On Wednesday, Volkswagen Group doubled down on its global electrification drive despite slowing EV demand worldwide, highlighting production milestones that underscore Germany’s manufacturing scale — a key factor as Berlin backs a consortium competing against South Korea for Canada’s Canadian Patrol Submarine Project (CPSP).

Volkswagen said its global production network, spanning Győr in Hungary, Tianjin in China and Kassel in Germany, has now surpassed 5 million electric drive systems. The Kassel plant alone increased output by 24 percent year-on-year, producing more than 850,000 units this year.

Beyond volume, the company emphasized technological self-reliance, noting it develops and manufactures core components in-house, including the pulse inverter — often referred to as the “brain” of an electric vehicle — and key control systems.

Industry observers say the timing is hardly coincidental.

Canada’s submarine program has evolved into more than a defense procurement. Facing tariff uncertainty under U.S. President Donald Trump, Ottawa has made domestic industrial revitalization and job creation central criteria in evaluating bids.

Volkswagen’s battery subsidiary PowerCo is building a C$7 billion gigafactory in St. Thomas, Ontario — its first such facility in North America.

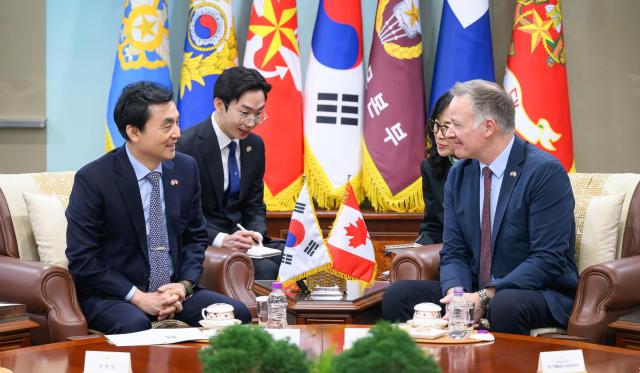

According to The Globe and Mail, German Economy Minister Katherina Reiche recently visited Ottawa and met senior members of Prime Minister Mark Carney’s cabinet to promote German automotive investment.

In an interview, Reiche said discussions went “more than just talking,” adding that “we are looking into numbers, into details.”

Analysts interpret the move as part of a coordinated German strategy: pairing submarine technology with tangible, large-scale industrial investment.

Against Germany’s aggressive push, Korea’s consortium of Hanwha Ocean and HD Hyundai Heavy Industries faces mounting pressure.

While Volkswagen has finalized multibillion-dollar investments and is showcasing operational facilities, Hyundai Motor Group has yet to formalize plans for a direct EV production base in Canada.

Industry experts argue Seoul must move beyond a defense-only pitch and present an integrated industrial package.

Such a package, analysts say, could counterbalance Germany’s early-mover advantage in large-scale manufacturing investment.

Ryu Yeon-seung, director at the Institute of Defense Industrial Security, cautioned that not all cooperation details can be disclosed publicly.

“Regarding cooperation with the three major Korean battery makers, some aspects have not been made public, and some cannot be disclosed,” Ryu said. “Germany is a competitor, so we cannot reveal all of our cards. Doing so would put us at a disadvantage in negotiations.”

He added that he understands the government is already working on such coordination at the practical level.

While some market watchers see Germany holding the upper hand due to NATO alignment and its visible industrial footprint in Canada, Ryu stressed that the outcome remains open.

“No one can guarantee the result,” he said. “If NATO membership alone determined everything, Canada would not still be weighing options between South Korea and Germany.”

Copyright ⓒ Aju Press All rights reserved.