Journalist

Kim Yeon-jae

-

Seoul's FX battle costs $4 bn over the last two months SEOUL, February 04 (AJP) - South Korea has deployed nearly every tool in its policy playbook to defend the won, which authorities say has weakened “excessively” beyond its fundamentals — a view shared even by the U.S. Treasury secretary. Measures have ranged from pressuring public and private institutions to sell dollar holdings to offering tax incentives aimed at drawing capital back home. Yet despite these efforts, the national coffers have paid a heavy price. As of the end of January 2026, foreign exchange reserves stood at $425.91 billion, down $2.15 billion from the previous month, following a decline of more than $2 billion in December, according to the Bank of Korea (BOK) on Wednesday. Nearly $4.2 billion has been depleted in just two months. The central bank attributed the decline primarily to its FX swap arrangement with the National Pension Service (NPS). Under the program, the BOK supplies dollars to the NPS for overseas equity purchases, temporarily limiting capital outflows that typically weaken the won. The BOK has said the swap would temporarily dent reserves but be reversed once the dollars are returned. However, whether the strategy is producing meaningful results remains uncertain. The average exchange rate rose to 1,467.35 won per dollar in December, up from 1,461 in November. Despite continued intervention, the rate remained weak at around 1,451 won as of Feb. 4. In late January, the won posted the sharpest decline among major currencies, briefly approaching the 1,470 level. Private dollar hoarding offsets intervention A broader look at the private sector highlights a structural challenge. According to BOK data released on Jan. 26, resident foreign currency deposits reached a record $119.43 billion in December, up $15.88 billion from November. Both the balance and the monthly increase marked all-time highs. The central bank is well aware of the trend. At a press conference following the January Monetary Policy Board meeting, BOK Governor Rhee Chang-yong noted that individuals and corporations already hold ample dollar liquidity. Rhee explained that many market participants, betting on continued dollar strength, prefer lending their dollars in financial markets rather than selling them in the spot market. “The issue lies in circulation structure, not in total supply,” he said. Meanwhile, growing preference for overseas assets reflects persistent skepticism over corporate earnings growth and long-term prospects for “Korea Inc.” Data from the Korea Securities Depository show that Korean investors’ holdings of U.S. stocks reached a record $171.8 billion, rising 5 percent between Dec. 31 and Jan. 16. The BOK also reported that outward securities investment surged by $12.26 billion in November, led by equities, while foreign inflows remained below $6 billion and were concentrated largely in bonds. Policy efforts face structural limits Authorities are rolling out measures to attract capital back home, including Reshoring Investment Accounts and the National Growth Fund. The Financial Supervisory Service is also considering incentives such as higher interest rates for converting dollars into won. South Korea’s gradual inclusion in the World Government Bond Index through November is also raising hopes for stronger foreign inflows. Still, analysts stress that sustained currency stability ultimately depends on economic fundamentals. Shinhan Securities expects the exchange rate to remain around 1,400 won per dollar, citing weak growth and slowing potential output. South Korea’s economy contracted 0.3 percent in the fourth quarter of 2025, while full-year growth barely reached 1 percent. “The reason many people are investing in ‘Gobbuss’ (KODEX 200 Futures Inverse 2X) even as the KOSPI hits record highs is anxiety over the real economy,” said an investment banking official, speaking on condition of anonymity. “The psychology behind refusing to sell dollars is essentially the same.” Stocks surge despite currency weakness Despite the won’s fragility, equity markets continued to rally. The KOSPI closed Wednesday at a record 5,371.10, up 1.57 percent. Institutional investors posted net purchases of 1.4 trillion won ($964.2 million), while retail investors sold a net 1 trillion won. In January, institutions were net buyers of 34 trillion won, while retail and foreign investors were net sellers of 2.7 trillion won and 3.7 trillion won, respectively. Meanwhile, the dollar rose 1.30 won to close at 1,452.30. 2026-02-04 17:42:43

Seoul's FX battle costs $4 bn over the last two months SEOUL, February 04 (AJP) - South Korea has deployed nearly every tool in its policy playbook to defend the won, which authorities say has weakened “excessively” beyond its fundamentals — a view shared even by the U.S. Treasury secretary. Measures have ranged from pressuring public and private institutions to sell dollar holdings to offering tax incentives aimed at drawing capital back home. Yet despite these efforts, the national coffers have paid a heavy price. As of the end of January 2026, foreign exchange reserves stood at $425.91 billion, down $2.15 billion from the previous month, following a decline of more than $2 billion in December, according to the Bank of Korea (BOK) on Wednesday. Nearly $4.2 billion has been depleted in just two months. The central bank attributed the decline primarily to its FX swap arrangement with the National Pension Service (NPS). Under the program, the BOK supplies dollars to the NPS for overseas equity purchases, temporarily limiting capital outflows that typically weaken the won. The BOK has said the swap would temporarily dent reserves but be reversed once the dollars are returned. However, whether the strategy is producing meaningful results remains uncertain. The average exchange rate rose to 1,467.35 won per dollar in December, up from 1,461 in November. Despite continued intervention, the rate remained weak at around 1,451 won as of Feb. 4. In late January, the won posted the sharpest decline among major currencies, briefly approaching the 1,470 level. Private dollar hoarding offsets intervention A broader look at the private sector highlights a structural challenge. According to BOK data released on Jan. 26, resident foreign currency deposits reached a record $119.43 billion in December, up $15.88 billion from November. Both the balance and the monthly increase marked all-time highs. The central bank is well aware of the trend. At a press conference following the January Monetary Policy Board meeting, BOK Governor Rhee Chang-yong noted that individuals and corporations already hold ample dollar liquidity. Rhee explained that many market participants, betting on continued dollar strength, prefer lending their dollars in financial markets rather than selling them in the spot market. “The issue lies in circulation structure, not in total supply,” he said. Meanwhile, growing preference for overseas assets reflects persistent skepticism over corporate earnings growth and long-term prospects for “Korea Inc.” Data from the Korea Securities Depository show that Korean investors’ holdings of U.S. stocks reached a record $171.8 billion, rising 5 percent between Dec. 31 and Jan. 16. The BOK also reported that outward securities investment surged by $12.26 billion in November, led by equities, while foreign inflows remained below $6 billion and were concentrated largely in bonds. Policy efforts face structural limits Authorities are rolling out measures to attract capital back home, including Reshoring Investment Accounts and the National Growth Fund. The Financial Supervisory Service is also considering incentives such as higher interest rates for converting dollars into won. South Korea’s gradual inclusion in the World Government Bond Index through November is also raising hopes for stronger foreign inflows. Still, analysts stress that sustained currency stability ultimately depends on economic fundamentals. Shinhan Securities expects the exchange rate to remain around 1,400 won per dollar, citing weak growth and slowing potential output. South Korea’s economy contracted 0.3 percent in the fourth quarter of 2025, while full-year growth barely reached 1 percent. “The reason many people are investing in ‘Gobbuss’ (KODEX 200 Futures Inverse 2X) even as the KOSPI hits record highs is anxiety over the real economy,” said an investment banking official, speaking on condition of anonymity. “The psychology behind refusing to sell dollars is essentially the same.” Stocks surge despite currency weakness Despite the won’s fragility, equity markets continued to rally. The KOSPI closed Wednesday at a record 5,371.10, up 1.57 percent. Institutional investors posted net purchases of 1.4 trillion won ($964.2 million), while retail investors sold a net 1 trillion won. In January, institutions were net buyers of 34 trillion won, while retail and foreign investors were net sellers of 2.7 trillion won and 3.7 trillion won, respectively. Meanwhile, the dollar rose 1.30 won to close at 1,452.30. 2026-02-04 17:42:43 -

