SEOUL, February 10 (AJP) - Stocks are hot in South Korea, but Seoul apartments remain hotter, as data shows profits from record market surge are increasingly being redirected into property purchases.

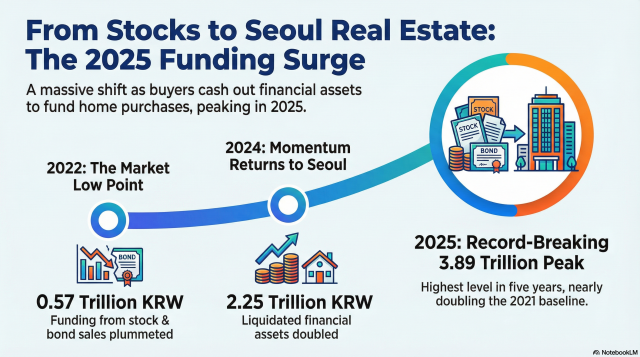

Between July and December last year—after the government unveiled a package of housing market curbs in June—2.09 trillion won ($14.4 billion) was withdrawn from stocks and bonds to finance home purchases, according to data obtained from the Ministry of Land, Infrastructure and Transport by the office of People Power Party lawmaker Kim Jong-yang.

The five-month figure exceeded the roughly 2 trillion won recorded for the whole of 2021, underscoring how quickly capital has pivoted back toward real estate.

In July, one month into office, Lee Jae Myung publicly warned against housing speculation and ordered tougher measures at a cabinet meeting.

The government followed up with high-intensity regulations, including a cap last October limiting mortgage loans to 600 million won for homes priced above 1.5 billion won. Less than a year later, however, the effectiveness of those policies appears limited.

Drivers for price hikes remain unchecked

The structural bias toward housing—especially in and around Seoul—remains firmly in place.

According to the Korea Real Estate Board, apartment prices across all districts in Seoul rose 9 percent over the past year, the sharpest increase since the 23.5 percent surge in 2006 during the Roh Moo-hyun administration.

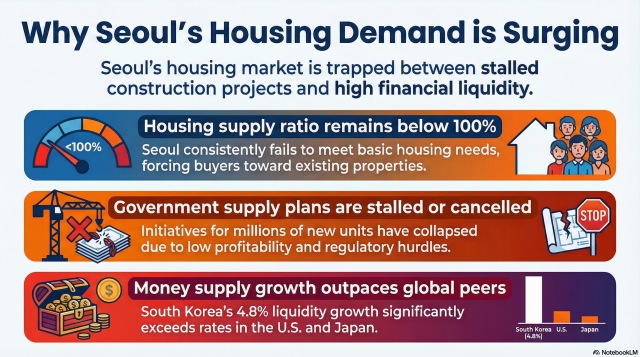

Supply constraints continue to aggravate demand. Seoul’s housing supply ratio has consistently remained below 100 percent, while major development initiatives have faced repeated delays or cancellations.

A previous government plan to deliver 2.7 million units by 2027 through private-led projects collapsed amid weak profitability and regulatory hurdles. The current administration announced in January a plan to supply 1.35 million units in the metropolitan area over five years, but formal negotiations have yet to begin.

“Although the government has announced supply measures, fear persists that the shortage will not be resolved,” said Seo Jin-hyung, a professor at Kwangwoon University’s Department of Real Estate Law.

Liquidity fuels the market

Economists point to excess liquidity as a decisive trigger behind the renewed price surge.

According to the Bank of Korea, broad money supply (M2), including securities such as stocks and ETFs, rose 8.4 percent year-on-year in November. Even excluding securities, money supply growth stood at 4.8 percent—well above levels seen in Japan and the United States.

“When liquidity rises rapidly, inflation and real estate prices inevitably follow,” said Kwon Dae-jung, a chair professor at Hansung University’s Department of Economics and Real Estate. “Excess liquidity cannot be ignored in discussions about housing.”

Stocks cannot replace homes

As capital continues to flow into property, skepticism is growing over the notion that equities can serve as a viable alternative to real estate.

Many analysts argue that securities often function as stepping stones—rather than substitutes—for buying tangible assets.

“There are many ways to make money besides stocks, but one cannot live without a house,” said Woo Seok-jin, an economics professor at Myongji University. “Because housing and stocks are fundamentally different, the substitution effect will be limited.”

Another real estate expert, speaking on condition of anonymity, was more blunt.

“Stocks and property cannot exist in a purely substitutable relationship,” the expert said. “Unless the government tackles the issue through orthodox means—expanding supply and adjusting taxes—housing prices will not stabilize.”

For broader Koreans, stocks remain a tool for accumulation and home in Seoul the ultimate destination, he added.

Copyright ⓒ Aju Press All rights reserved.