-12-11 14:45:24 -

South Korea's growth could fall to near zero by 2040s: BOK governor SEOUL, December 09 (AJP) - South Korea’s potential economic growth rate could fall to near zero by the 2040s without major structural reforms, Bank of Korea Governor Rhee Chang-yong warned on Tuesday. Speaking at a symposium co-hosted by the BOK and the Korean Finance Association, Rhee said the country’s potential growth rate has slowed sharply from around 5 percent in the early 2000s to below 2 percent in recent years. Rhee attributed the deceleration to a shrinking labor force driven by low birth rates and rapid population aging, as well as weak corporate investment and insufficient gains in productivity. He also pointed to inefficient resource allocation, with capital flowing into less productive sectors. “Finance plays a critical role in reallocating limited resources toward more efficient sectors, which in turn drives innovation and productivity,” Rhee said. Rhee cited an internal study by the central bank suggesting that redirecting credit toward more productive industries could raise South Korea’s long-term growth rate by around 0.2 percentage points. * This article, published by Aju Business Daily, was translated by AI and edited by AJP. 2025-12-09 14:28:38

South Korea's growth could fall to near zero by 2040s: BOK governor SEOUL, December 09 (AJP) - South Korea’s potential economic growth rate could fall to near zero by the 2040s without major structural reforms, Bank of Korea Governor Rhee Chang-yong warned on Tuesday. Speaking at a symposium co-hosted by the BOK and the Korean Finance Association, Rhee said the country’s potential growth rate has slowed sharply from around 5 percent in the early 2000s to below 2 percent in recent years. Rhee attributed the deceleration to a shrinking labor force driven by low birth rates and rapid population aging, as well as weak corporate investment and insufficient gains in productivity. He also pointed to inefficient resource allocation, with capital flowing into less productive sectors. “Finance plays a critical role in reallocating limited resources toward more efficient sectors, which in turn drives innovation and productivity,” Rhee said. Rhee cited an internal study by the central bank suggesting that redirecting credit toward more productive industries could raise South Korea’s long-term growth rate by around 0.2 percentage points. * This article, published by Aju Business Daily, was translated by AI and edited by AJP. 2025-12-09 14:28:38 -

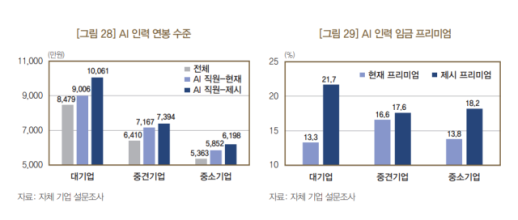

Low pay for AI talent is driving skilled workers overseas, BOK warns SEOUL, December 05 (AJP) - South Korea offers the lowest wage premiums for artificial intelligence specialists among major advanced economies, placing the country at a disadvantage in the global battle for high-tech talent, the Bank of Korea said in a report released Friday. The analysis, presented at a seminar co-hosted with the Korea Chamber of Commerce and Industry, called for upgrading compensation systems and research environments to meet international standards. Using data from LinkedIn profiles compiled by Revelio Labs, the report estimated South Korea had about 57,000 AI-skilled workers last year — more than double the 27,000 recorded in 2010 but far behind the United States (780,000), the United Kingdom (110,000) and France (70,000). South Korean AI professionals earned only a 6 percent wage premium over non-AI workers, compared with 25 percent in the U.S. and 18 percent in Canada. Wage premiums were higher in specialized fields such as pattern recognition and neuroscience, but remained low in core areas such as deep learning and machine learning. The weak premium has contributed to a persistent talent drain. Except for 2020, South Korea recorded a net outflow of AI professionals every year from 2010 to 2024. Last year, about 11,000 South Korean AI specialists were working overseas, including 6,300 in the U.S. “The high rate of overseas employment among workers facing low domestic wage premiums suggests a clear link between compensation and international mobility,” said Oh Sam-il, one of the report’s authors. “South Korea is losing ground in the global competition for AI talent.” Oh said rigid wage structures and intense global competition are suppressing domestic premiums. He urged the government and companies to focus on improving career development pathways and offering competitive compensation packages to retain and attract top-tier AI professionals. * This article, published by Aju Business Daily, was translated by AI and edited by AJP. 2025-12-05 16:28:36

Low pay for AI talent is driving skilled workers overseas, BOK warns SEOUL, December 05 (AJP) - South Korea offers the lowest wage premiums for artificial intelligence specialists among major advanced economies, placing the country at a disadvantage in the global battle for high-tech talent, the Bank of Korea said in a report released Friday. The analysis, presented at a seminar co-hosted with the Korea Chamber of Commerce and Industry, called for upgrading compensation systems and research environments to meet international standards. Using data from LinkedIn profiles compiled by Revelio Labs, the report estimated South Korea had about 57,000 AI-skilled workers last year — more than double the 27,000 recorded in 2010 but far behind the United States (780,000), the United Kingdom (110,000) and France (70,000). South Korean AI professionals earned only a 6 percent wage premium over non-AI workers, compared with 25 percent in the U.S. and 18 percent in Canada. Wage premiums were higher in specialized fields such as pattern recognition and neuroscience, but remained low in core areas such as deep learning and machine learning. The weak premium has contributed to a persistent talent drain. Except for 2020, South Korea recorded a net outflow of AI professionals every year from 2010 to 2024. Last year, about 11,000 South Korean AI specialists were working overseas, including 6,300 in the U.S. “The high rate of overseas employment among workers facing low domestic wage premiums suggests a clear link between compensation and international mobility,” said Oh Sam-il, one of the report’s authors. “South Korea is losing ground in the global competition for AI talent.” Oh said rigid wage structures and intense global competition are suppressing domestic premiums. He urged the government and companies to focus on improving career development pathways and offering competitive compensation packages to retain and attract top-tier AI professionals. * This article, published by Aju Business Daily, was translated by AI and edited by AJP. 2025-12-05 16:28:36