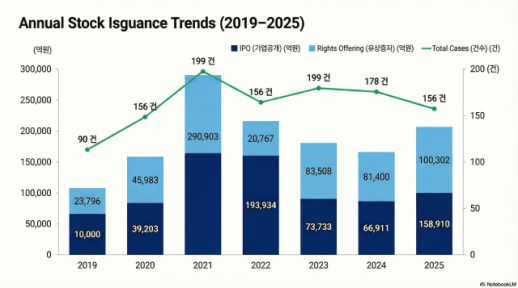

Greater rights offerings and fewer IPOs amid big-cap-led Korean stock boom SEOUL, Feb. 04 (AJP) - South Korea’s equity issuance saw a significant jump of approximately 55 percent last year, fueled by large-scale rights offerings. In contrast, new shares issued through initial public offerings (IPOs) contracted, underscoring a deepening funding freeze for small- and medium-sized enterprises (SMEs) and venture firms. According to the Financial Supervisory Service (FSS) on Wednesday, public equity issuance last year totaled 13.71 trillion won ($9.4 billion), an increase of 55.4 percent from the previous year. Rights offerings accounted for 10.30 trillion won of the total, skyrocketing 113.3 percent compared to 2024. The surge was primarily driven by major conglomerates, with the total value of rights offerings by large corporations alone increasing by nearly 220 percent on year. The number of rights offerings reached 72, an increase of 28.6 percent from the 56 cases recorded in 2024. Reflecting a growth trend skewed toward conglomerates, the push in rights offerings was led by major players. While rights offerings by large firms surged 220 percent versus the previous year, those by SMEs decreased 22.6 percent during the same period. IPO market chills amid tightened regulations Equity issuance through IPOs amounted to 3.68 trillion won, down 10.7 percent from a year ago. The number of IPOs fell 14 percent to 98 cases. By market, 6 cases were listed on the benchmark KOSPI, while 92 cases were on the tech-heavy KOSDAQ. The divergence is attributed to continued strong performances by existing listed giants, while SMEs and venture firms struggled. Furthermore, the government's aggressive moves to exit "zombie companies" and block "split-off listings" have raised the bar for initial public offerings. Corporate bond issuance totaled 276.25 trillion won, a slight decrease of 0.7 percent against the previous year. Compared to 2024, general corporate bonds and ABS increased 6.5 percent and 20.0 percent, respectively, while financial bonds fell 4.0 percent. For general corporate bonds, refinancing accounted for the largest share at 79.6 percent, followed by operating capital (16.4 percent) and facility investment (4.0 percent). By credit rating, high-grade bonds (AA or higher) rose to 70.7 percent, while lower-rated bonds (A or lower) fell to 29.3 percent relative to the year before. By maturity, mid-term bonds continued to dominate at 95.0 percent, with long-term and short-term bonds accounting for 3.4 percent and 1.6 percent, respectively. Among financial bonds, bank bonds and other financial bonds decreased 12.2 percent and 2.4 percent, while bonds issued by financial holding companies jumped 31.3 percent from a year earlier. As of the end of last year, the total outstanding balance of corporate bonds stood at 756.88 trillion won, up 9.3 percent from the prior year. Meanwhile, issuance of commercial paper (CP) and short-term bonds reached 1,663.32 trillion won, marking a 27.6 percent increase over 2024. 2026-02-04 10:28:27

Greater rights offerings and fewer IPOs amid big-cap-led Korean stock boom SEOUL, Feb. 04 (AJP) - South Korea’s equity issuance saw a significant jump of approximately 55 percent last year, fueled by large-scale rights offerings. In contrast, new shares issued through initial public offerings (IPOs) contracted, underscoring a deepening funding freeze for small- and medium-sized enterprises (SMEs) and venture firms. According to the Financial Supervisory Service (FSS) on Wednesday, public equity issuance last year totaled 13.71 trillion won ($9.4 billion), an increase of 55.4 percent from the previous year. Rights offerings accounted for 10.30 trillion won of the total, skyrocketing 113.3 percent compared to 2024. The surge was primarily driven by major conglomerates, with the total value of rights offerings by large corporations alone increasing by nearly 220 percent on year. The number of rights offerings reached 72, an increase of 28.6 percent from the 56 cases recorded in 2024. Reflecting a growth trend skewed toward conglomerates, the push in rights offerings was led by major players. While rights offerings by large firms surged 220 percent versus the previous year, those by SMEs decreased 22.6 percent during the same period. IPO market chills amid tightened regulations Equity issuance through IPOs amounted to 3.68 trillion won, down 10.7 percent from a year ago. The number of IPOs fell 14 percent to 98 cases. By market, 6 cases were listed on the benchmark KOSPI, while 92 cases were on the tech-heavy KOSDAQ. The divergence is attributed to continued strong performances by existing listed giants, while SMEs and venture firms struggled. Furthermore, the government's aggressive moves to exit "zombie companies" and block "split-off listings" have raised the bar for initial public offerings. Corporate bond issuance totaled 276.25 trillion won, a slight decrease of 0.7 percent against the previous year. Compared to 2024, general corporate bonds and ABS increased 6.5 percent and 20.0 percent, respectively, while financial bonds fell 4.0 percent. For general corporate bonds, refinancing accounted for the largest share at 79.6 percent, followed by operating capital (16.4 percent) and facility investment (4.0 percent). By credit rating, high-grade bonds (AA or higher) rose to 70.7 percent, while lower-rated bonds (A or lower) fell to 29.3 percent relative to the year before. By maturity, mid-term bonds continued to dominate at 95.0 percent, with long-term and short-term bonds accounting for 3.4 percent and 1.6 percent, respectively. Among financial bonds, bank bonds and other financial bonds decreased 12.2 percent and 2.4 percent, while bonds issued by financial holding companies jumped 31.3 percent from a year earlier. As of the end of last year, the total outstanding balance of corporate bonds stood at 756.88 trillion won, up 9.3 percent from the prior year. Meanwhile, issuance of commercial paper (CP) and short-term bonds reached 1,663.32 trillion won, marking a 27.6 percent increase over 2024. 2026-02-04 10:28:27 -

KOSPI, Nikkei rebound from 'Warsh Shock,' hit fresh record highs SEOUL, Feb 03 (AJP) - Asian equity markets staged a decisive rebound Tuesday, shaking off jitters dubbed the “Warsh Shock,” as South Korea’s benchmark KOSPI surged nearly 7 percent to a fresh all-time high and fueling a regionwide rally. The sharp recovery followed gains on Wall Street after U.S. purchasing managers’ index data returned to expansion for the first time in a year, easing concerns about an economic slowdown. Market sentiment also improved as investors reassessed initial fears that Federal Reserve chair nominee Kevin Warsh would take an aggressively hawkish stance, increasingly viewing them as overblown. The Korean won strengthened alongside equities, with the dollar falling as much as 10.5 won to 1,443 won from the previous close. Meanwhile, a rapid rotation into risk assets pushed the yield on the 10-year Korean government bond up 5.8 basis points to 3.661 percent. The KOSPI soared 6.84 percent to close at 5,228.08, recouping the previous session’s losses and setting a new intraday and closing record. Hopes that Warsh could emerge as a “hawkish dove” rather than a hardliner helped reignite appetite for equities. Institutional investors led the rally with a net purchase of 2.17 trillion won ($1.5 billion), while foreign investors added 705 billion won. Retail investors, who had fueled buying the previous day, took profits, unloading 2.94 trillion won. Chip behemoths roared on. Samsung Electronics jumped 11.37 percent to a record 167,500 won, while SK hynix climbed 9.28 percent to 907,000 won, both marking fresh 52-week highs. Hyundai Motor, the third-largest company by market capitalization, rose 2.82 percent to 491,500 won. LG Energy Solution, which has struggled with sluggish earnings, gained 2.9 percent to close at 391,000 won. Naver, however, lagged the broader rally, edging up just 0.37 percent to 269,000 won as investors stayed on the sidelines ahead of its earnings release expected around Feb. 5. The tech-heavy KOSDAQ advanced 4.19 percent to 1,144.33, erasing the previous session’s sharp losses, though it fell short of a new record. Mirae Asset Venture Investment was the day’s standout performer, hitting the daily 30 percent upper limit to close at 22,100 won. The surge followed news that Elon Musk’s SpaceX had acquired xAI, benefiting Mirae Asset Venture, a major investor in SpaceX. In Japan, the Nikkei 225 snapped its losing streak, jumping 3.92 percent to close at 54,720.66, also a new all-time high. A rebound in U.S. technology stocks lifted Japanese semiconductor shares. Advantest rose 7.1 percent, Disco gained 7.4 percent, Tokyo Electron climbed 4.8 percent, and Ibiden surged 8.6 percent, capping a strong day for the chip sector. Toyota Motor advanced a more modest 1.67 percent to 3,594 yen, as much of its strength as the world’s top auto seller in 2025 was already priced in. Elsewhere in the region, Taiwan’s TAIEX rose 1.81 percent to 32,195.36. MediaTek surged 5.28 percent after reporting better-than-expected earnings, while TSMC gained 2.0 percent. Chinese markets also rebounded broadly, with the Shanghai Composite up 1.3 percent and the Shenzhen Composite climbing 2.2 percent. Hong Kong’s Hang Seng Index, however, lagged peers, inching up just 0.13 percent to close at 26,810, weighed down by dollar strength and turbulence in cryptocurrency markets. 2026-02-03 17:07:55

