SEOUL, December 11 (AJP) - That South Korea is a semiconductor powerhouse is established fact: it is home to the world’s largest memory-chip production base. But in the fabless sector — the chip-design layer that defines system-semiconductor competitiveness — the country remains a laggard. That gap is driving an urgent and ambitious push to cultivate proprietary chip architecture capabilities.

The government-led vision calls for more than 700 trillion won (about $518 billion) in public–private investment through 2047 to expand manufacturing capacity, elevate system-chip design capabilities, and build a national talent pipeline. Government documents show that by 2031, 1.26 trillion won will go toward AI-specialized chips, 2.6 trillion won into compound semiconductors, and 3.6 trillion won into advanced packaging, along with a 300-billion-won graduate-level semiconductor university intended to produce 300 MS/PhD engineers each year.

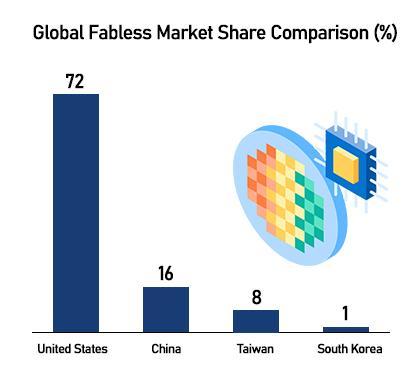

Korea’s semiconductor strength remains overwhelmingly concentrated in memory, leaving the industry exposed to boom-and-bust cycles and dependent on design decisions made by U.S. chip architects, most notably Nvidia. While Samsung Electronics and SK hynix dominate memory globally, Korea’s fabless firms hold barely 1 percent of the global market—far behind the United States’ 72 percent and Taiwan’s 8 percent. Only one domestic firm, LX Semicon, is ranked among the world’s top 50 fabless companies. The combined revenue of Korea’s top ten fabless firms amounts to just 1.17 percent of global fabless sales. Chronic engineering shortages and limited access to affordable prototype production have long constrained growth.

Industry experts say the government’s strategy reflects a structural truth: a world-class foundry cannot thrive without a strong base of domestic design customers.

“Korea has extremely strong memory makers, but a healthy foundry business requires a wide range of fabless customers constantly bringing new designs and challenges,” said Gong Byung-don, a professor at POSTECH. “That was the foundation of Taiwan’s ecosystem. For 15 to 20 years, dozens of mid-sized design houses grew around TSMC, and that accumulated demand is what made the foundry giant possible.”

To close Korea’s structural gap, the government will establish a 4.5-trillion-won “shared foundry”—a 12-inch, 40-nanometer fab that sets aside dedicated production capacity for domestic chip designers. Officials say the facility will ease prototyping bottlenecks, cut early-stage costs, and mirror Taiwan’s MPW and shuttle-run system that enabled rapid iteration among its small and mid-sized chip-design houses.

The broader industrial blueprint links the fabless hub in Pangyo, the Yongin mega-fab cluster, and advanced packaging bases in Gwangju and Busan into an integrated value chain supporting design, production, testing, and assembly. Policymakers argue that AI accelerators, automotive semiconductors, and power devices will increasingly shape global chip demand—and that Korea must compete in these segments to reduce overreliance on memory cycles.

Analysts say the initiative also responds to an AI-driven shift in global semiconductor power, with fabless firms such as Nvidia, AMD, and U.S. startups dictating the roadmap for next-generation chips. With hyperscalers pouring unprecedented capital expenditure into AI accelerators, governments see strategic value in securing both design and manufacturing capabilities to safeguard supply chains.

Korean fabless firms have long argued that the lack of a dependable domestic manufacturing partner forced them abroad, weakening collaboration between designers and manufacturers and slowing commercialization. Gong said improved access to early-stage production could meaningfully change the landscape.

“Test runs, MPWs and prototype fabrication matter enormously for small fabless firms,” he said. “But Korea still faces a market-access challenge. Domestic demand alone is not enough, and Korean startups must be able to reach U.S. and global customers to scale.”

He added that while Korea has narrowed the technical gap, constraints remain. “In AI-specific chips, Korea has reached perhaps 80 to 90 percent of global competitiveness. But talent flows mainly into major corporations, and small fabless firms still struggle to secure diverse customers in a highly concentrated domestic market.”

If the plan succeeds, officials believe Korea could raise its fabless market share to 10 percent by 2030 and build a semiconductor industry driven by both system-chip innovation and manufacturing scale. But they acknowledge the challenges: intensifying global competition for design talent, the entrenched dominance of U.S. and Taiwanese ecosystems, and the need for domestic firms to break quickly into AI and next-generation system-chip markets.

Still, the government argues that combining mega-cluster development, expanded AI-chip R&D, and a dedicated fabless production line marks Korea’s most ambitious semiconductor realignment in decades — an attempt to build an industry powered not only by memory but by a full spectrum of system semiconductors.

Copyright ⓒ Aju Press All rights reserved.