This year’s Seollal holiday arrives amid an uncomfortable contrast: a red-hot stock market and record-breaking bonus payouts at a handful of corporate champions, even as a growing share of companies scale back seasonal bonuses.

According to a survey by the Korea Enterprises Federation, 58.7 percent of companies paid Seollal bonuses this year, down 2.8 percentage points from 61.5 percent last year.

The gap is particularly stark by company size. Among enterprises with more than 300 employees, 71.1 percent provided bonuses, compared with 57.3 percent of smaller firms.

For workers at small and mid-sized businesses, the strain is palpable.

The subdued holiday mood stands in sharp contrast to bonus windfalls at export powerhouses riding boom cycles in semiconductors and defense.

Hanwha Ocean made headlines by granting a uniform 400 percent performance bonus based on monthly base salary to both in-house and subcontractor workers — a first for a major Korean shipbuilder. The decision reflects the shipbuilding sector’s resurgence and acknowledges that roughly 60 percent of production processes are handled by subcontractors.

Previously, in-house employees received 150 percent bonuses in 2024, while partner workers received 75 percent. The equal payout this year was framed as an effort to strengthen labor-management harmony during a boom period.

Kakao followed with bonuses of up to 9 percent of annual salary, slightly higher than last year’s 8 percent. The company posted record 2025 results, reporting 8.99 trillion won in revenue and 732 billion won in operating profit — a 48 percent increase — driven by growth of its KakaoTalk platform.

Hanwha Aerospace offered bonuses of up to 700 percent of monthly base pay, varying by division, after three consecutive years of record profits. Its Land Systems division led with 725 percent, while other units exceeded 500 percent. The company reported 2025 revenue of 26.6 trillion won and operating profit of 3 trillion won.

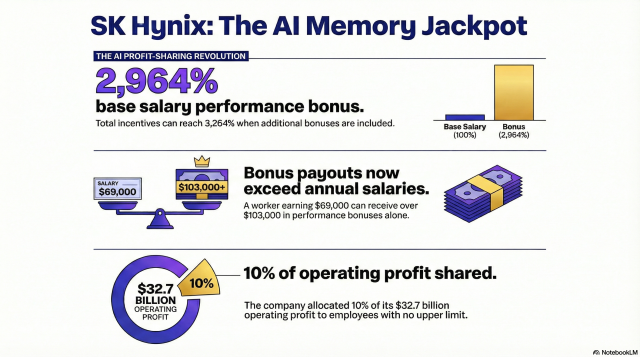

SK hynix Reshapes the Bonus Benchmark

But it was SK hynix that reset expectations across corporate Korea.

The chipmaker announced an unprecedented 2,964 percent performance bonus based on base salary under its excess profit-sharing system. For an employee earning 100 million won annually, that translates into roughly 148 million won in bonus pay alone.

With operating margins approaching 50 percent and 2025 revenue reaching 97.15 trillion won, SK hynix has emerged as Korea’s most profitable company — and its transparent profit-sharing model has intensified scrutiny elsewhere.

The contrast has fueled unease at rival Samsung Electronics, long considered the gold standard for compensation.

Samsung continues to base bonuses on Economic Value Added (EVA), a metric employees often criticize as opaque. Depreciation and capital cost adjustments can reduce payouts even in strong sales years, creating what some workers describe as a “black box.”

Frustration has translated into organization. The Samsung Electronics branch of the Super-Large Company Union surpassed 63,000 members by late January 2026, up from 6,300 just four months earlier. Crossing the claimed majority threshold grants exclusive bargaining rights, setting the stage for potentially contentious wage negotiations.

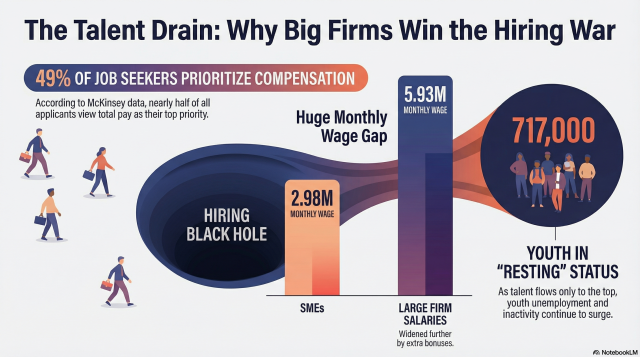

The widening compensation gap risks deepening structural imbalances across the labor market.

While major exporters distribute record incentives, small and mid-sized enterprises struggle to compete. McKinsey survey data show 49 percent of Korean workers prioritize total compensation when choosing jobs. The average monthly salary at large firms stands at 5.93 million won — nearly double the 2.98 million won average at smaller companies.

The Lunar New Year has traditionally been a time for shared prosperity and symbolic generosity. This year, however, bonus polarization underscores a broader economic divide — one that risks turning a season of reunion into a quiet reminder of inequality.

Copyright ⓒ Aju Press All rights reserved.