KOSPI, Nikkei rebound from 'Warsh Shock,' hit fresh record highs SEOUL, Feb 03 (AJP) - Asian equity markets staged a decisive rebound Tuesday, shaking off jitters dubbed the “Warsh Shock,” as South Korea’s benchmark KOSPI surged nearly 7 percent to a fresh all-time high and fueling a regionwide rally. The sharp recovery followed gains on Wall Street after U.S. purchasing managers’ index data returned to expansion for the first time in a year, easing concerns about an economic slowdown. Market sentiment also improved as investors reassessed initial fears that Federal Reserve chair nominee Kevin Warsh would take an aggressively hawkish stance, increasingly viewing them as overblown. The Korean won strengthened alongside equities, with the dollar falling as much as 10.5 won to 1,443 won from the previous close. Meanwhile, a rapid rotation into risk assets pushed the yield on the 10-year Korean government bond up 5.8 basis points to 3.661 percent. The KOSPI soared 6.84 percent to close at 5,228.08, recouping the previous session’s losses and setting a new intraday and closing record. Hopes that Warsh could emerge as a “hawkish dove” rather than a hardliner helped reignite appetite for equities. Institutional investors led the rally with a net purchase of 2.17 trillion won ($1.5 billion), while foreign investors added 705 billion won. Retail investors, who had fueled buying the previous day, took profits, unloading 2.94 trillion won. Chip behemoths roared on. Samsung Electronics jumped 11.37 percent to a record 167,500 won, while SK hynix climbed 9.28 percent to 907,000 won, both marking fresh 52-week highs. Hyundai Motor, the third-largest company by market capitalization, rose 2.82 percent to 491,500 won. LG Energy Solution, which has struggled with sluggish earnings, gained 2.9 percent to close at 391,000 won. Naver, however, lagged the broader rally, edging up just 0.37 percent to 269,000 won as investors stayed on the sidelines ahead of its earnings release expected around Feb. 5. The tech-heavy KOSDAQ advanced 4.19 percent to 1,144.33, erasing the previous session’s sharp losses, though it fell short of a new record. Mirae Asset Venture Investment was the day’s standout performer, hitting the daily 30 percent upper limit to close at 22,100 won. The surge followed news that Elon Musk’s SpaceX had acquired xAI, benefiting Mirae Asset Venture, a major investor in SpaceX. In Japan, the Nikkei 225 snapped its losing streak, jumping 3.92 percent to close at 54,720.66, also a new all-time high. A rebound in U.S. technology stocks lifted Japanese semiconductor shares. Advantest rose 7.1 percent, Disco gained 7.4 percent, Tokyo Electron climbed 4.8 percent, and Ibiden surged 8.6 percent, capping a strong day for the chip sector. Toyota Motor advanced a more modest 1.67 percent to 3,594 yen, as much of its strength as the world’s top auto seller in 2025 was already priced in. Elsewhere in the region, Taiwan’s TAIEX rose 1.81 percent to 32,195.36. MediaTek surged 5.28 percent after reporting better-than-expected earnings, while TSMC gained 2.0 percent. Chinese markets also rebounded broadly, with the Shanghai Composite up 1.3 percent and the Shenzhen Composite climbing 2.2 percent. Hong Kong’s Hang Seng Index, however, lagged peers, inching up just 0.13 percent to close at 26,810, weighed down by dollar strength and turbulence in cryptocurrency markets. 2026-02-03 17:07:55 -

UPDATE: Korea's inflation cools to 2% in January on soft fuel prices, weak demand *Updated with additional information SEOUL, February 03 (AJP) - South Korea’s inflation eased back to the central bank’s target level in January, as softer fuel prices and subdued domestic demand outweighed lingering pressures from a weak currency. According to the Ministry of Data and Statistics, the consumer price index (CPI) rose 2.0 percent in January from a year earlier, slowing from 2.3 percent in December and 2.4 percent in both October and November. The moderation partly reflected seasonal factors. The Lunar New Year holiday falls in February this year, unlike last year when it came in January and pushed up food prices due to family gatherings and ceremonial demand. Energy prices also helped contain inflation despite the won’s prolonged weakness against the U.S. dollar. Gasoline and diesel prices fell 2.4 percent and 3.5 percent, respectively, easing pressure on utility costs during the winter peak season. The data suggest that sluggish domestic demand has so far offset inflationary pass-through effects from currency depreciation and global price volatility. The exchange rate remained a key inflationary factor, though pressures softened slightly. The won averaged 1,458.19 per dollar in January, strengthening modestly from 1,467.35 in December. The stabilization was supported by government intervention in the foreign exchange market and a broader softening of the U.S. dollar through January, allowing the won to recover part of its recent losses. The easing helped reduce energy import costs. Dubai crude oil traded in a narrow range of $58 to $62 per barrel in January, broadly unchanged from December. Fuel prices, however, reversed the sharp increases seen late last year, when gasoline and diesel surged 5.7 percent and 10.8 percent, respectively. Reflecting the fuel decline, transportation costs fell 0.9 percent month-on-month. Month-on-month price movements underscore restrained consumption behavior amid still-elevated price levels. Food and beverages rose 0.6 percent from December, household goods increased 0.5 percent, and recreation and culture climbed 0.6 percent. Prices for “miscellaneous goods and services” rose 2.8 percent on the month and 5.0 percent year-on-year, largely due to annual price adjustments at the start of the year. Insurance service fees surged 15.3 percent from a year earlier, the steepest increase among all CPI items. Household goods and domestic services also rose 2.9 percent year-on-year, outpacing most other categories. A breakdown by item type confirms the subdued demand trend. Dining-out prices rose just 0.3 percent, while non-dining personal services increased 1.0 percent. In contrast, price growth for agricultural and industrial products either slowed or shifted toward contraction. Prices of agricultural, livestock and fishery products rose 0.7 percent year-on-year, easing from 1.0 percent in December. Overall goods inflation narrowed sharply from 0.4 percent to 0.1 percent. Notably, manufactured goods prices fell 0.1 percent month-on-month, helped by the won’s relative stabilization. The Ministry of Economy and Finance assessed in a press release that inflation remained relatively stable in January but warned of potential upward pressure during the Lunar New Year holiday in mid-February. “Given lingering uncertainties such as international oil price volatility and winter weather conditions, the government plans to devote all its resources to stabilizing perceived inflation for the public,” the ministry said. 2026-02-03 08:29:52

UPDATE: Korea's inflation cools to 2% in January on soft fuel prices, weak demand *Updated with additional information SEOUL, February 03 (AJP) - South Korea’s inflation eased back to the central bank’s target level in January, as softer fuel prices and subdued domestic demand outweighed lingering pressures from a weak currency. According to the Ministry of Data and Statistics, the consumer price index (CPI) rose 2.0 percent in January from a year earlier, slowing from 2.3 percent in December and 2.4 percent in both October and November. The moderation partly reflected seasonal factors. The Lunar New Year holiday falls in February this year, unlike last year when it came in January and pushed up food prices due to family gatherings and ceremonial demand. Energy prices also helped contain inflation despite the won’s prolonged weakness against the U.S. dollar. Gasoline and diesel prices fell 2.4 percent and 3.5 percent, respectively, easing pressure on utility costs during the winter peak season. The data suggest that sluggish domestic demand has so far offset inflationary pass-through effects from currency depreciation and global price volatility. The exchange rate remained a key inflationary factor, though pressures softened slightly. The won averaged 1,458.19 per dollar in January, strengthening modestly from 1,467.35 in December. The stabilization was supported by government intervention in the foreign exchange market and a broader softening of the U.S. dollar through January, allowing the won to recover part of its recent losses. The easing helped reduce energy import costs. Dubai crude oil traded in a narrow range of $58 to $62 per barrel in January, broadly unchanged from December. Fuel prices, however, reversed the sharp increases seen late last year, when gasoline and diesel surged 5.7 percent and 10.8 percent, respectively. Reflecting the fuel decline, transportation costs fell 0.9 percent month-on-month. Month-on-month price movements underscore restrained consumption behavior amid still-elevated price levels. Food and beverages rose 0.6 percent from December, household goods increased 0.5 percent, and recreation and culture climbed 0.6 percent. Prices for “miscellaneous goods and services” rose 2.8 percent on the month and 5.0 percent year-on-year, largely due to annual price adjustments at the start of the year. Insurance service fees surged 15.3 percent from a year earlier, the steepest increase among all CPI items. Household goods and domestic services also rose 2.9 percent year-on-year, outpacing most other categories. A breakdown by item type confirms the subdued demand trend. Dining-out prices rose just 0.3 percent, while non-dining personal services increased 1.0 percent. In contrast, price growth for agricultural and industrial products either slowed or shifted toward contraction. Prices of agricultural, livestock and fishery products rose 0.7 percent year-on-year, easing from 1.0 percent in December. Overall goods inflation narrowed sharply from 0.4 percent to 0.1 percent. Notably, manufactured goods prices fell 0.1 percent month-on-month, helped by the won’s relative stabilization. The Ministry of Economy and Finance assessed in a press release that inflation remained relatively stable in January but warned of potential upward pressure during the Lunar New Year holiday in mid-February. “Given lingering uncertainties such as international oil price volatility and winter weather conditions, the government plans to devote all its resources to stabilizing perceived inflation for the public,” the ministry said. 2026-02-03 08:29:52 -

Trump's Warsh pick triggers panic in Korean markets for strong USD bias SEOUL, February 02 (AJP) - Korean markets saw panicky selling on Monday following Donald Trump’s nomination of Kevin Warsh as the next chair of the U.S. Federal Reserve, with equities and the won sliding sharply on concerns that his policy framework could reinforce dollar strength and drain global liquidity. Whether Warsh would ultimately comply with Trump’s long-standing calls for lower borrowing costs remains uncertain. Investors, however, moved quickly to price in a scenario in which rate cuts coexist with tighter underlying liquidity — a mix widely viewed as unfavorable for emerging-market currencies such as the Korean won. Trump announced Warsh’s nomination last Friday. He is set to succeed Jerome Powell, whose term expires on May 15 after a tenure frequently marked by public friction with the White House. The selloff was broad-based. The KOSPI closed down 5.26 percent at 4,949.67, falling below the psychologically important 5,000 level. Intraday volatility triggered a sell-side “sidecar” trading halt, underscoring the disorderly nature of the move. The won weakened to 1,464.3 per dollar, down 24.8 won by late afternoon. Commodity markets echoed the risk-off mood. Gold futures fell 11.4 percent to $4,745.10 per troy ounce, while silver futures plunged 31.4 percent to $78.531, marking their steepest single-day declines since January 1980, when former Fed chair Paul Volcker unleashed aggressive rate hikes to rein in inflation. Hawkish by structure, not by label Warsh is not generally regarded as a traditional monetary hawk. Paradoxically, that nuance has unsettled markets. Investors point to his record as a Fed governor, particularly his clashes with Ben Bernanke over the second round of quantitative easing (QE2). At the time, Warsh openly opposed large-scale asset purchases, warning Bernanke, “If I were in your chair, I would not be leading the Fed in this direction.” That history has reinforced expectations that Warsh, even if willing to lower policy rates, would prioritize balance-sheet discipline — keeping the dollar scarce and underpinning its value. Warsh’s more recent thinking suggests a hybrid approach: cutting rates to support investment while continuing quantitative tightening (QT) through Treasury sales. The goal is to stimulate corporate activity without undermining the dollar. Under such a framework, rate cuts would not necessarily weaken the greenback. Instead, reduced global dollar liquidity could persist, weighing on currencies like the won and making Korean assets less attractive on a currency-adjusted basis. Warsh has defended the apparent contradiction by arguing that productivity gains from artificial intelligence can offset inflationary pressures. In a July interview, he said the AI revolution would be a “significant disinflationary force,” allowing looser policy without destabilizing prices. He has also cited Alan Greenspan as a reference point, praising Greenspan’s decision to refrain from preemptive rate hikes during the 1990s technology boom as productivity gains kept inflation in check. For South Korea, that historical parallel is unsettling. Greenspan’s accommodative stance ultimately preceded the 2000 dot-com collapse, when the Nasdaq plunged 78 percent and the U.S. dollar index weakened sharply. Korea was hit harder still: the KOSDAQ fell nearly 80 percent, while the won depreciated from the 1,100 range to around 1,360 per dollar. Analysts warn that a similar combination of equity volatility and currency weakness could re-emerge if global liquidity tightens more aggressively than markets expect under a Warsh-led Fed. Liquidity stress back on the radar Concerns are also resurfacing over potential liquidity stress as QT drains bank reserves. In September 2019, heavy Treasury issuance combined with corporate tax payments pushed the U.S. repo rate from 2 percent to 10 percent, forcing emergency Fed intervention. Some market participants fear that under Warsh, such stress might be tolerated — or allowed to run longer — as part of balance-sheet normalization. “Unlike in 2019, there is now a broader consensus that normalizing the balance sheet itself is a core policy objective,” a KB Securities official said on condition of anonymity. NH Investment & Securities similarly cautioned that a rapid policy pivot should not be assumed. A tougher outlook for the won Optimism earlier this year that the won could stabilize near 1,400 per dollar, as suggested by Lee Jae Myung, is now being reassessed. For Korean markets, the concern is less about Warsh’s personal ideology than about whether the next Fed chair institutionalizes a framework that favors a strong dollar by design. If that proves to be the case, Monday’s panicky selling may mark the start of a longer adjustment rather than a one-off reaction. 2026-02-02 17:15:04

Trump's Warsh pick triggers panic in Korean markets for strong USD bias SEOUL, February 02 (AJP) - Korean markets saw panicky selling on Monday following Donald Trump’s nomination of Kevin Warsh as the next chair of the U.S. Federal Reserve, with equities and the won sliding sharply on concerns that his policy framework could reinforce dollar strength and drain global liquidity. Whether Warsh would ultimately comply with Trump’s long-standing calls for lower borrowing costs remains uncertain. Investors, however, moved quickly to price in a scenario in which rate cuts coexist with tighter underlying liquidity — a mix widely viewed as unfavorable for emerging-market currencies such as the Korean won. Trump announced Warsh’s nomination last Friday. He is set to succeed Jerome Powell, whose term expires on May 15 after a tenure frequently marked by public friction with the White House. The selloff was broad-based. The KOSPI closed down 5.26 percent at 4,949.67, falling below the psychologically important 5,000 level. Intraday volatility triggered a sell-side “sidecar” trading halt, underscoring the disorderly nature of the move. The won weakened to 1,464.3 per dollar, down 24.8 won by late afternoon. Commodity markets echoed the risk-off mood. Gold futures fell 11.4 percent to $4,745.10 per troy ounce, while silver futures plunged 31.4 percent to $78.531, marking their steepest single-day declines since January 1980, when former Fed chair Paul Volcker unleashed aggressive rate hikes to rein in inflation. Hawkish by structure, not by label Warsh is not generally regarded as a traditional monetary hawk. Paradoxically, that nuance has unsettled markets. Investors point to his record as a Fed governor, particularly his clashes with Ben Bernanke over the second round of quantitative easing (QE2). At the time, Warsh openly opposed large-scale asset purchases, warning Bernanke, “If I were in your chair, I would not be leading the Fed in this direction.” That history has reinforced expectations that Warsh, even if willing to lower policy rates, would prioritize balance-sheet discipline — keeping the dollar scarce and underpinning its value. Warsh’s more recent thinking suggests a hybrid approach: cutting rates to support investment while continuing quantitative tightening (QT) through Treasury sales. The goal is to stimulate corporate activity without undermining the dollar. Under such a framework, rate cuts would not necessarily weaken the greenback. Instead, reduced global dollar liquidity could persist, weighing on currencies like the won and making Korean assets less attractive on a currency-adjusted basis. Warsh has defended the apparent contradiction by arguing that productivity gains from artificial intelligence can offset inflationary pressures. In a July interview, he said the AI revolution would be a “significant disinflationary force,” allowing looser policy without destabilizing prices. He has also cited Alan Greenspan as a reference point, praising Greenspan’s decision to refrain from preemptive rate hikes during the 1990s technology boom as productivity gains kept inflation in check. For South Korea, that historical parallel is unsettling. Greenspan’s accommodative stance ultimately preceded the 2000 dot-com collapse, when the Nasdaq plunged 78 percent and the U.S. dollar index weakened sharply. Korea was hit harder still: the KOSDAQ fell nearly 80 percent, while the won depreciated from the 1,100 range to around 1,360 per dollar. Analysts warn that a similar combination of equity volatility and currency weakness could re-emerge if global liquidity tightens more aggressively than markets expect under a Warsh-led Fed. Liquidity stress back on the radar Concerns are also resurfacing over potential liquidity stress as QT drains bank reserves. In September 2019, heavy Treasury issuance combined with corporate tax payments pushed the U.S. repo rate from 2 percent to 10 percent, forcing emergency Fed intervention. Some market participants fear that under Warsh, such stress might be tolerated — or allowed to run longer — as part of balance-sheet normalization. “Unlike in 2019, there is now a broader consensus that normalizing the balance sheet itself is a core policy objective,” a KB Securities official said on condition of anonymity. NH Investment & Securities similarly cautioned that a rapid policy pivot should not be assumed. A tougher outlook for the won Optimism earlier this year that the won could stabilize near 1,400 per dollar, as suggested by Lee Jae Myung, is now being reassessed. For Korean markets, the concern is less about Warsh’s personal ideology than about whether the next Fed chair institutionalizes a framework that favors a strong dollar by design. If that proves to be the case, Monday’s panicky selling may mark the start of a longer adjustment rather than a one-off reaction. 2026-02-02 17:15:04 -

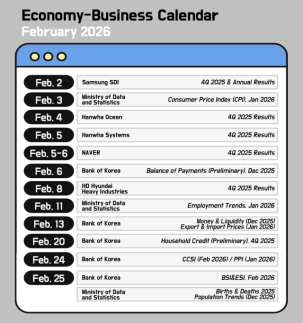

Korean Economy/Business Calendar SEOUL, January 30 (AJP) - Feb 2 (Mon) 4Q 2025 & Annual Results - Samsung SDI Feb 3 (Tue) Jan. 2026 Consumer Price Index (CPI) - Ministry of Data and Statistics Feb 4 (Wed) 4Q 2025 Results - Hanwha Ocean Feb 5 (Thu) 4Q 2025 Results - Hanwha Systems Feb 5–6 (Thu–Fri) 4Q 2025 Results - NAVER Feb 6 (Fri) Dec. 2025 Balance of Payments (Preliminary) - Bank of Korea Feb 8 (Sun) 4Q 2025 Results - HD Hyundai Heavy Industries Feb 11 (Wed) Jan. 2026 Employment Trends - Ministry of Data and Statistics Feb 13 (Fri) Dec. 2025 Money & Liquidity / Jan. 2026 Export & Import Prices - Bank of Korea Feb 20 (Fri) 4Q 2025 Household Credit (Preliminary) - Bank of Korea Feb 24 (Tue) Feb. 2026 CCSI / Jan. 2026 PPI - Bank of Korea Feb 25 (Wed) Feb. 2026 BSI & ESI - Bank of Korea Annual 2025 Births & Deaths / Dec. 2025 Population Trends - Ministry of Data and Statistics 2026-01-30 14:46:13

Korean Economy/Business Calendar SEOUL, January 30 (AJP) - Feb 2 (Mon) 4Q 2025 & Annual Results - Samsung SDI Feb 3 (Tue) Jan. 2026 Consumer Price Index (CPI) - Ministry of Data and Statistics Feb 4 (Wed) 4Q 2025 Results - Hanwha Ocean Feb 5 (Thu) 4Q 2025 Results - Hanwha Systems Feb 5–6 (Thu–Fri) 4Q 2025 Results - NAVER Feb 6 (Fri) Dec. 2025 Balance of Payments (Preliminary) - Bank of Korea Feb 8 (Sun) 4Q 2025 Results - HD Hyundai Heavy Industries Feb 11 (Wed) Jan. 2026 Employment Trends - Ministry of Data and Statistics Feb 13 (Fri) Dec. 2025 Money & Liquidity / Jan. 2026 Export & Import Prices - Bank of Korea Feb 20 (Fri) 4Q 2025 Household Credit (Preliminary) - Bank of Korea Feb 24 (Tue) Feb. 2026 CCSI / Jan. 2026 PPI - Bank of Korea Feb 25 (Wed) Feb. 2026 BSI & ESI - Bank of Korea Annual 2025 Births & Deaths / Dec. 2025 Population Trends - Ministry of Data and Statistics 2026-01-30 14:46:13 -

UPDATE: Korea's factory output strongest in four months in December, slows for full 2025 *Updated with additional information and market response SEOUL, January 30 (AJP) - South Korea’s factory output grew at its fastest pace in four months in December, driven by chip-led exports and a sharp rebound in construction, though growth slowed for full-year 2025 amid prolonged weakness in building activity. Mining and manufacturing production rose 1.7 percent from the previous month, rebounding from two consecutive contractions and accelerating from a 0.8 percent gain in November, according to data released Friday by the Ministry of Data and Statistics. Services output increased 1.1 percent on month, with retail sales rising 0.9 percent. Capital investment fell 3.6 percent, while construction investment surged 12.1 percent. Gains in manufacturing were primarily driven by semiconductors, where production rose 2.9 percent on month, marking a second straight month of expansion. The pace moderated from November’s 8.8 percent surge as the base effect from October’s slump began to fade. The most significant sector-specific rebound occurred in pharmaceuticals. After a 10.5 percent decline in November, output jumped 10.2 percent in December. Conversely, automobile production — a major pillar of the manufacturing base — fell 2.8 percent, marking its second consecutive monthly decrease. On a year-on-year basis, production of “other transport equipment,” including ships, surged 26.4 percent, driven by strong orders for specialized vessels such as LNG carriers. However, facility investment in this segment plunged 16.1 percent from the previous month, contributing to an overall 3.6 percent decline in total capital expenditure. Overall manufacturing shipments rose 2.5 percent. While shipments of automobiles and pharmaceuticals declined, semiconductors and electrical equipment anchored the aggregate gain. Both domestic and export demand showed strength, with domestic shipments rising 1.2 percent and export shipments climbing 4.0 percent. Korean markets were mixed. The KOSPI was trading at 5,273, up 1.0 percent, while the KOSDAQ remained virtually flat at 1,165. The dollar added 3.8 won to 1,438.8 won. Domestic front improves The retail sales index edged up 0.5 percent year on year, driven by a 4.5 percent increase in durable goods, particularly passenger cars. Still, sticky inflation weighed on spending. Semi-durable goods, such as clothing, fell 2.2 percent, while non-durable goods, including cosmetics, decreased 0.3 percent. Retail patterns also showed a stark divergence. Year-on-year sales at supermarkets and general stores fell 4.3 percent, department stores dropped 4.4 percent, and convenience stores declined 2.6 percent. In contrast, the retail index for passenger cars and fuel stations rose 5.3 percent. This suggests that while households are tightening their belts on food and daily necessities, spending on automotive-related items has remained elevated. A standout figure in the latest report was the performance of the construction sector. Construction output surged 12.1 percent from the previous month, reversing a downturn that had persisted for 19 months. The recovery was led by a 13.7 percent increase in building construction and a 7.4 percent rise in civil engineering. Construction orders also climbed 18.7 percent on month. Building orders, particularly in the residential segment, rose 21.2 percent, while civil engineering orders increased 13.0 percent. The surge in orders, however, was heavily concentrated in the public sector, which recorded a 65.2 percent jump in contracts. In contrast, private-sector orders — a key gauge of organic market demand — fell 1.3 percent. Analysts say that while output figures point to a short-term rebound, the divergence between public and private orders suggests the sector has yet to achieve a structural recovery. Five-year streak continues, but momentum falters For the full year of 2025, South Korea’s total industrial production edged up 0.5 percent, supported by synchronized gains in manufacturing and services. This marked the fifth consecutive year of expansion since 2021. Mining and manufacturing output rose 1.6 percent for the year, with semiconductors again leading the gains and other transport equipment providing a notable tailwind. Momentum, however, weakened toward year-end, with fourth-quarter production falling 3.2 percent from the previous quarter, signaling a cooling trend in late 2025. The service sector grew 1.9 percent for the year, supported by increased activity in health and social welfare as well as wholesale and retail trade. By contrast, the education sector contracted, weighing on overall service-sector growth. Despite the continued expansion, the pace of growth has slowed markedly. After surging 5.5 percent in 2021 on post-pandemic base effects, growth decelerated to 4.8 percent in 2022, 1.2 percent in 2023 and 1.5 percent in 2024. Last year’s 0.5 percent gain marked the first time since the recovery began that growth slipped below the 1 percent threshold. 2026-01-30 09:21:59

UPDATE: Korea's factory output strongest in four months in December, slows for full 2025 *Updated with additional information and market response SEOUL, January 30 (AJP) - South Korea’s factory output grew at its fastest pace in four months in December, driven by chip-led exports and a sharp rebound in construction, though growth slowed for full-year 2025 amid prolonged weakness in building activity. Mining and manufacturing production rose 1.7 percent from the previous month, rebounding from two consecutive contractions and accelerating from a 0.8 percent gain in November, according to data released Friday by the Ministry of Data and Statistics. Services output increased 1.1 percent on month, with retail sales rising 0.9 percent. Capital investment fell 3.6 percent, while construction investment surged 12.1 percent. Gains in manufacturing were primarily driven by semiconductors, where production rose 2.9 percent on month, marking a second straight month of expansion. The pace moderated from November’s 8.8 percent surge as the base effect from October’s slump began to fade. The most significant sector-specific rebound occurred in pharmaceuticals. After a 10.5 percent decline in November, output jumped 10.2 percent in December. Conversely, automobile production — a major pillar of the manufacturing base — fell 2.8 percent, marking its second consecutive monthly decrease. On a year-on-year basis, production of “other transport equipment,” including ships, surged 26.4 percent, driven by strong orders for specialized vessels such as LNG carriers. However, facility investment in this segment plunged 16.1 percent from the previous month, contributing to an overall 3.6 percent decline in total capital expenditure. Overall manufacturing shipments rose 2.5 percent. While shipments of automobiles and pharmaceuticals declined, semiconductors and electrical equipment anchored the aggregate gain. Both domestic and export demand showed strength, with domestic shipments rising 1.2 percent and export shipments climbing 4.0 percent. Korean markets were mixed. The KOSPI was trading at 5,273, up 1.0 percent, while the KOSDAQ remained virtually flat at 1,165. The dollar added 3.8 won to 1,438.8 won. Domestic front improves The retail sales index edged up 0.5 percent year on year, driven by a 4.5 percent increase in durable goods, particularly passenger cars. Still, sticky inflation weighed on spending. Semi-durable goods, such as clothing, fell 2.2 percent, while non-durable goods, including cosmetics, decreased 0.3 percent. Retail patterns also showed a stark divergence. Year-on-year sales at supermarkets and general stores fell 4.3 percent, department stores dropped 4.4 percent, and convenience stores declined 2.6 percent. In contrast, the retail index for passenger cars and fuel stations rose 5.3 percent. This suggests that while households are tightening their belts on food and daily necessities, spending on automotive-related items has remained elevated. A standout figure in the latest report was the performance of the construction sector. Construction output surged 12.1 percent from the previous month, reversing a downturn that had persisted for 19 months. The recovery was led by a 13.7 percent increase in building construction and a 7.4 percent rise in civil engineering. Construction orders also climbed 18.7 percent on month. Building orders, particularly in the residential segment, rose 21.2 percent, while civil engineering orders increased 13.0 percent. The surge in orders, however, was heavily concentrated in the public sector, which recorded a 65.2 percent jump in contracts. In contrast, private-sector orders — a key gauge of organic market demand — fell 1.3 percent. Analysts say that while output figures point to a short-term rebound, the divergence between public and private orders suggests the sector has yet to achieve a structural recovery. Five-year streak continues, but momentum falters For the full year of 2025, South Korea’s total industrial production edged up 0.5 percent, supported by synchronized gains in manufacturing and services. This marked the fifth consecutive year of expansion since 2021. Mining and manufacturing output rose 1.6 percent for the year, with semiconductors again leading the gains and other transport equipment providing a notable tailwind. Momentum, however, weakened toward year-end, with fourth-quarter production falling 3.2 percent from the previous quarter, signaling a cooling trend in late 2025. The service sector grew 1.9 percent for the year, supported by increased activity in health and social welfare as well as wholesale and retail trade. By contrast, the education sector contracted, weighing on overall service-sector growth. Despite the continued expansion, the pace of growth has slowed markedly. After surging 5.5 percent in 2021 on post-pandemic base effects, growth decelerated to 4.8 percent in 2022, 1.2 percent in 2023 and 1.5 percent in 2024. Last year’s 0.5 percent gain marked the first time since the recovery began that growth slipped below the 1 percent threshold. 2026-01-30 09:21:59 -

Asian shares struggle for direction amid Fed signals, Middle East tensions SEOUL, January 29 (AJP) - Asian markets closed mixed on Thursday as investors struggled to find direction amid conflicting signals from corporate earnings, central bank policy and rising geopolitical tensions, a combination that kept volatility elevated across the region. Currency markets reflected the uncertainty. The South Korean won was quoted at 1,428.9 per dollar at 4:40 p.m., down 4.6 won from the previous close. While the won pared earlier losses as the U.S. dollar weakened in late trading, it remained volatile amid competing global factors. Market sentiment was initially buoyed by comments from U.S. Treasury Secretary Scott Bessent, who dismissed the possibility of intentional intervention to weaken the Japanese yen, alongside the U.S. Federal Reserve’s decision to hold rates at 3.5–3.75 percent with a hawkish tone. The dollar later reversed course after media reports said President Donald Trump was weighing military options against Iran. The U.S. Dollar Index fell 0.16 percent to 96.20 by late afternoon. The benchmark 10-year U.S. Treasury yield rose 3.9 basis points to 3.557 percent, reflecting investor unease over the Fed’s stance and heightened geopolitical risks. South Korean stocks recovered from early losses, with the benchmark KOSPI closing up 0.98 percent at 5,221.25, supported by strong earnings and corporate investment announcements that offset macroeconomic concerns. Samsung Electronics fell 1.05 percent to 160,700 won despite reporting fourth-quarter operating profit of 20.1 trillion won ($14 billion). Investors were cautious after the company warned that rising memory prices could weigh on demand for smartphones and personal computers, while losses in its home appliances business also dampened sentiment. SK hynix climbed 2.38 percent to 861,000 won after overtaking Samsung in semiconductor profitability for the first time. The chipmaker posted quarterly operating profit of 19.2 trillion won and announced a shareholder return plan that includes the cancellation of 15.3 million treasury shares. Shares in SK Square, a major shareholder, jumped 5.36 percent. Hyundai Motor surged 7.21 percent to 528,000 won, extending gains that have lifted the stock more than 150 percent from late January last year. Investors welcomed the automaker’s commitment to complete real-world testing of its humanoid robot “Atlas” and smart-car prototypes by late 2026, despite a nearly 20 percent year-on-year decline in operating profit. LG Energy Solution fell 3.36 percent to 416,500 won after confirming a fourth-quarter operating loss of 122 billion won. Weakness in its energy storage system business and recent contract cancellations weighed on the stock, pushing it out of the top three by market capitalization. The tech-heavy KOSDAQ outperformed, rising 2.73 percent to 1,164.41, driven by technology shares and government-backed “value-up” initiatives. Rainbow Robotics jumped 9.35 percent following Samsung’s pledge to accelerate robotics investments, while EcoPro BM gained 7.42 percent. Biotech firm Alteogen slipped 1.15 percent ahead of its planned move to the KOSPI. In Japan, the Nikkei 225 ended flat at 53,375.60 after a volatile session. Early losses linked to yen strength were offset by gains in automakers, though safe-haven demand for the yen amid Middle East tensions capped the index’s advance. The yen was quoted at 153.30 per dollar late in the day. Toyota Motor rose 3.02 percent after reporting record sales for 2025, while Honda gained 2.17 percent on strong guidance led by hybrid vehicles. Chip tester Advantest climbed 5.17 percent after posting an earnings beat. Taiwan’s TAIEX fell 0.82 percent to 32,536.27 on profit-taking and concerns over the impact of a weaker dollar on foreign exchange reserves. TSMC slipped 0.82 percent, Foxconn fell 0.67 percent, and MediaTek ended flat after erasing early gains. Mainland Chinese markets were steadier, with the Shanghai Composite edging up 0.16 percent to 4,157.98. In Hong Kong, the Hang Seng Index reversed early losses to trade 0.36 percent higher at 27,928 in late afternoon dealings, supported by gains in gold-related shares. 2026-01-29 17:08:02

Asian shares struggle for direction amid Fed signals, Middle East tensions SEOUL, January 29 (AJP) - Asian markets closed mixed on Thursday as investors struggled to find direction amid conflicting signals from corporate earnings, central bank policy and rising geopolitical tensions, a combination that kept volatility elevated across the region. Currency markets reflected the uncertainty. The South Korean won was quoted at 1,428.9 per dollar at 4:40 p.m., down 4.6 won from the previous close. While the won pared earlier losses as the U.S. dollar weakened in late trading, it remained volatile amid competing global factors. Market sentiment was initially buoyed by comments from U.S. Treasury Secretary Scott Bessent, who dismissed the possibility of intentional intervention to weaken the Japanese yen, alongside the U.S. Federal Reserve’s decision to hold rates at 3.5–3.75 percent with a hawkish tone. The dollar later reversed course after media reports said President Donald Trump was weighing military options against Iran. The U.S. Dollar Index fell 0.16 percent to 96.20 by late afternoon. The benchmark 10-year U.S. Treasury yield rose 3.9 basis points to 3.557 percent, reflecting investor unease over the Fed’s stance and heightened geopolitical risks. South Korean stocks recovered from early losses, with the benchmark KOSPI closing up 0.98 percent at 5,221.25, supported by strong earnings and corporate investment announcements that offset macroeconomic concerns. Samsung Electronics fell 1.05 percent to 160,700 won despite reporting fourth-quarter operating profit of 20.1 trillion won ($14 billion). Investors were cautious after the company warned that rising memory prices could weigh on demand for smartphones and personal computers, while losses in its home appliances business also dampened sentiment. SK hynix climbed 2.38 percent to 861,000 won after overtaking Samsung in semiconductor profitability for the first time. The chipmaker posted quarterly operating profit of 19.2 trillion won and announced a shareholder return plan that includes the cancellation of 15.3 million treasury shares. Shares in SK Square, a major shareholder, jumped 5.36 percent. Hyundai Motor surged 7.21 percent to 528,000 won, extending gains that have lifted the stock more than 150 percent from late January last year. Investors welcomed the automaker’s commitment to complete real-world testing of its humanoid robot “Atlas” and smart-car prototypes by late 2026, despite a nearly 20 percent year-on-year decline in operating profit. LG Energy Solution fell 3.36 percent to 416,500 won after confirming a fourth-quarter operating loss of 122 billion won. Weakness in its energy storage system business and recent contract cancellations weighed on the stock, pushing it out of the top three by market capitalization. The tech-heavy KOSDAQ outperformed, rising 2.73 percent to 1,164.41, driven by technology shares and government-backed “value-up” initiatives. Rainbow Robotics jumped 9.35 percent following Samsung’s pledge to accelerate robotics investments, while EcoPro BM gained 7.42 percent. Biotech firm Alteogen slipped 1.15 percent ahead of its planned move to the KOSPI. In Japan, the Nikkei 225 ended flat at 53,375.60 after a volatile session. Early losses linked to yen strength were offset by gains in automakers, though safe-haven demand for the yen amid Middle East tensions capped the index’s advance. The yen was quoted at 153.30 per dollar late in the day. Toyota Motor rose 3.02 percent after reporting record sales for 2025, while Honda gained 2.17 percent on strong guidance led by hybrid vehicles. Chip tester Advantest climbed 5.17 percent after posting an earnings beat. Taiwan’s TAIEX fell 0.82 percent to 32,536.27 on profit-taking and concerns over the impact of a weaker dollar on foreign exchange reserves. TSMC slipped 0.82 percent, Foxconn fell 0.67 percent, and MediaTek ended flat after erasing early gains. Mainland Chinese markets were steadier, with the Shanghai Composite edging up 0.16 percent to 4,157.98. In Hong Kong, the Hang Seng Index reversed early losses to trade 0.36 percent higher at 27,928 in late afternoon dealings, supported by gains in gold-related shares. 2026-01-29 17:08:02 -

Asian equities swing flat in post-FOMC early trade; KOSDAQ unfazed SEOUL, January 29 (AJP) - Asian equities traded unevenly in early Thursday sessions following the Federal Open Market Committee (FOMC) decision, with key indices swinging between gains and losses as investors struggled to digest a flood of corporate earnings alongside a renewed rebound in the U.S. dollar. The previous rally in South Korea and Taiwan gave way to choppy, directionless trading, while mainland China and Japan remained clouded by uncertainty, making it difficult for investors to establish a clear near-term trend. As of 10:30 a.m. Seoul time, the Korean won strengthened, with the dollar down 4 won at 1,429.50. As widely expected, the Federal Reserve on Wednesday entered a new holding pattern on interest rates, signaling little urgency to resume cuts following contentious reductions at its previous three meetings. The decision to keep the benchmark federal funds rate unchanged at 3.50–3.75 percent was approved by a 10–2 vote. Fed Chair Jerome Powell said recent data had painted a somewhat brighter picture than at the last meeting, citing firmer economic growth and tentative signs of stabilization in the labor market. Despite U.S. President Donald Trump’s continued endorsement of a weaker dollar as “great,” the greenback found firm support in offshore trading. This followed Treasury Secretary Scott Bessent’s emphatic “Absolutely not” when asked whether Washington was deliberately encouraging yen strength to prevent an unwinding of yen-carry trades. The remarks caused the won’s early gains to fade. South Korea’s benchmark KOSPI was trading at 5,143 as of 10:30 a.m., down 0.54 percent, as the market took a breather after a monthlong record-setting rally. After hitting all-time highs for two consecutive sessions on Tuesday and Wednesday, the index appeared to have entered a consolidation phase. Performance among South Korea’s semiconductor blue chips diverged. Samsung Electronics fell 1.7 percent to 159,600 won, as its record fourth-quarter and full-year chip earnings were overshadowed by those of its local rival. SK Hynix, by contrast, rose 0.5 percent to 845,000 won, continuing to benefit from record earnings and a stronger fundamental valuation. Hyundai Motor climbed 2.5 percent to 505,000 won ahead of its earnings release and conference call later in the day, where it is expected to outline its robotics roadmap. Market attention remained focused on the 2 p.m. announcement, with investors cautious after its key subsidiary Kia reported a nearly 30 percent year-on-year drop in operating profit. Secondary battery stocks came under heavier selling pressure. LG Energy Solution plunged 4.3 percent to 412,500 won, once again relinquishing its position as South Korea’s third-largest company by market capitalization to Hyundai Motor. Samsung SDI also slid 4.0 percent to 380,500 won. In contrast, the tech-heavy KOSDAQ defied the broader cautious mood, rising 1.2 percent to 1,147, buoyed by government stimulus expectations and renewed momentum in robotics-related shares. Rainbow Robotics, in which Samsung Electronics is the largest shareholder, surged 11.0 percent to 772,000 won after Samsung publicly reaffirmed its commitment to the humanoid robot market. Robotics optimism also lifted EcoPro BM, which jumped 6.1 percent to 243,000 won, reclaiming the top spot in KOSDAQ market capitalization for the first time in four months. In Tokyo, the Nikkei 225 hovered in positive territory, up 0.2 percent at 53,480. After a weak open, the index reversed course following Bessent’s dismissal of bets against the yen. The yen stood at 153.30 per dollar, up 0.15 yen, though it is expected to weaken again as the dollar regains momentum offshore. Japanese exporters rallied on the currency shift. Toyota Motor rose 2.1 percent to 3,417 yen, while Honda Motor gained 1.5 percent to 1,522 yen. Among semiconductor stocks, Advantest stood out, surging after reporting operating profit of 78.7 billion yen, beating market consensus by 65 percent. Taiwan’s TAIEX slipped 0.6 percent to 32,610, paring part of Wednesday’s 2 percent surge. TSMC edged down 0.55 percent to 1,810 Taiwan dollars, while Foxconn fell 1.1 percent to 223 Taiwan dollars. MediaTek, however, rose 0.85 percent to 1,795 Taiwan dollars on forecasts that it will remain the world’s top mobile chip shipper through 2026. Mainland Chinese markets were mixed. The Shanghai Composite eased 0.15 percent to 4,145, while the Shenzhen Composite added 0.35 percent to 14,396. In Hong Kong, the Hang Seng Index slipped 0.4 percent to 27,707, cooling after the previous session’s nearly 3 percent rally driven by safe-haven demand for gold. 2026-01-29 11:23:11

Asian equities swing flat in post-FOMC early trade; KOSDAQ unfazed SEOUL, January 29 (AJP) - Asian equities traded unevenly in early Thursday sessions following the Federal Open Market Committee (FOMC) decision, with key indices swinging between gains and losses as investors struggled to digest a flood of corporate earnings alongside a renewed rebound in the U.S. dollar. The previous rally in South Korea and Taiwan gave way to choppy, directionless trading, while mainland China and Japan remained clouded by uncertainty, making it difficult for investors to establish a clear near-term trend. As of 10:30 a.m. Seoul time, the Korean won strengthened, with the dollar down 4 won at 1,429.50. As widely expected, the Federal Reserve on Wednesday entered a new holding pattern on interest rates, signaling little urgency to resume cuts following contentious reductions at its previous three meetings. The decision to keep the benchmark federal funds rate unchanged at 3.50–3.75 percent was approved by a 10–2 vote. Fed Chair Jerome Powell said recent data had painted a somewhat brighter picture than at the last meeting, citing firmer economic growth and tentative signs of stabilization in the labor market. Despite U.S. President Donald Trump’s continued endorsement of a weaker dollar as “great,” the greenback found firm support in offshore trading. This followed Treasury Secretary Scott Bessent’s emphatic “Absolutely not” when asked whether Washington was deliberately encouraging yen strength to prevent an unwinding of yen-carry trades. The remarks caused the won’s early gains to fade. South Korea’s benchmark KOSPI was trading at 5,143 as of 10:30 a.m., down 0.54 percent, as the market took a breather after a monthlong record-setting rally. After hitting all-time highs for two consecutive sessions on Tuesday and Wednesday, the index appeared to have entered a consolidation phase. Performance among South Korea’s semiconductor blue chips diverged. Samsung Electronics fell 1.7 percent to 159,600 won, as its record fourth-quarter and full-year chip earnings were overshadowed by those of its local rival. SK Hynix, by contrast, rose 0.5 percent to 845,000 won, continuing to benefit from record earnings and a stronger fundamental valuation. Hyundai Motor climbed 2.5 percent to 505,000 won ahead of its earnings release and conference call later in the day, where it is expected to outline its robotics roadmap. Market attention remained focused on the 2 p.m. announcement, with investors cautious after its key subsidiary Kia reported a nearly 30 percent year-on-year drop in operating profit. Secondary battery stocks came under heavier selling pressure. LG Energy Solution plunged 4.3 percent to 412,500 won, once again relinquishing its position as South Korea’s third-largest company by market capitalization to Hyundai Motor. Samsung SDI also slid 4.0 percent to 380,500 won. In contrast, the tech-heavy KOSDAQ defied the broader cautious mood, rising 1.2 percent to 1,147, buoyed by government stimulus expectations and renewed momentum in robotics-related shares. Rainbow Robotics, in which Samsung Electronics is the largest shareholder, surged 11.0 percent to 772,000 won after Samsung publicly reaffirmed its commitment to the humanoid robot market. Robotics optimism also lifted EcoPro BM, which jumped 6.1 percent to 243,000 won, reclaiming the top spot in KOSDAQ market capitalization for the first time in four months. In Tokyo, the Nikkei 225 hovered in positive territory, up 0.2 percent at 53,480. After a weak open, the index reversed course following Bessent’s dismissal of bets against the yen. The yen stood at 153.30 per dollar, up 0.15 yen, though it is expected to weaken again as the dollar regains momentum offshore. Japanese exporters rallied on the currency shift. Toyota Motor rose 2.1 percent to 3,417 yen, while Honda Motor gained 1.5 percent to 1,522 yen. Among semiconductor stocks, Advantest stood out, surging after reporting operating profit of 78.7 billion yen, beating market consensus by 65 percent. Taiwan’s TAIEX slipped 0.6 percent to 32,610, paring part of Wednesday’s 2 percent surge. TSMC edged down 0.55 percent to 1,810 Taiwan dollars, while Foxconn fell 1.1 percent to 223 Taiwan dollars. MediaTek, however, rose 0.85 percent to 1,795 Taiwan dollars on forecasts that it will remain the world’s top mobile chip shipper through 2026. Mainland Chinese markets were mixed. The Shanghai Composite eased 0.15 percent to 4,145, while the Shenzhen Composite added 0.35 percent to 14,396. In Hong Kong, the Hang Seng Index slipped 0.4 percent to 27,707, cooling after the previous session’s nearly 3 percent rally driven by safe-haven demand for gold. 2026-01-29 11:23:11 -

South Korean equities log rare double win as decoupling fears grow SEOUL, January 28 (AJP) - South Korean equities are logging a rare double win, with both the main KOSPI and the tech-heavy KOSDAQ hitting historic highs, but the synchronized rally is increasingly stirring anxiety that markets are pulling away from economic reality. The benchmark KOSPI climbed to 5,170.81 on Wednesday, setting a fresh record, while the KOSDAQ advanced to 1,133.52. Both indices are up about 20 percent so far this year, extending last year’s outsized gains of 76 percent for the KOSPI and 36 percent for the KOSDAQ. The surge has lifted South Korea’s total equity market capitalization above that of Germany, underscoring the scale — and speed — of the rally. Leadership has been concentrated. Alongside heavyweight chipmakers Samsung Electronics and SK hynix, Hyundai Motor has joined the record-setting run, with its share price up more than 63 percent year to date. Optimism around semiconductor exports, autos and emerging technologies such as robotics has reinforced investor appetite. Yet beneath the headline strength, warning signs are accumulating. Markets diverge from the real economy For one, equity markets appear increasingly decoupled from underlying economic conditions. South Korea’s economy contracted 0.3 percent in the fourth quarter and 1 percent for the full year, according to the Bank of Korea — the weakest performance among major Asian economies. Even compared with Japan, which entered a low-growth era earlier, South Korea’s annual growth rate remained similar or lower, falling well short of the earlier consensus forecast of 1.8 percent. Leverage is adding to concerns. Margin debt reached approximately 29.35 trillion won ($20.6 billion) as of Jan. 26, according to the Korea Financial Investment Association, approaching the 30 trillion won mark — an all-time high for funds borrowed to purchase stocks. The pace of the increase has been particularly striking. Compared with about a year earlier, margin borrowing has surged by 12.51 trillion won, or 74.3 percent, amplifying fears that rising asset prices are being fueled by debt rather than earnings fundamentals. Household balance sheets remain stretched as well. Non-bank household debt increased by 37.6 trillion won over the course of 2025. Although it edged down by 1.5 trillion won in December, the ratio still stood at 89 percent of GDP at year-end — among the highest levels in major economies. Labor-market indicators offer little reassurance. Youth employment, a key barometer of long-term growth potential, remains mired in stagnation. The employment rate for those aged 15 to 29 stood at 44.3 percent in December, down 0.4 percentage points from a year earlier and marking the 20th consecutive month of decline, according to data released by the National Data Agency on Jan. 14. As the gap between asset prices and the real economy widens, volatility has risen sharply. The KOSPI Volatility Index (VKOSPI) closed Wednesday at 38.68, up 11.12 percent from the previous day and more than double its level a year earlier. Liquidity, not recovery This is not the first time South Korean equities have diverged from economic fundamentals. Similar patterns emerged in the aftermath of the global financial crisis, during the COVID-19 stimulus cycle and in the early stages of the dot-com boom — periods when abundant liquidity converged with compelling technology narratives. The current rally appears driven less by a broad-based recovery than by excess liquidity and concentrated inflows into specific sectors such as AI and semiconductors. According to a Bank of Korea report released Jan. 14, the M2 money supply grew 4.8 percent year on year as of November 2025. When beneficiary certificates — including ETFs, equity funds and bond funds — are included, effective liquidity growth reached 8 percent. Investor positioning reflects this trend. Investor deposits climbed to a record 97.54 trillion won as of Monday, highlighting the scale of capital circulating around the stock market. “The rally that began last year and continued into early this year reflects domestic liquidity conditions and expectations surrounding monetary accommodation by major economies such as Japan and the United States, rather than improvements in the real economy,” said Lee Kyung-min, a strategist at Daishin Securities. Lee added, however, that with forward earnings per share expected to trend upward, liquidity could eventually translate into corporate investment and growth. Others remain more cautious. J.P. Morgan, in its “2026 Market Outlook,” warned that downside risks remain elevated amid weak business sentiment and a cooling labor market, posing potential headwinds for global equities, including South Korea. Adding to concerns, the U.S. Consumer Confidence Index fell sharply to 84.5 in January, nearly 10 points lower than the previous month and well below market expectations. “We are not unaware that key real-economy indicators — including youth employment and construction activity — remain weak despite rising stock prices,” said a securities industry official, speaking on condition of anonymity. “But given the belief that a buoyant stock market can support corporate investment in R&D and facilities — and potentially lift the real economy — it is difficult to openly raise the prospect of a correction.” 2026-01-28 18:11:27